- Aqua 1 invests $100 million in WLF’s WLFI for governance participation.

- Governance token strategy resembles big finance’s foray into DeFi.

- Token transfer restrictions to lift amid rising institutional interest.

Aqua 1, a Web3 native fund, announced acquiring $100 million worth of WLFI, World Liberty Financial’s governance token, to influence the platform’s governance.

This acquisition marks a significant institutional interest in decentralized finance projects associated with public figures, carrying implications for governance and financial ecosystems.

Aqua 1 Invests $100M to Reshape DeFi Governance

Aqua 1’s bold $100 million WLFI purchase positions the fund to significantly influence World Liberty Financial’s decentralized protocol. This decision aims to bolster the blockchain ecosystem, aligning with plans to establish a Middle East fund to drive digital economic change. The Trump family’s association with the project underlines its public attention. Aqua 1’s investment calls for the expected transition of WLFI from non-transferable status, enabling greater liquidity and community participation. “You asked to make WLFI transferable — we heard you. The team is working behind the scenes to make it happen.” The need for transparency has been recognized, with plans to unlock token transfers being well-received. Anticipated governance shifts could reflect broader DeFi adoption. Market participants are closely watching for responses from major exchanges and potential listing announcements. Positive sentiment surrounds expected public company integration of WLFI in treasuries, underscoring growing institutional confidence in DeFi integration. The blockchain community eagerly anticipates deployment of the incoming mobile DeFi app, enhancing usability.

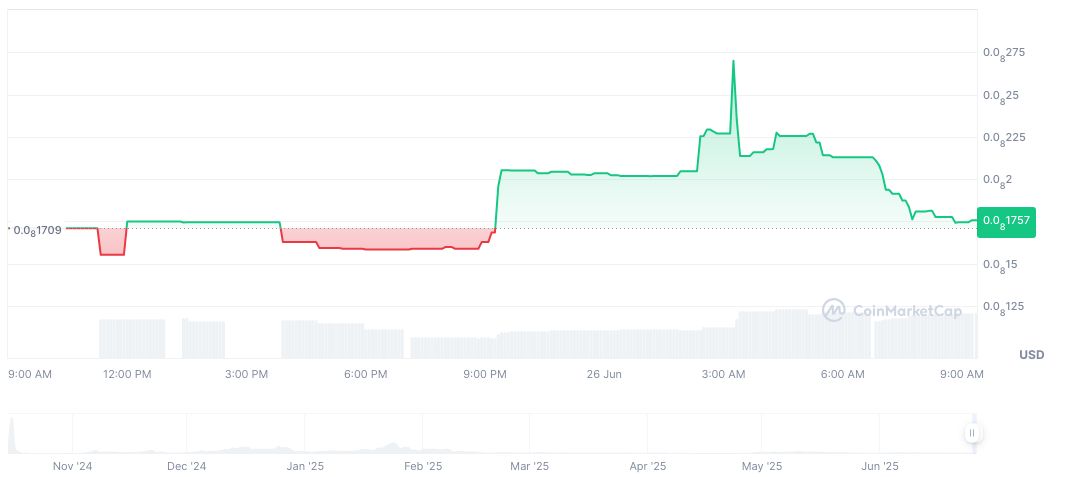

World Liberty Financial (WLFI)’s governance token details show no current market value, impacting moves by Aqua 1. With no market cap and a fully diluted market cap of $18.07 million, recent trades reached $27,581.24 with a 16.63% increase. Recently, WLFI experienced a 10.49% drop in 24 hours but gained 7.36% over 7 days according to CoinMarketCap.

Bold moves like Aqua 1’s are part of a broader trend in institutional engagement with DeFi, noted by the Coincu research team. These strategies often precede mainstream adoption, normalizing governance token use in business treasuries. Institutional forces could drive regulatory clarity and ecosystem advancements as roles expand. Zak Folkman, Co-founder, World Liberty Financial, said, “There has been a lot of interest from several public vehicles who want to use WLFI to be held in their treasuries as well.”

Market Trends and Institutional Influence in Crypto Ecosystems

Did you know? Investment activities in DeFi governance tokens by large funds often precede significant protocol updates and television momentum, similar to Paradigm’s moves in the Uniswap protocol.

World Liberty Financial (WLFI)’s governance token details show no current market value, impacting moves by Aqua 1. With no market cap and a fully diluted market cap of $18.07 million, recent trades reached $27,581.24 with a 16.63% increase. Recently, WLFI experienced a 10.49% drop in 24 hours but gained 7.36% over 7 days according to CoinMarketCap.

Bold moves like Aqua 1’s are part of a broader trend in institutional engagement with DeFi, noted by the Coincu research team. These strategies often precede mainstream adoption, normalizing governance token use in business treasuries. Institutional forces could drive regulatory clarity and ecosystem advancements as roles expand. Zak Folkman, Co-founder, World Liberty Financial, said, “There has been a lot of interest from several public vehicles who want to use WLFI to be held in their treasuries as well.”

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/345390-aqua1-100m-investment-wlfi/