- ARK Invest, led by Cathie Wood, sold Circle shares, earning $243M.

- Profit-taking occurred after a 248% post-IPO stock surge.

- Despite selling, ARK retains substantial Circle shareholdings.

ARK Invest sold 1.25 million shares of Circle (CRCL) over the past week, grossing approximately $243 million following Circle’s IPO-related stock surge. The sale reflects significant profit-taking as Circle’s shares surged 248% since its NYSE debut, positioning ARK for a substantial financial gain.

ARK Invest, led by Cathie Wood, sold Circle shares, earning $243M. Profit-taking occurred after a 248% post-IPO stock surge. Despite selling, ARK retains substantial Circle shareholdings.

ARK Divests 29% of Circle Holdings for $243 Million Profit

ARK Invest, managed by Cathie Wood, made strategic divestments from its Circle shareholdings across three funds. The move resulted in the sale of 609,175 shares on Friday alone, valuing the transaction at $146.2 million. ARK’s actions, totaling 29% of its original stock allocation, attracted industry attention as a tactical profit-taking move.

Despite this activity, ARK’s overall strategy appears unchanged, as the firm remains a major shareholder in CRCL, holding approximately $750 million worth of shares. Cathie Wood, CEO and Founder, ARK Invest, “ARK’s selling was primarily profit-taking after CRCL’s post-IPO rally, not an exit from the Circle thesis entirely.” Circle’s stock saw a sharp increase, closing at $240.30, reflecting investor enthusiasm post-IPO.

Market analysts noted the almost 248% rise in Circle’s stock since its public listing, suggesting ARK’s decision may have been profit-driven rather than diminishing confidence in Circle’s growth potential. However, no statements or explanations have emerged from ARK’s leadership concerning this divestment strategy.

Circle’s 248% Stock Surge Sparks Market Discussion

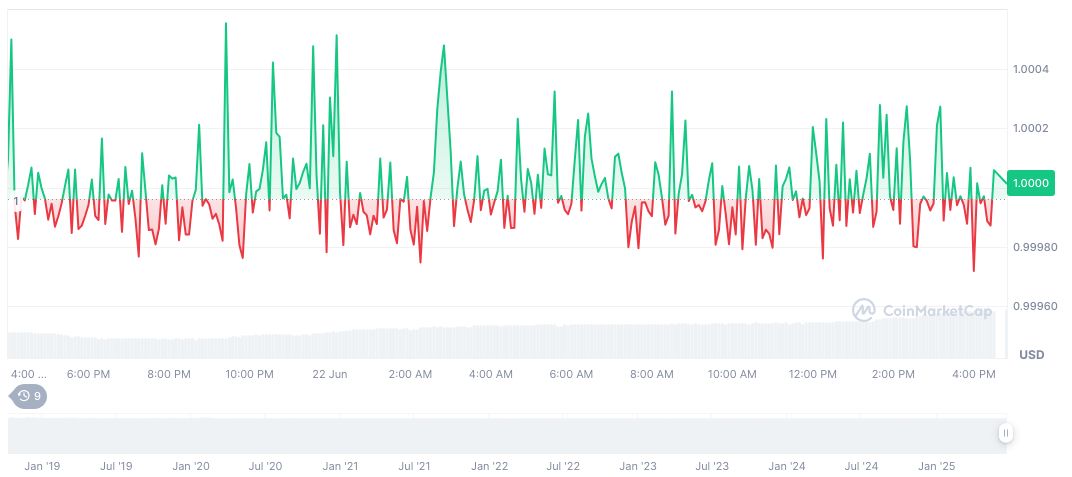

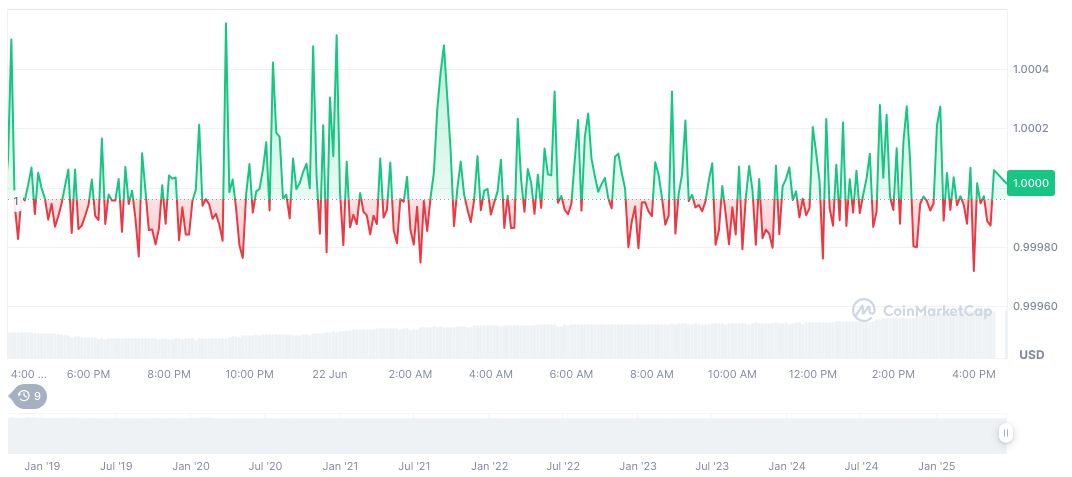

Did you know? Circle’s stock has experienced significant volatility, reflecting broader market trends and investor sentiment.

According to CoinMarketCap, USDC remains stable at $1.00 with a market cap of over $61 billion, maintaining a 1.99% dominance. The stablecoin witnessed a slight 1.18% dip in 24 hours, though its 30-day movement was minimally positive.

The Coincu research team highlighted the impact of ARK’s sale on broader market sentiment. Although direct effects on digital assets like USDC are unlikely, confidence dynamics amongst institutional investors could ripple, affecting investment behaviors in related sectors. Circle’s stock saw a sharp increase, closing at $240.30, reflecting investor enthusiasm post-IPO.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/344636-ark-sells-circle-shares/