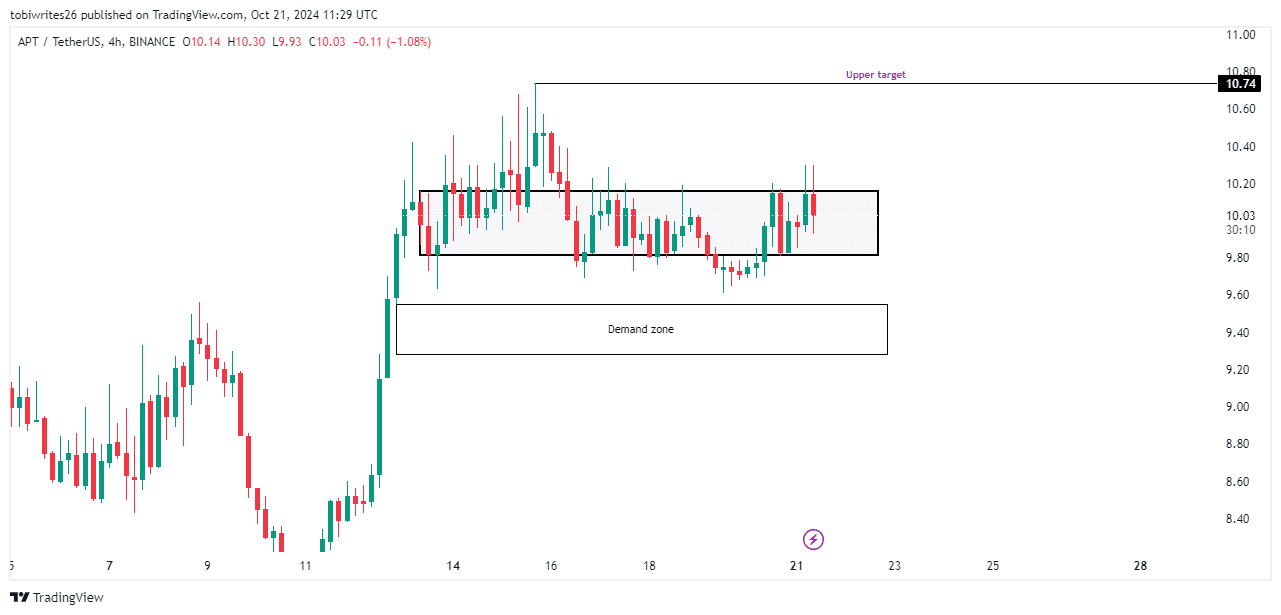

- Since 13th October, APT has been trading within a range.

- Given recent market activity, a move to the upside seems likely.

Aptos [APT] has failed to sustain the enthusiasm it initially generated despite a 29.61% gain in the past month. The asset has slipped, recording a 1.91% loss over the past week, though it experienced a slight 0.25% uptick in the last 24 hours.

Will this slight rise expand to the upside? AMBCrypto’s analysis offers insight on what to anticipate.

What does the consolidation phase mean for APT?

APT has been in a consolidation phase since 13th October, reflecting market neutrality as the price fluctuates between a defined support level of $9.81 and resistance at $10.61.

Although this phase is neutral, it often signals an accumulation period, with market participants buying APT in anticipation of a breakout to the upside.

If the upward move materializes, APT could rally to the peak of the pattern at $10.74. Otherwise, it may dip into a lower demand zone, searching for liquidity before a potential rebound.

Source: TradingView

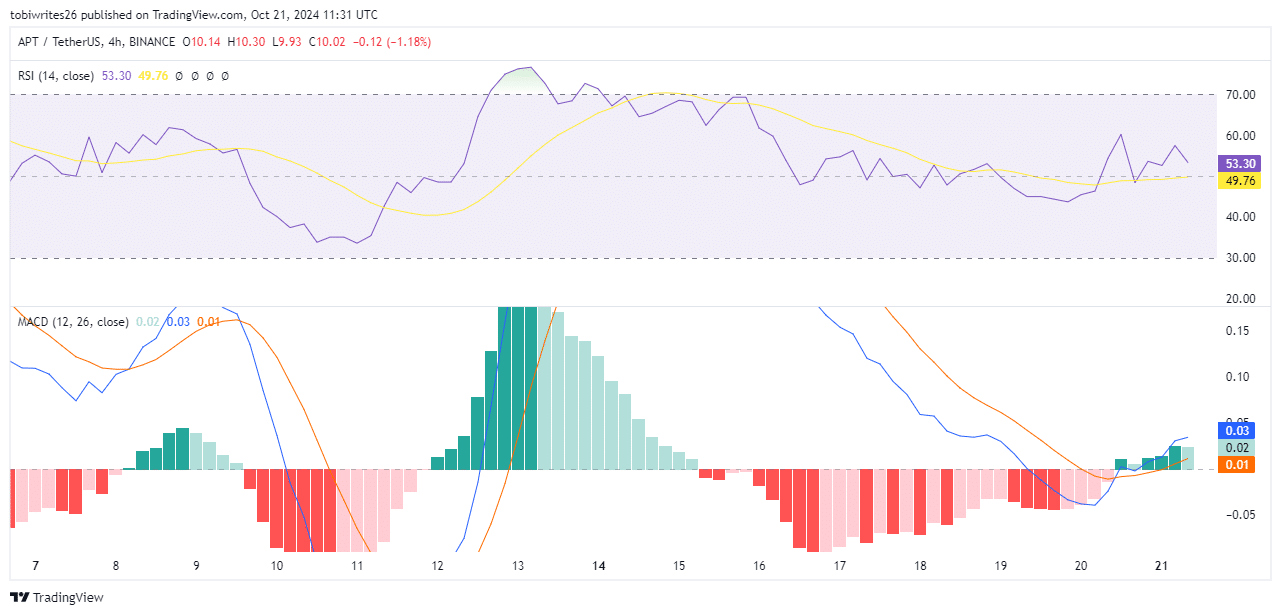

Current technical indicators are showing signs that support the likelihood of an upward move.

Market activity skewed in favor of the bulls

According to the Moving Average Convergence Divergence (MACD), APT is likely to experience an upswing. This is indicated by the formation of a Golden Cross pattern as the asset continues to trade in the positive region.

A Golden Cross occurs when the blue MACD line crosses above the orange signal line, typically accompanied by rising volume. What strengthens this bullish signal is the MACD line is already in the positive zone, which reflects a strong sentiment toward the asset.

Source: Trading View

Additionally, the Relative Strength Index (RSI), which measures the speed and change in price momentum, was in the bullish territory, sitting above 50 at press time.

This means that APT’s price is well-positioned for a rally and could see an uptick, potentially shifting market direction in favor of the bulls.

A drop before an upswing?

According to Coinglass, APT’s Open Interest has dropped slightly over the last 24 hours, declining by 1.65% to $215.99 million.

Read Aptos’ [APT] Price Prediction 2024–2025

However, a broader view of the chart suggests that this correction may be nearing its end, with a significant upward move likely to follow. This pattern, characterized by a retracement before a rally, has been the predominant trend.

Once this occurs, APT could begin its ascent toward the previously mentioned target of $10.74, or potentially trend even higher.

Source: https://ambcrypto.com/aptos-why-apts-sideways-trading-may-soon-give-way-to-bullish-surge/