- Baanx and Visa present a Visa-linked USDC card for crypto wallets.

- Allows spending USDC directly from wallets in real-time.

- Boosts USDC’s utility and bridges traditional and crypto economies.

Baanx has announced a partnership with Visa, launching a payment card that allows users to spend USDC directly from self-custody wallets. This innovative card will initially support transactions in regions where Visa is accepted through real-time smart contract transfers to Baanx, which enables conversion to fiat currency for payment.

The initiative represents a shift in finance, aiming to integrate stablecoins within everyday transactions. Visa’s engagement exemplifies the gradual mainstream acceptance of stablecoins and highlights their potential as practical financial instruments. This Visa card narrows the gap between conventional payment methods and digital currencies, offering more flexible spending options for users.

Baanx and Visa’s Role in Stablecoin Finance

Baanx has introduced a Visa-enabled payment method allowing users to directly spend USDC from their crypto wallets. By partnering with Visa and Circle, Baanx integrates traditional payment rails with on-chain assets. This development builds on Baanx’s prior efforts to integrate crypto-card products with digital wallets. Previously, Baanx has facilitated rewards-based crypto cards for platforms like MetaMask and 1inch.

Industry reaction has been positive, as highlighted by comments from key players. Simon Jones, CCO of Baanx, emphasized the potential for stable currencies to reach a wider audience, stating, “In many regions, access to stable currency is a luxury. We’re giving people the ability to hold and spend USD-backed stablecoins seamlessly — in a self-custodial, real-time way — anywhere Visa is accepted. This is what the future of finance looks like.” Rubail Birwadker from Visa echoed these sentiments, noting emerging utility in the stablecoin ecosystem. As the use of stablecoins gains traction, similar advancements in crypto payments are anticipated.

Industry reaction has been positive, as highlighted by comments from key players. Simon Jones, CCO of Baanx, emphasized the potential for stable currencies to reach a wider audience, stating, “In many regions, access to stable currency is a luxury. We’re giving people the ability to hold and spend USD-backed stablecoins seamlessly — in a self-custodial, real-time way — anywhere Visa is accepted. This is what the future of finance looks like.” Rubail Birwadker from Visa echoed these sentiments, noting emerging utility in the stablecoin ecosystem. As the use of stablecoins gains traction, similar advancements in crypto payments are anticipated.

Exploring USDC’s Market Performance and Future Prospects

Did you know? The rise of stablecoins like USDC signifies increasing integration with financial systems, bridging crypto assets with traditional finance mechanisms for enhanced practicality.

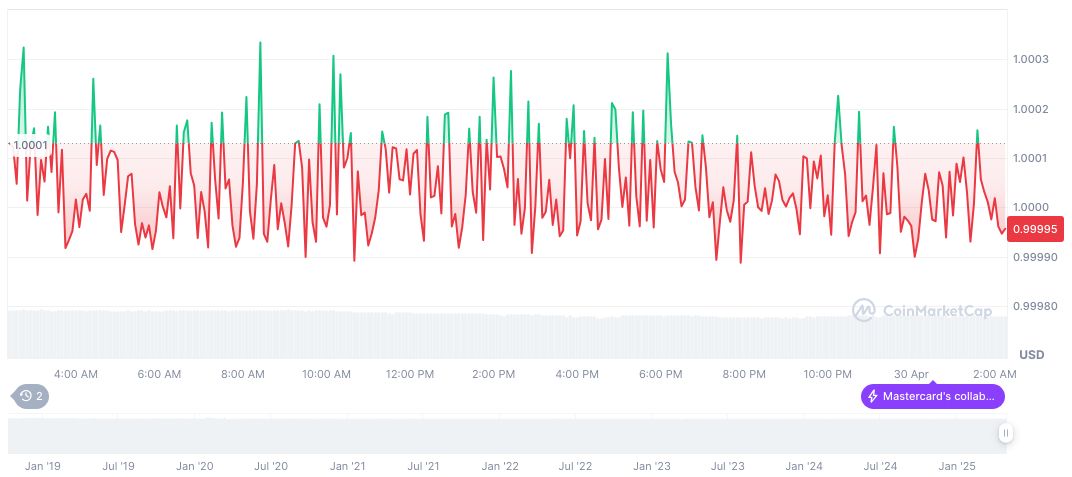

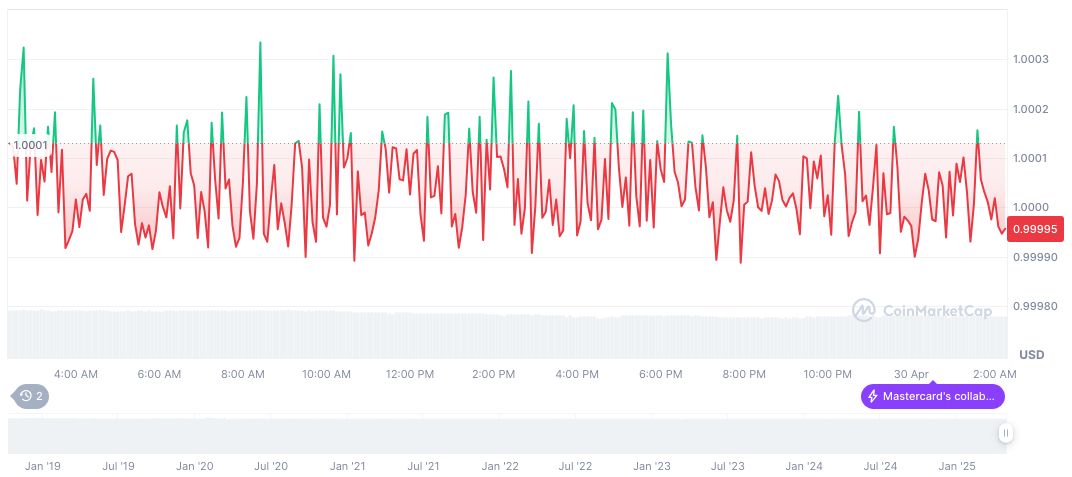

According to CoinMarketCap, USDC maintains a stable price of $1.00, holding a market cap of $61.51 billion. Despite slight changes, its recent trading volume reached $9.72 billion. Over the last 60 days, it saw a minor rise of 1.05%, suggesting stable market performance. The circulating supply stands at 61.51 billion as of the most recent data. Coincu research indicates that this card could enhance USDC’s utility, encouraging broader adoption. Stablecoin integration with payment systems may lead to increased regulatory scrutiny but could also drive innovations in decentralized finance, merging technological benefits with user convenience.

Stablecoin integration with payment systems may lead to increased regulatory scrutiny but could also drive innovations in decentralized finance, merging technological benefits with user convenience.

Source: https://coincu.com/335122-baanx-visa-usdc-payment-card/