- Avalanche’s social sentiment turned bullish in the last few days.

- Market indicators also looked bullish on the token.

After an 8% increase, Avalanche [AVAX] bears took over and pushed the token’s price drop in the last 24 hours. However, there was more to the story, as this latest price dip might just be the beginning of a new bull rally.

Avalanche’s bullish breakout

The last 24 hours weren’t in investors’ favor as the token’s price dropped by more than 3%. At press time, it was trading at $27.16 with a market capitalization of over $11 billion.

Notably, after the price drop, 50% of the total number of Avalanche holding addresses remained in profit, as per IntoTheBlock’s data. But the trend might change soon as Avalanche might just be testing its support after a breakout from a bullish pattern.

Captain Faibik, a popular crypto analyst, posted a tweet revealing that AVAX broke above a bullish falling wedge pattern. As per the tweet, the pattern emerged in November 2023, and since then the token’s price has been consolidating inside it.

The latest price decliner could be a retest of the support of the pattern. If the token manages to test it, then investors might expect Avalanche to surge by over 100%. Additionally, it might also retouch its March highs in the coming days.

Source: X

What to expect from AVAX

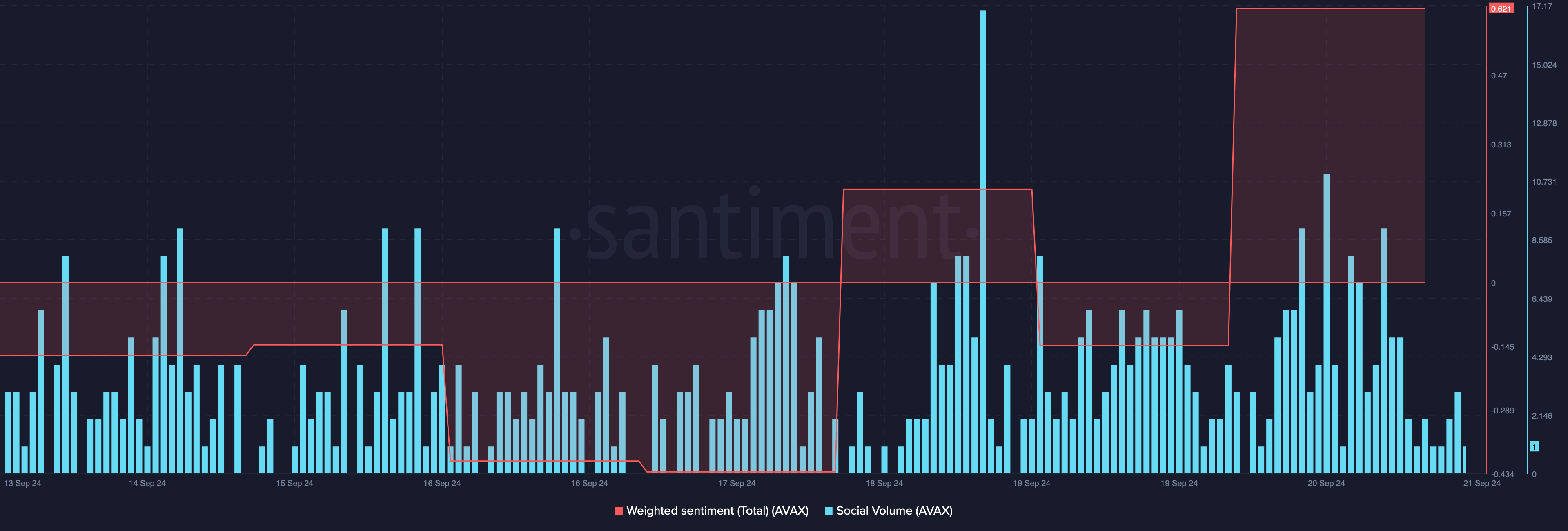

AMBCrypto then checked Avalanche’s on-chain data to find out what metrics suggested a 100% price rise. As per our analysis, Avalanche’s weighted sentiment increased.

This clearly indicated that bullish sentiment around the token was high. Additionally, its social volume also increased, reflecting the token’s popularity in the crypto space.

Source: Santiment

However, at the time of writing, Avalanche’s fear and greed index had a value of 71%, meaning that the market was in a “greed” position. Whenever the metric hits this level it indicates that the chances of a price correction are high.

Therefore, we checked AVAX’s daily chart to better understand what to expect from it in the coming days.

We also found that AVAX was testing a support level. On top of that, Avalanche’s MACD displayed a clear bullish advantage in the market.

Read Avalanche’s [AVAX] Price Prediction 2024–2025

Its Chaikin Money Flow (CMF) also registered a sharp uptick, indicating that the token might test the support successfully and move northwards in the coming days.

If that happens, then AVAX might first target $32. A jump over that could lead the token to its March highs.

Source: TradingView

Source: https://ambcrypto.com/avalanche-poised-for-100-rally-after-testing-key-support-level/