- Masamichi Adachi’s statement signals potential BoJ rate increases, impacting markets.

- Economists expect a 25 basis point hike in coming months.

- Japanese government bond yields rise, yen sees slight strengthening.

Masamichi Adachi from UBS predicts a potential interest rate hike by the Bank of Japan in the coming months, highlighting negative real rates and supportive inflation dynamics.

The anticipated rate increase could impact Japanese assets, but historical data indicates little direct effect on major cryptocurrencies like Bitcoin and Ethereum.

BoJ Rate Hike Signals a Shift in Monetary Policy

Masamichi Adachi stated on October 21st that the Bank of Japan might raise interest rates in the coming months. As Japan currently operates with a negative real interest rate, a more accommodative financial environment prevails. Inflation dynamics, including a forecasted rise of long-term inflation expectations towards 2.0%, suggest the need to reduce the accommodative policy further.

The government’s potential fiscal expansion plans could result in higher inflationary pressures, adding to the already anticipated policy rate increase by 25 basis points. Japanese government bond yields have seen slight increases, and the yen has strengthened modestly. However, major cryptocurrencies such as BTC and ETH have not demonstrated direct price impacts from these developments.

Kazuo Ueda, Governor of the Bank of Japan, remarked, “If the BOJ revises up its growth forecasts… then the BoJ has no reason to stand still.”

Cryptocurrency Market Holds Steady Amidst BoJ Developments

Did you know? After past minor Bank of Japan rate adjustments, JPY experienced short-lived volatility, yet key cryptocurrencies like Bitcoin typically displayed no sustained price changes.

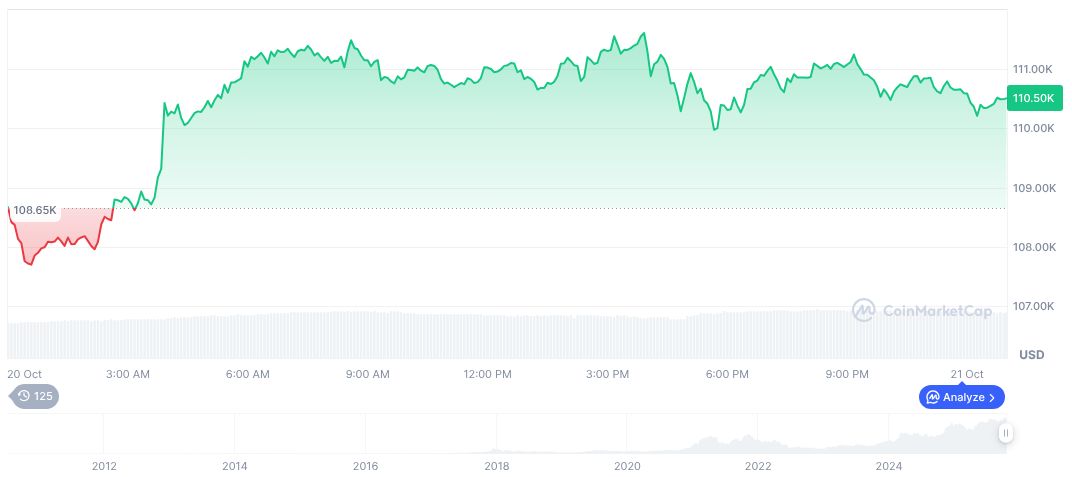

Bitcoin’s price stood at $108,043.44, with a market cap of $2.15 trillion, dominating 58.92% of the crypto market, CoinMarketCap data reports. Its fully diluted market cap reached $2.27 trillion, with a 24-hour trading volume of $63.20 billion, despite a 2.95% price drop.

The Coincu research team highlights that potential Japanese interest rate hikes could indirectly influence investor sentiment in global markets. Economic adjustments from rate changes might alter foreign exchange-sensitive assets and traditional hedging strategies, but significant on-chain cryptocurrency impact remains unlikely.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/bank-of-japan-interest-rate-hike/