- Banca Sella pilots digital asset custody with Fireblocks, aiming for client roll-out.

- Internal test currently limited to select staff.

- Banca Sella focuses on future retail and regulatory readiness.

Banca Sella Holding SpA is conducting an internal pilot to test digital asset custody services using technology from Fireblocks. Currently, this initiative is confined to a limited number of professional employees. The pilot marks a cautious step toward potential client-facing services.

The test underscores Banca Sella’s strategic advancement in digital finance, aligning with broader market trends. The emphasis remains on robust organizational controls ahead of any public rollout.

Banca Sella Expands Digital Asset Portfolio with Fireblocks

Banca Sella’s internal digital asset custody pilot involves collaboration with Fireblocks, focusing initially on stablecoins and potentially Bitcoin (BTC) and Ethereum (ETH). Only select employees partake in this phase, reflecting a controlled and measured approach to integrating digital assets. Emphasizing employee education and hiring signals Banca Sella’s long-term commitment to competencies in digital finance.

Immediate changes include expanding the pilot to potentially integrate client services. Though internal, this move paves the way for significant service offerings. The pilot aligns with the bank’s existing digital asset engagements, including BTC trading via the Hype platform. Regulatory compliance and competency building are central to expanding into the consumer market.

Market reactions are primarily focused within industry circles watching the pilot’s progress, with governmental and regulatory entities poised for evaluation as the initiative matures. Despite the financial sector’s inherent conservatism, supportive narratives emphasize Banca Sella’s proactive innovation approach, especially from figures like Mico Curatolo, Co-Head, DLT and Digital Assets Team.

Strategic Alignment with EU Regulations and Market Trends

Did you know? Banca Sella’s move to test digital asset custody aligns with its 2021 introduction of Bitcoin trading through the Hype platform, hinting at a broader strategic pattern.

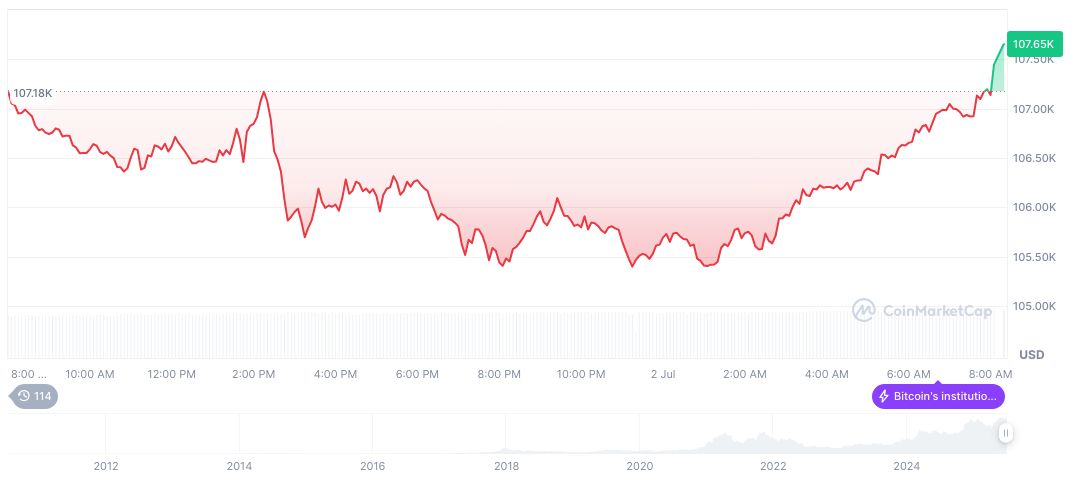

Bitcoin (BTC) is currently valued at $107,439.93, according to CoinMarketCap data. The market cap is $2.14 trillion, with a dominance of 64.69%. The 24-hour trading volume is $45.31 billion, noting a 4.46% increase. Bitcoin’s supply remains at 19,886,403 of a 21 million cap. Price changes over 90 days have reached 29.31%.

Insights from the Coincu research team highlight Banca Sella’s pilot as potentially influencing both financial and regulatory standards. By aligning with European regulatory frameworks like MiCA, the bank aims not only for technological innovation but also crucial compliance, especially against evolving EU and Basel prudential standards.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/346430-banca-sella-custody-pilot-fireblocks/