Key Takeaways

Polygon’s POL surged 12% to $0.2736 on rising Active Addresses, Daily Transactions, and buyer accumulation. Yet profit-taking and higher Spot Netflows suggest caution.

After defending support at $0.23, Polygon [POL] rallied 12.72% to a three-month high of $0.2736. Over the same stretch, trading volume jumped 34% to $315.7 million, while market cap touched $2.8 billion.

Polygon’s demand surges

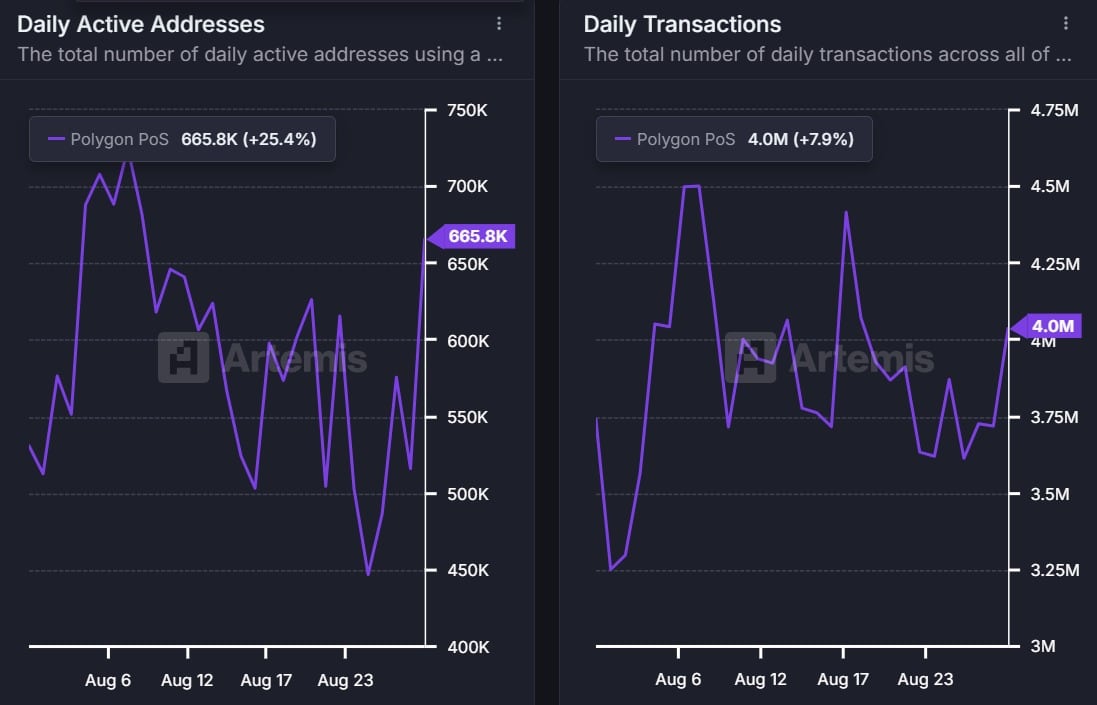

Polygon’s network usage has strengthened sharply.

According to Artemis, Active Addresses climbed from 447k to 665k – a 25% increase, signaling revived demand.

Source: Artemis

At the same time, Daily Transactions recovered to 4 million — an increase of 7.9%, reflecting higher on-chain activity.

According to X (formerly Twitter) user Dhee, these transactions were boosted mainly by the recent Polygon PoS USDT upgrade to the USDT0 standard. This made Polygon the leader in transacting USDT0 addresses.

Source: Dhee on X

Also, on the 18th of August, Sealunch data showed Polygon recorded 780k transacting addresses, ahead of Arbitrum’s 492k.

Meanwhile, Polygon seemed to gradually become Singapore’s stablecoin hub, according to crypto analyst Petertherock.

He observed that, over the past four months, it processed $66 million, $88 million, $74 million, and $94 million in XSGD transfers.

Source: Petertherock

Buyer accumulation builds

Significantly, as POL dipped to $0.23, buyers stepped in.

Source: Coinalyze

According to Coinalyze, Buy Volume reached 86.7 million vs. 70.6 million Sell Volume, producing a Buy–Sell Delta of 16.1 million. This marked two straight days of accumulation.

Also, profit-taking accelerates

Unsurprisingly, as POL rebounded from the recent correction, holders rushed to cash out.

For instance, Santiment’s Ratio of Daily On-chain Transaction Volume in Profit to Loss surged to 3.24 at press time.

Source: Santiment

Such a massive spike implies that there are 3.2 profitable transactions for every one losing transaction on-chain. There is high profit-taking activity, which warns of potential corrections as profit-taking could trigger sell-offs.

Furthermore, exchange activity reflected the increasing selling activity.

According to CoinGlass, Polygon Network’s token recorded a positive Spot Netflows for two consecutive days.

Source: CoinGlass

At press time, Netflow stood at $929k, down from $2.02 million the prior day, signaling higher inflows.

Momentum indicators flash bullish

According to AMBCrypto’s analysis, RSI climbed to 61, confirming bullish momentum.

The Directional Movement Index showed the Positive DI at 24 vs. the Negative DI at 20, underlining buyer dominance.

Source: TradingView

If buying continues, $0.28 is the next key resistance, with potential to stretch toward $0.30. Conversely, failure at $195 support could drag prices toward $0.247.

Source: https://ambcrypto.com/assessing-polygons-12-comeback-2-key-levels-for-pols-next-move/