- Sarah Breeden announces stablecoin reserve changes at the Bank of England.

- Systemic issuers can use high-quality liquid assets.

- New regulations support UK digital securities sandbox integration.

Sarah Breeden, Deputy Governor of the Bank of England, announced a revision in the UK’s stablecoin regulations during an official speech in early September 2023.

This regulatory shift allows stablecoin issuers to hold interest-earning assets, potentially altering the business landscape and fostering UK adoption of blockchain-based financial infrastructure.

Bank of England Expands Stablecoin Issuers’ Reserve Options

Sarah Breeden, Deputy Governor at the Bank of England, announced revisions to the stablecoin reserve framework, allowing systemically important issuers to hold a portion of reserves in high-quality assets. This development benefits large issuers significantly.

The change also means that stablecoins and tokenized deposits will play a role in settling tokenized securities within the UK Digital Securities Sandbox. By broadening use cases beyond retail, the UK’s digital asset strategy is aligning more closely with traditional financial markets.

Market reactions have been largely positive, noting that interest-bearing assets will now support revenue generation for stablecoin issuers. Breeden emphasized that the consultation process with the industry continues, signaling cooperative regulatory developments. She stated, “We look forward to engaging further with industry through the consultation process before finalising our regime.”

UK Stablecoin Regulations Look to Enhance Financial Integration

Did you know? The UK Digital Securities Sandbox now incorporates both stablecoins and tokenized deposits for settlement, an opportunity not previously included in original plans.

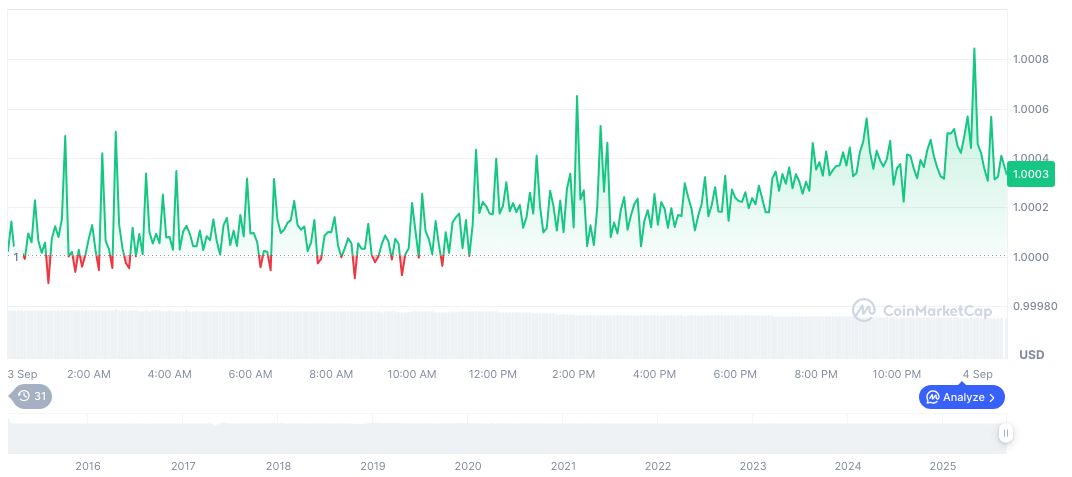

According to CoinMarketCap, Tether USDt (USDT) reports a stable price of $1.00 with a market cap of $168.21 billion, reflecting a dominant market presence. The 24-hour trading volume stands at $103.01 billion. Over a 90-day period, the price saw slight changes, demonstrating consistency.

Insights from the CoinCu research team suggest that these regulatory changes could lead to a more stable financial environment for UK-based stablecoin issuers. Additionally, this integration into traditional financial ecosystems might promote wider acceptance and use of digital currencies in established markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/bank-england-stablecoin-reserve-rule/