“The Big Short” Michael Burry, famous for predicting the 2008 financial crisis, has issued a stark warning regarding the plans of the US Fed to purchase $40 billion in Treasury bills (T-bills). Will the liquidity crunch in the banking sector trigger Bitcoin and crypto market crash?

Michael Burry Warns About Weakness in Banking System

Fed Chair Jerome Powell announced that the US Federal Reserve will buy T-bills worth $40 billion in a month. The Fed also claimed this isn’t QE. However, it shows a sign of a liquidity crunch in the banking system.

Also, Michael Burry red flags the Fed’s latest move to buy $40 billion of Treasury bills within 30 days. He claims it is a sign of fragility in the U.S. banking system rather than strength, with significant negative consequences for the U.S. economy and financial markets.

He scoffs at the Fed for making the treasuries purchase announcement under the term “Reserve Management Purchases.” Burry claimed this plan is essentially a hidden attempt to stabilize a banking sector still struggling with the aftershocks of the 2023 mini-banking crisis.

He points out that bank reserves stood at just $2.2 trillion before the crisis, compared to over $3 trillion today. “If the US Banking system can’t function without $3+ trillion in reserves/life support from the Fed, that is not a sign of strength but a sign of fragility,” Burry warns.

Burry added that each new crisis would permanently inflate the Fed’s balance sheet. “Seems that after every crisis now the Fed needs to expand its balance sheet permanently or guarantee a bank funding crisis. No wonder stocks are doing well,” he wrote.

Michael Burry Says Fed Will Start QE Soon

As CoinGape earlier reported, the US Fed started injecting funds into the banking system through repurchase agreements (repo) immediately after quantitative tightening (QT) ended. This helped bring a slight rebound in crypto stocks, Bitcoin, and altcoins.

Michael Burry also cautioned about the misleading Wall Street recommendations to buy bank stocks. Burry revealed that he prefers to keep cash in Treasury Money Market Funds for amounts over the $250,000 FDIC limit.

He also highlights a shift in the US Treasury toward selling more short-term bills and the US Fed’s focus on buying those. This strategy helps avoid driving up 10-year treasury yields. As expected, the US 2-month Treasury yield (US2M) has jumped and the US 10-Year Treasury yield has dropped after the FOMC meeting.

With repo market volatility persisting, some analysts expect the Fed will have to take even more aggressive action to avoid a year-end funding crunch. Burry sees it as further evidence of underlying financial system weakness.

Remember when the Fed launched “NOT QE” in Sept 2019 to tame the repo market crisis… and 6 months later it was doing $1 trillion daily injections.

Good times

— zerohedge (@zerohedge) December 10, 2025

Bitcoin Falls to $90K

Bitcoin price fell more than 2% in the past 24 hours ahead of the Bitcoin options expiry, currently trading at $90,252. The 24-hour low and high are $89,459 and $94,477, respectively.

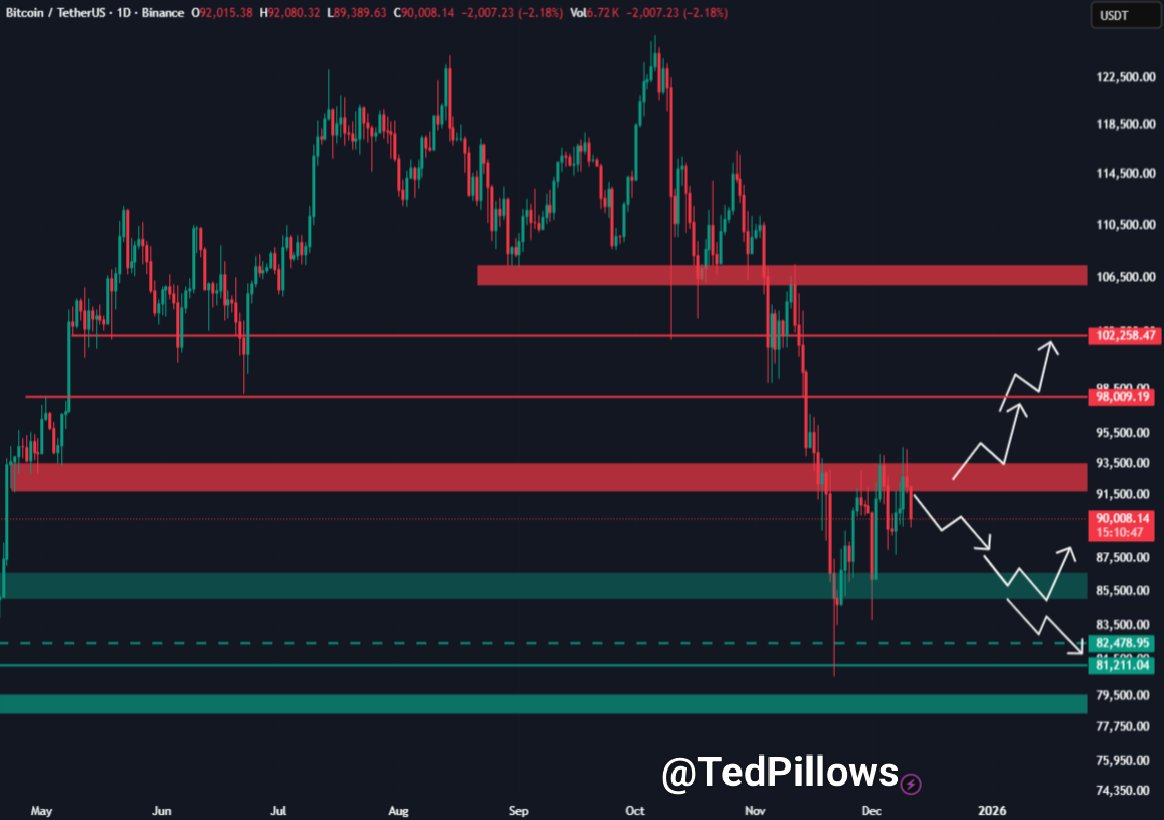

Crypto analyst Ted Pillows warned that the Bitcoin price could drop towards the $85,000 level again. He pointed out that BTC failed to reclaim the $93,000-$94,000 level and tumbled to $90K after the US Fed rate cut.

On the daily timeframe chart, the next major support zone is around the $88,000-$89,000 level, which will most likely get retested.

Notably, BTC miners are selling, with Marathon Digital (MARA) dumping 275 BTC worth $25.31 million, Lookonchain reported.

Also Read: 10 Best Crypto Swapping Sites for December 2025

Source: https://coingape.com/big-short-michael-burry-issues-dire-warning-on-us-fed-40b-t-bills-buy-plan/