- B token holders’ sell-off, market impact, community concerns.

- B token drops 40% in 24 hours.

- Major holders’ actions trigger further declines.

Last updated data indicates that BUILDon (B) token suffered a sharp 40% decline over 24 hours. Key holders have been implicated, including Adam Cochran, who sold B tokens at a loss, impacting the market.

The sharp decline of B token, which dropped by 40% in 24 hours, contradicts previous assertions about the stability of key addresses.

The fall of B token holds broader implications for cryptocurrency pricing and market stability, with industry players closely monitoring sell-off patterns and financial repercussions.

B Token’s 40% Drop: Market Dynamics Explained

ChainCatcher reported that influential individuals sold significant B token holdings, triggering market instability. Notably, Adam Cochran acquired 10.2 million tokens, later selling them at a loss, which contributed to a sharp market drop.

The rapid sale activity contributed to a widespread market reaction. Cochran’s actions resulted in a cascading liquidation, significantly dropping the B token’s value, sparking immediate financial repercussions. Smart money addresses quickly followed suit, exacerbating the market crash. Community sentiment remains tense as market players assessed the implications of the sell-off. Various stakeholders questioned the motives behind the strategic disposals and expressed skepticism about future price stability. These developments underscore the volatility inherent within cryptocurrency markets.

Insights from the Coincu research team highlight potential long-term impacts of such events. They note that regulatory frameworks may evolve in response to recurring sell-off patterns, aiming to stabilize market environments. These insights underscore the dynamic and rapidly changing nature of the crypto sphere.

Strategic Sell-Offs: Implications for Crypto Stability

Did you know? Historical analysis shows that strategic sell-offs by large holders are often precursors to significant volatility. The B token’s recent decline aligns with past market behaviors post-large liquidation events.

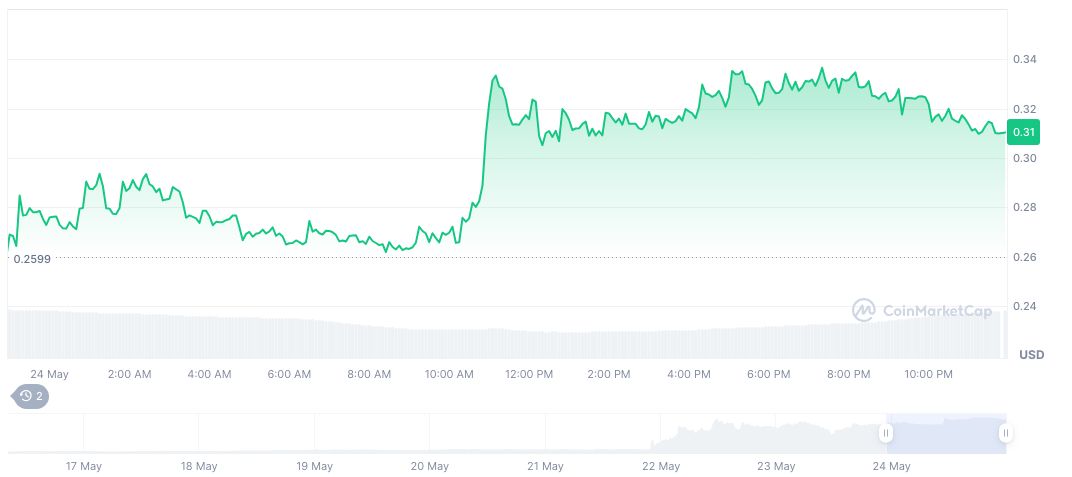

CoinMarketCap data indicates the B token’s current trading at $0.31, with a market cap standing at 310,440,224. Over a 24-hour period, trading volume decreased by 19.78%, indicating a market reaction to recent activities. The token has displayed notable long-term growth despite recent declines, with significant percentage increases over 30- and 60-day cycles.

Insights from the Coincu research team highlight potential long-term impacts of such events. They note that regulatory frameworks may evolve in response to recurring sell-off patterns, aiming to stabilize market environments. These insights underscore the dynamic and rapidly changing nature of the crypto sphere.

Source: https://coincu.com/339524-b-token-price-drop-events/