- Ant Group and JD.com halted stablecoin projects in Hong Kong.

- Beijing’s regulatory concerns led to the suspension.

- 36 firms remain involved under Hong Kong’s stablecoin rules.

Ant Group and JD.com have paused their stablecoin plans in Hong Kong after Beijing’s regulatory intervention and the recent local regulatory changes in August 2025.

This pause by major tech companies highlights growing regulatory challenges for stablecoins amid efforts to control private digital currency creation and maintain financial stability.

Ant and JD.com’s Stablecoin Suspension Amid Beijing’s Scrutiny

Ant Group and JD.com have paused their stablecoin issuance plans in Hong Kong. This decision followed Hong Kong’s new regulatory framework’s implementation. Both companies initially showed intentions to engage in Hong Kong’s stablecoin pilot projects. Regulatory interventions from Beijing have influenced this suspension. The People’s Bank of China (PBoC) and Cyberspace Administration of China (CAC) were noted as key players in encouraging the suspension. Hong Kong’s Securities and Futures Commission (SFC) had earlier expressed concerns regarding potential fraud increases with the new regulatory guidelines.

The suspension implications are significant. With Hong Kong’s regulations in place, 36 firms have applied for stablecoin licenses, yet major entities like Ant Group and JD.com have ceased their operations, indicating potential hesitancy within the industry. The Ant and JD.com stablecoin projects aimed at utilizing Hong Kong Dollar (HKD) or Renminbi (RMB)-pegged currencies. These moves could see restrained marketplace activity and institution-driven innovations in Hong Kong’s crypto market. Market responses are primarily cautious. No major on-chain activity changes relating directly to the suspensions were recorded. Official statements from Ant Group and JD.com have yet to be released regarding this situation.

The city’s new stablecoin regulatory framework has heightened the risk of fraud. – Ye Zhiheng, Executive Director, Hong Kong SFC

Historical Comparisons and Market Sentiments on Regulation

Did you know? The Diem project from Meta faced similar regulatory roadblocks years ago, leading to its ultimate shutdown. These occurrences exemplify the challenges large tech companies face in entering the stablecoin market.

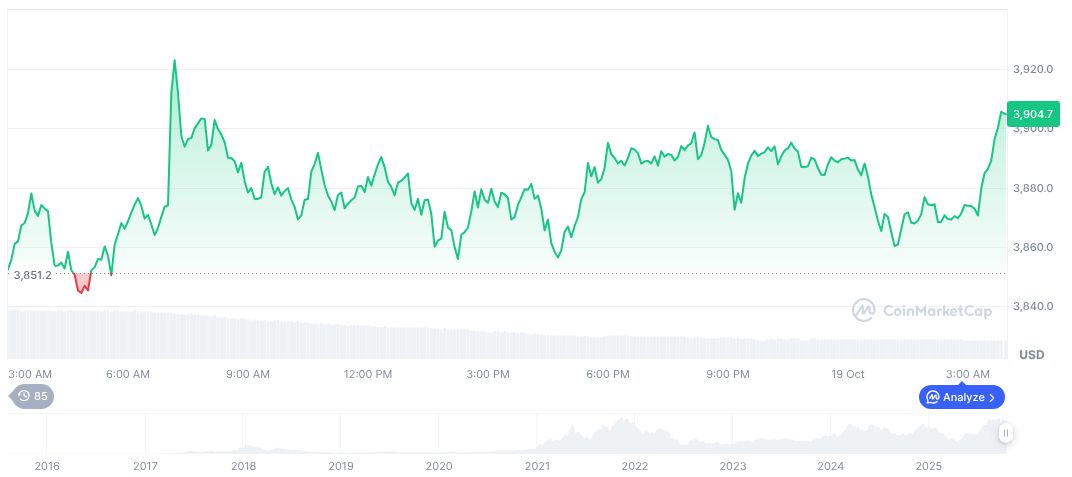

According to CoinMarketCap, Ethereum (ETH) is currently priced at $3,938.94 as of October 20, 2025. The cryptocurrency has a market cap of $463.84 billion and shows a 24-hour trading volume increase of 47.11% to $33.72 billion. Over the past 90 days, the ETH price has shown a positive change of 5.08%. Despite these figures, the anticipated releases from Ant Group and JD.com were not associated with Ethereum, suggesting potential missed opportunities for market expansion.

The Coincu research team suggests that ongoing regulatory interventions may realign future stablecoin projects towards more tightly regulated parameters. The potential for blockchain advancements could be affected by short-term caution in market adoption due to increased regulatory scrutiny. Strengthened compliance frameworks may dictate future dynamics of stablecoin offerings from heavily regulated jurisdictions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/ant-jd-halt-stablecoins-hong-kong/