- The Central Bank of Bahrain unveiled a new framework to regulate stablecoin issuers.

- This move aims to increase investor confidence.

- Framework supports growth and transparency in financial systems.

The Central Bank of Bahrain (CBB) announced a licensing framework for stablecoin issuers on July 4, 2025, during a fintech event in collaboration with the Bahrain Economic Development Board.

This policy aims to safely integrate stablecoins into Bahrain’s financial system, enhancing investor confidence and promoting industry growth through comprehensive regulation.

Bahrain to License Fiat-Backed Stablecoin Issuers

The CBB’s new framework permits licensed entities to issue single-currency stablecoins backed by the Bahraini dinar, U.S. dollar, or other approved fiats. This initiative aims to mitigate risks associated with unregulated stablecoins. The objective is to strengthen Bahrain’s position as a financial hub in the Middle East. According to Mohamed Al Sadek, the CBB’s executive director for market development, “By encouraging the development and adoption of innovative financial technologies, the CBB aims to enhance Bahrain’s position as a leading financial hub in the MENA region. This milestone reflects the pioneering role the CBB continues to play in overseeing the crypto-asset market and ensuring that the Kingdom’s financial services landscape is equipped for future developments.”

By introducing licensing for stablecoin issuers and custodians, the CBB framework ensures only authorized institutions can distribute fiat-backed stablecoins. The framework also outlines mandates for yield-bearing stablecoins, ensuring returns do not compromise coin stability.

Ali Haroon AlAamer from CBB’s Capital Markets Supervision Directorate highlighted the initiative’s goal to maintain a transparent crypto asset market. The policy includes robust investor protection measures, with the market showing cautious optimism. Feedback from Bahrain’s financial circles suggests increased confidence in regulated digital assets.

Impact of Bahrain’s Stablecoin Framework on Global Markets

Did you know? Regional efforts like Bahrain’s tend to increase regulatory clarity and promote greater institutional participation in the stablecoin market, as seen in previous frameworks from the EU and Japan.

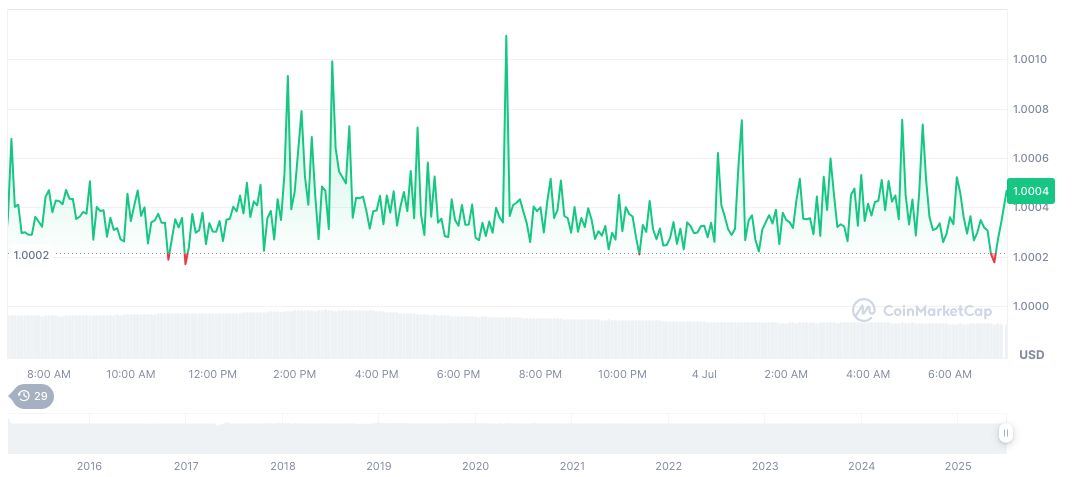

Tether USDt (USDT) holds a steady price of $1.00 with a market cap of $158.48 billion, according to CoinMarketCap. Market dominance is 4.78%, and the 24-hour trading volume is down 27.15%, totaling $61.47 billion. Price changes over 90 days show minimal fluctuation at 0.08%.

Experts from the Coincu research team suggest that Bahrain’s stablecoin framework could stimulate significant institutional interest and spur regional adoption of crypto assets. These regulations highlight the nation’s commitment to a controlled and transparent integration of digital and traditional finance.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/346844-bahrain-central-bank-stablecoin-regulation/