- An unknown wallet transferred 20 million TRUMP worth $341.923 million

- Whales built $49 million worth of long positions at the $15.92-level

After a sustained and significant price drop on the charts, U.S President Donald Trump’s memecoin, TRUMP, noted a breakout on the back of impressive upside momentum. In fact, at the time of writing, the larger cryptocurrency market sentiment appeared to have turned positive, with the same heavily influencing the altcoin.

Whale moves 20 million TRUMP from Binance

Another key factor fueling TRUMP’s momentum is a hike in whale interest and its recent listing on Upbit.

Recently, the blockchain-based transaction tracker Whale Alert shared on X (formerly Twitter) that an unknown wallet transferred a significant 20 million TRUMP memecoins, worth $341.923 million, from Binance.

Impact on TRUMP’s price

Following this transaction, the memecoin saw notable upside momentum, with the same accompanied by greater trading volume too. At press time, the crypto was trading near $19.05, following a hike of over 12.50% in the last 24 hours.

Additionally, its trading volume jumped by 25% over the same period – A sign of heightened participation from traders and investors compared to the previous day.

Bullish on-chain metrics

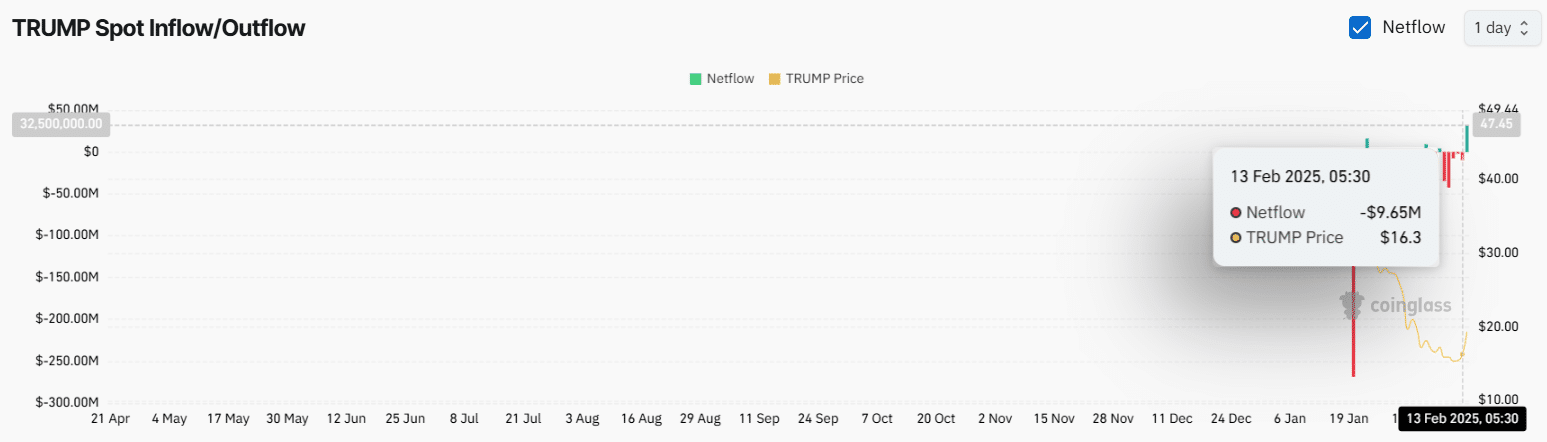

According to CoinGlass’s data, since the token’s launch, the memecoin has seen continuous accumulation from exchanges, with dumping seen on only three days.

At the time of writing, data from the spot inflow/outflow metric indicated that exchanges witnessed an outflow of nearly $10 million in TRUMP memecoins in the last 24 hours – Indicating potential accumulation.

Source: Coinglass

Major liquidation levels

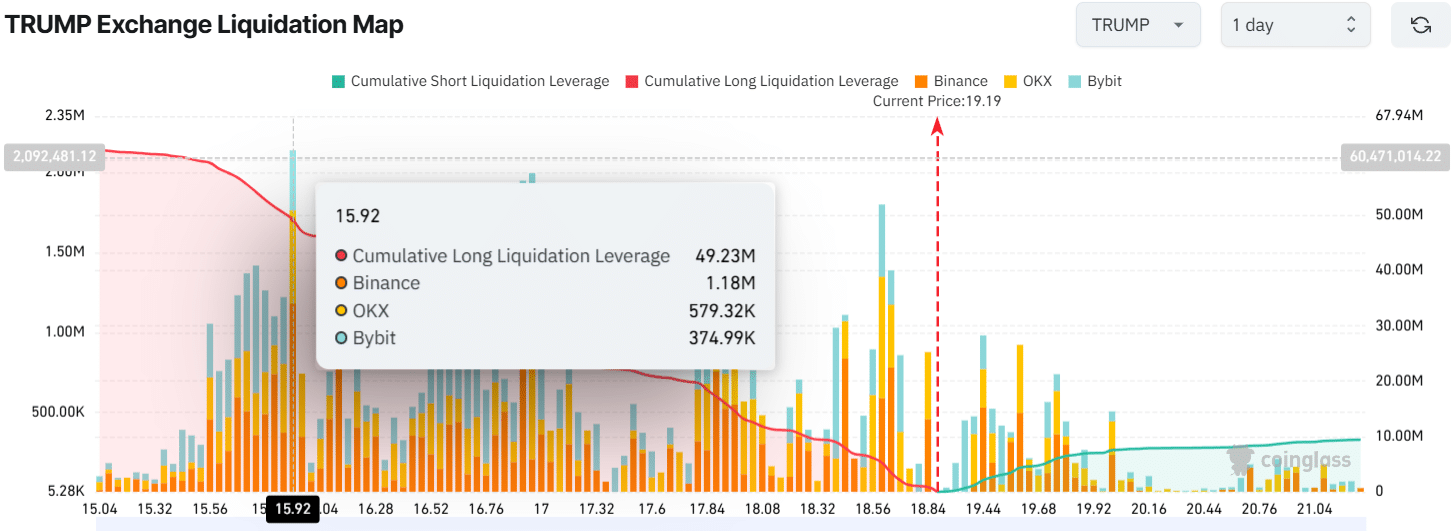

Now, while investors, whales, and long-term holders hinted at potential accumulation, intraday traders significantly increased their open positions. Data found that TRUMP’s Open Interest (OI) surged by 12% in the last 24 hours, with a majority of the positions being built on the long side.

Intraday traders appeared to be highly bullish and at press time, were over-leveraged at the $15.92 level – Holding $49.23 million worth of long open positions. Meanwhile, traders betting on short positions were over-leveraged at $20, having built $7.50 million worth of short positions.

Source: Coinglass

Traders’ continuous bets on long positions suggest that TRUMP is bullish and could soon trigger the liquidation of short positions. To put it simply, the hike in interest, along with whale accumulation and traders’ bullish bets, has shifted the market sentiment for TRUMP.

TRUMP’s upcoming levels

Over the last few days, the memecoin’s four-hour chart flashed a pattern of lower highs and lower lows. However, TRUMP has broken this pattern since, breaching two crucial resistance levels at $17 and $19.

Source: TradingView

Based on its price action and historical trends, if TRUMP holds above the $19-level, there is a strong possibility that the asset could soar by 28% to hit $25.15 in the near future.

Source: https://ambcrypto.com/assessing-the-342m-trump-transfer-and-its-effect-on-memecoins-price/