- AVAX has retraced all its gains from November

- Its apparently resurgent network activity from a week ago vanished as well

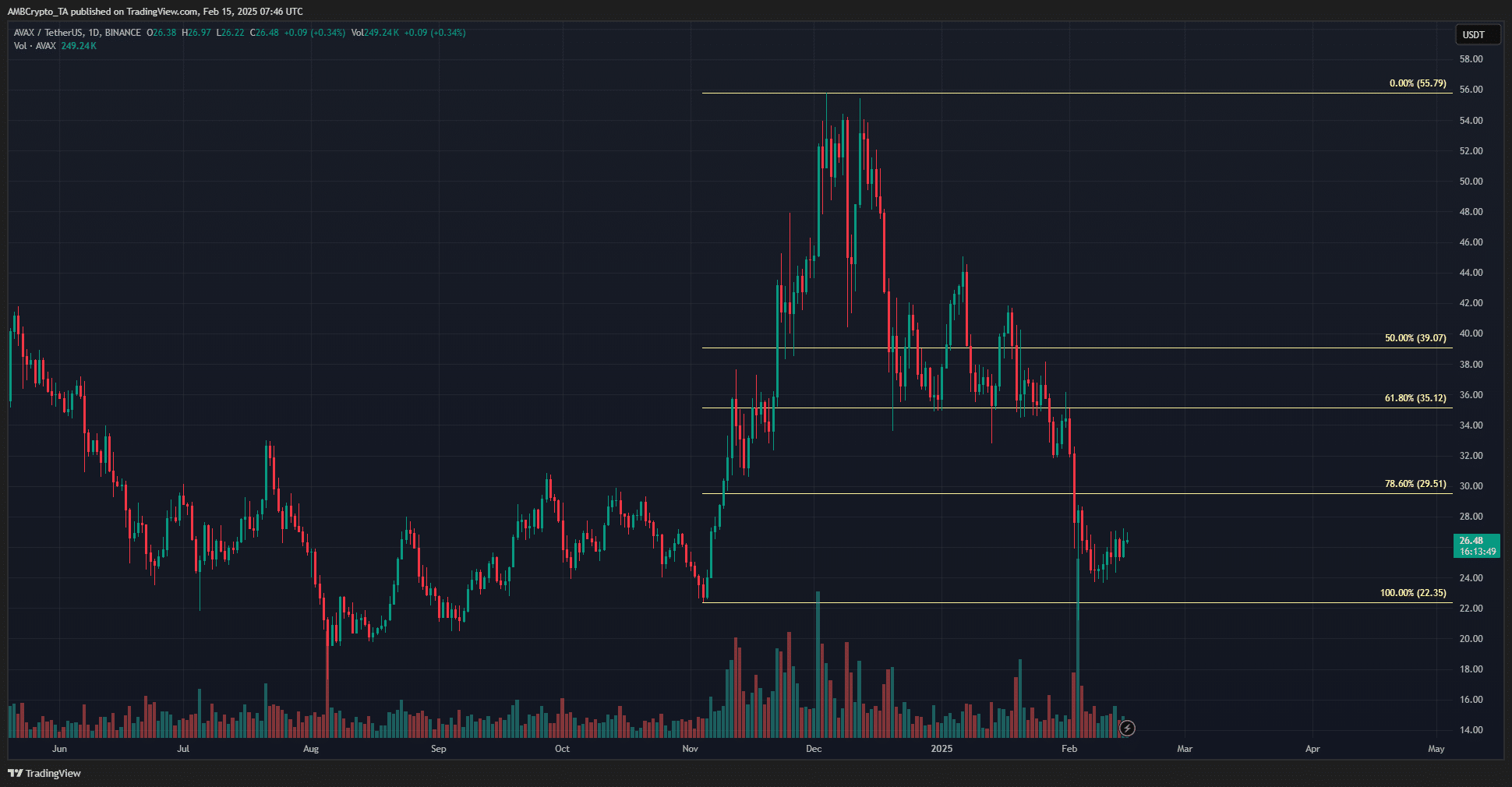

Avalanche [AVAX], at press time, had receded back to its November levels. The strong gains AVAX made when Bitcoin [BTC] pumped from $68k to $106k have now been wiped out. This, despite BTC retaining most of its own gains.

To put it simply, this episode highlighted the altcoin’s weakness on the price charts.

Source: AVAX/USDT on TradingView

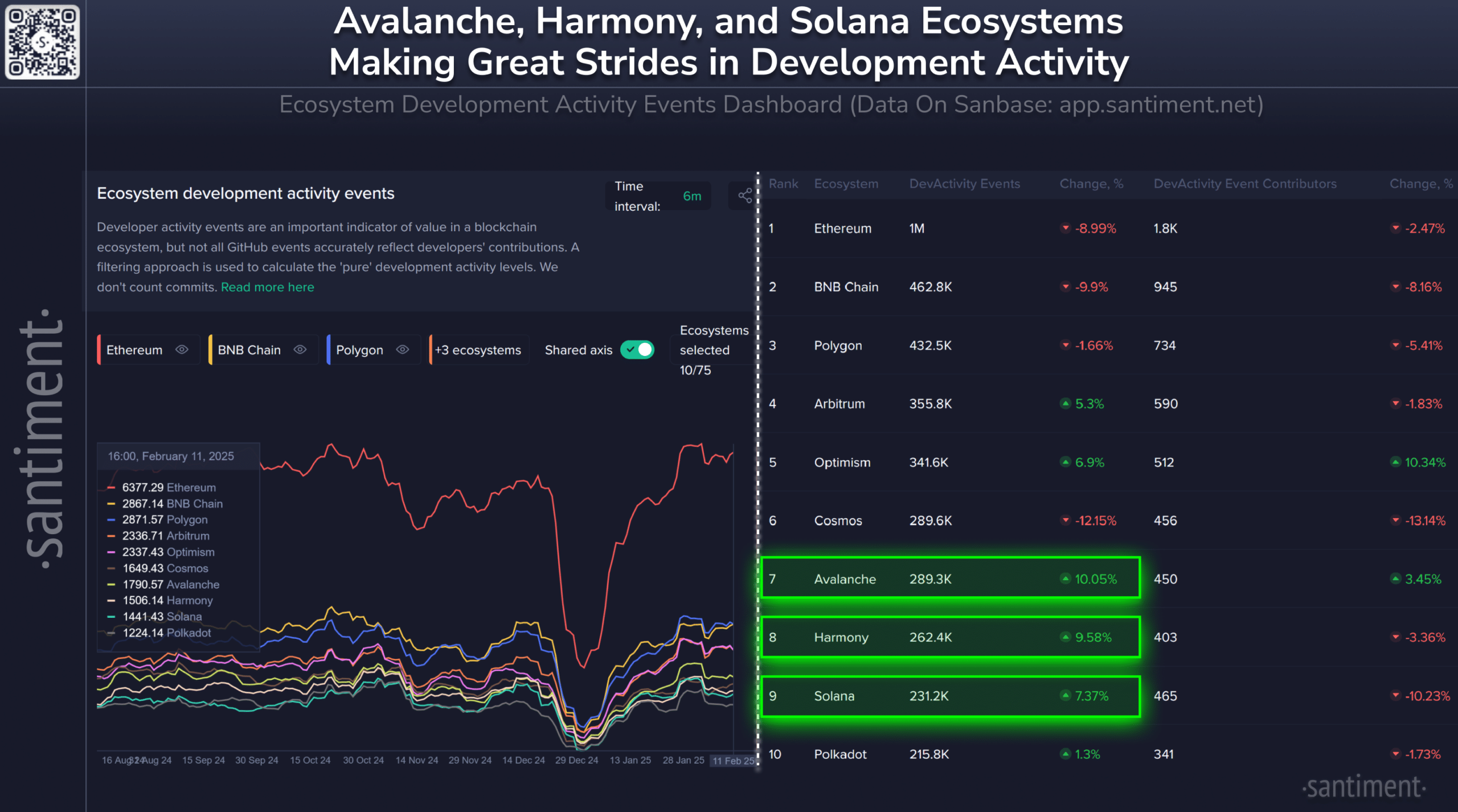

Worth pointing out, however, that ecosystem development activity has been on the rise over the last six months. Even though the price action has been fairly weak.

Source: Santiment

In a Santiment Insights post, user Brian listed some of the top protocols across the crypto sphere that saw high development activity.

Among them, Avalanche noted a 10% hike in activity over the last six months – An encouraging sight. AMBCrypto looked closer at some other metrics to understand if investors should be enthused or cautious.

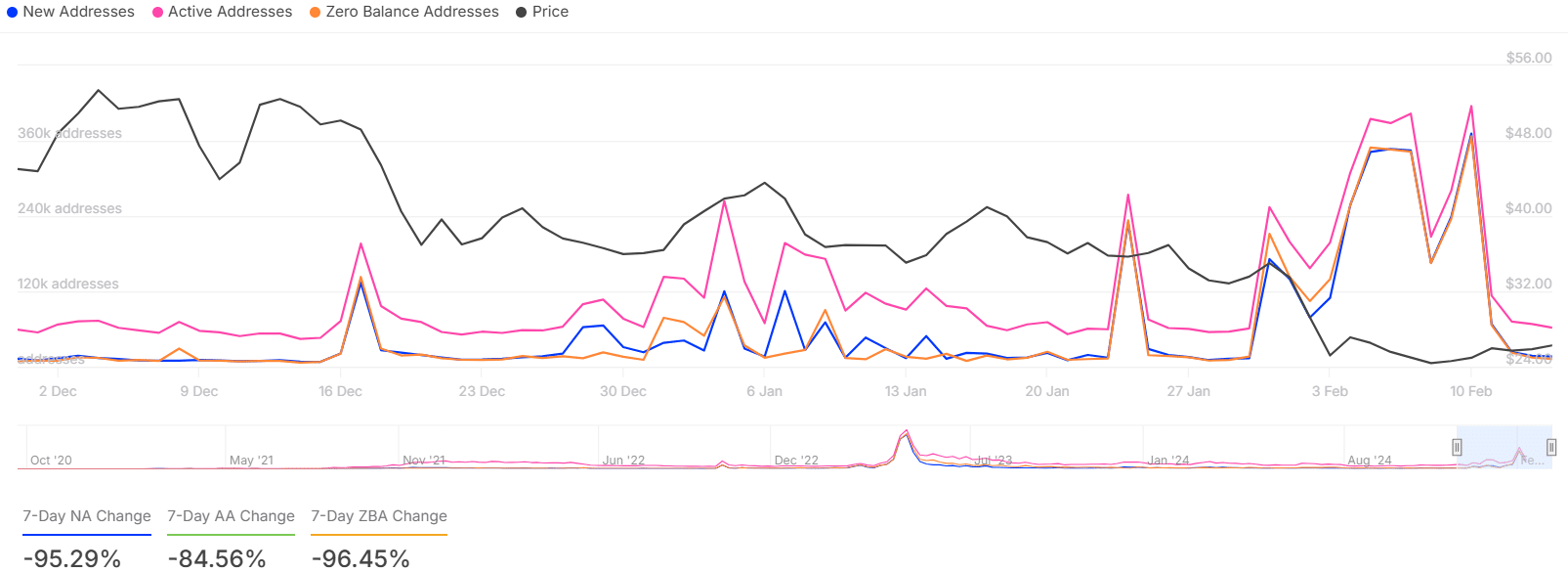

Active addresses and network growth slump is a warning

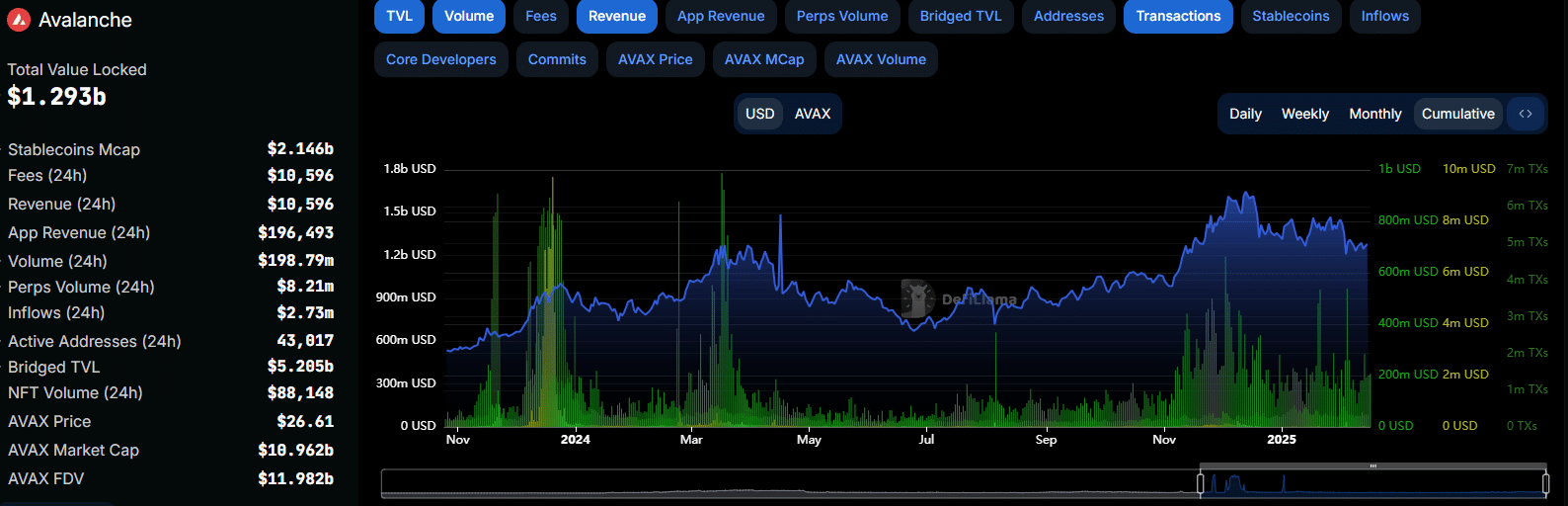

Source: DefiLlama

The total value locked (TVL) hit a local peak of $1.65 billion in mid-December. Alas, it has receded since, standing at $1.28 billion at press time.

Transaction counts also reached local highs in January, a a time when 500k transactions a day were common. However, that number is now closer to 350k.

Source: IntoTheBlock

More worryingly, the significant surge in active addresses and new addresses in the first week of February has almost entirely vanished.

Zero balance addresses also trended in lockstep with the network’s active addresses. In fact, over the past week, new addresses dropped by 95% and active addresses by 84% – A sign of a lack of confidence in the market.

Source: Ali on X

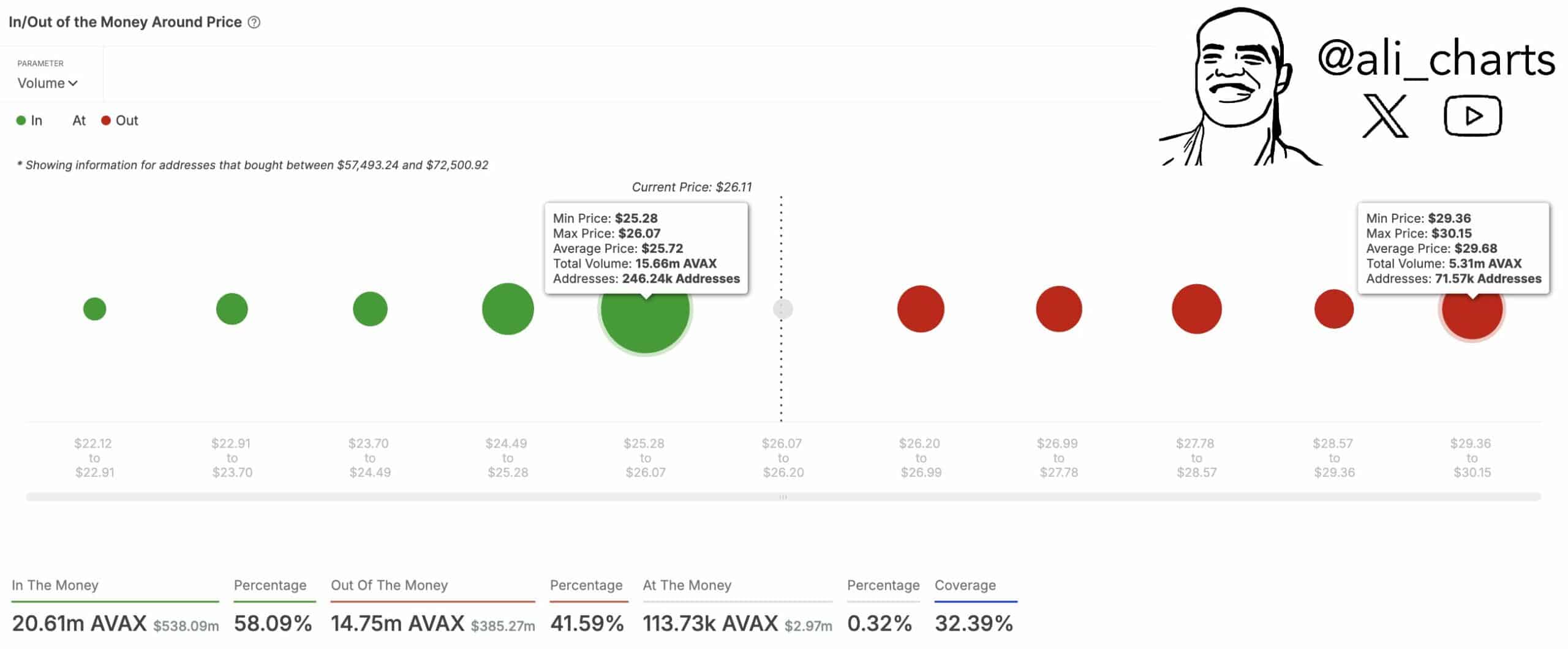

Crypto analyst Ali Martinez used the in/out of the money around price chart to highlight the importance of the $26-level. Investors should remember that the chart is based around price, meaning $26 is a local demand zone.

As the daily price chart revealed earlier, the trend right now is strongly bearish. The price is back at its November lows. Falling active addresses and network growth seemed to hint at reduced demand. Hence, a quick recovery may be unlikely for Avalanche [AVAX].

Source: https://ambcrypto.com/avalanche-what-next-for-avaxs-roadmap-after-price-hits-november-lows/