- Visa partners with Baanx to introduce a USDC payment card.

- Enables USDC transactions from self-custodial wallets.

- Potential to increase stablecoin adoption globally.

Visa has teamed up with Baanx, collaborating to develop a stablecoin payment card that uses the self-custodial wallet features of Circle’s USDC. The innovation allows cardholders to carry out USDC transactions directly.

The launch signals a step towards making stablecoin use more mainstream, potentially widening the adoption of cryptocurrencies in everyday transactions.

Real-Time Stablecoin Transactions Reshape Financial Access

Baanx, a leader in crypto payments, partnered with Visa to facilitate direct USDC transactions from self-custodial wallets. Using real-time smart contract technology, this feature enables users to convert USDC to fiat for payments globally where Visa is accepted. This card is designed to empower individuals by reducing reliance on custodial systems, offering direct crypto spending through existing payment infrastructures.

Immediate implications include a broadened landscape for stablecoin utility. This card is aimed at integrating stablecoins into everyday spending formats, encouraging adoption in regions where stable currencies are less accessible, according to Simon Jones, Chief Commercial Officer at Baanx.

“In many regions, access to stable currency is a luxury. We’re giving people the ability to hold and spend USD-backed stablecoins seamlessly — in a self-custodial, real-time way — anywhere Visa is accepted. This is what the future of finance looks like” – Simon Jones, Chief Commercial Officer, Baanx

Market and community reactions highlight anticipation within the DeFi community, viewing this as a pragmatic step in bridging digital finance with traditional systems. Rubail Birwadker of Visa expressed optimism regarding the ongoing evolution and real-world utility of stablecoins.

Market Data and Insights

Did you know? The introduction of Visa’s stablecoin card is reminiscent of previous attempts where direct conversion to fiat wasn’t feasible, distinguishing this initiative by facilitating non-custodial, real-time transactions.

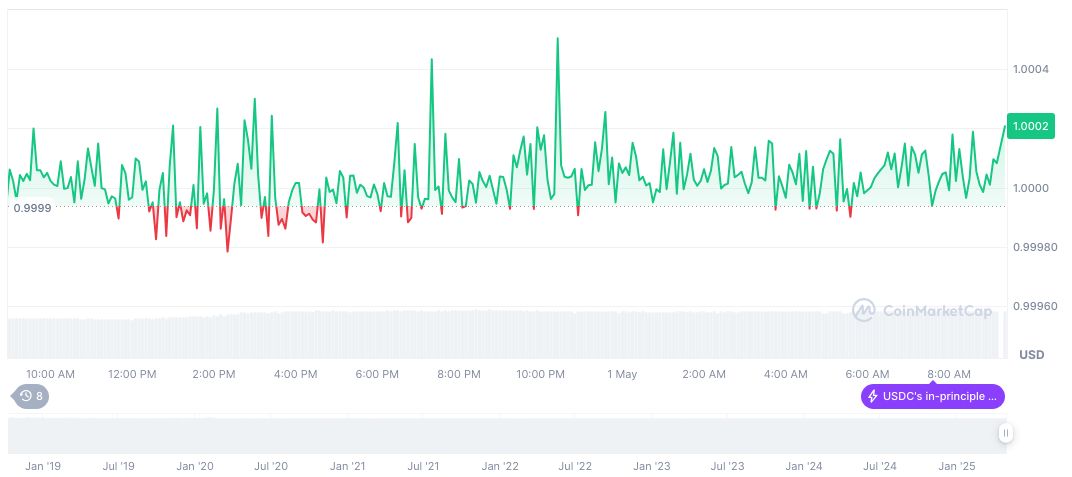

As of May 1, 2025, USDC, at $1.00, holds a market cap of $61.54 billion, reflecting 2.07% market dominance. The 24-hour trading volume reached $9.86 billion, according to CoinMarketCap. Though price fluctuations remain minimal, these data underscore USDC’s stability in current market conditions.

Insights from the Coincu research team suggest potential heightened interest from regulatory authorities due to increased stablecoin utility. Stablecoin infrastructure broadens financial access, impacting long-term regulatory strategies and fostering technological advancements in decentralized finance.

Source: https://coincu.com/335183-baanx-visa-usdc-payment-card-2/