- Anna Paulson supports two more 25bp rate cuts in 2025.

- The cut could bolster risk assets like BTC and ETH.

- Paulson emphasizes looking past tariff-driven price spikes.

Anna Paulson, President of the Philadelphia Fed, advocated for further rate cuts in a speech, aligning with FOMC projections for 2025, emphasizing ignoring tariff-induced price impacts.

Paulson’s remarks suggest potential market boosts for cryptocurrencies like BTC and ETH, as previous rate cuts have historically driven up crypto asset valuations.

Anna Paulson Endorses 50 Basis Point Reduction for 2025

Anna Paulson, President of the Philadelphia Fed, expressed support for two more 25 basis point rate cuts this year during a speech. She noted that monetary policy should disregard the impact of tariffs on consumer prices. Recently appointed in July, this was her first major public address.

Paulson’s statement suggests a shift towards easing monetary policy, which is anticipated to stimulate market movements in risk assets. The Federal Reserve’s recent cut to 4.00%-4.25% is aligned with her vision of a gradual path towards further cuts, therefore indirectly affecting asset valuation trends.

Labor market risks do appear to be increasing—not outrageously, but noticeably. And momentum seems to be going in the wrong direction. — Anna Paulson, President, Philadelphia Federal Reserve

Anticipated Crypto Boost from Fed’s Policy Shift

Did you know? Historically, Federal Reserve rate cuts have often correlated with significant rallies across major cryptocurrencies, as seen in 2019 and 2020 when BTC’s value doubled following a pivot.

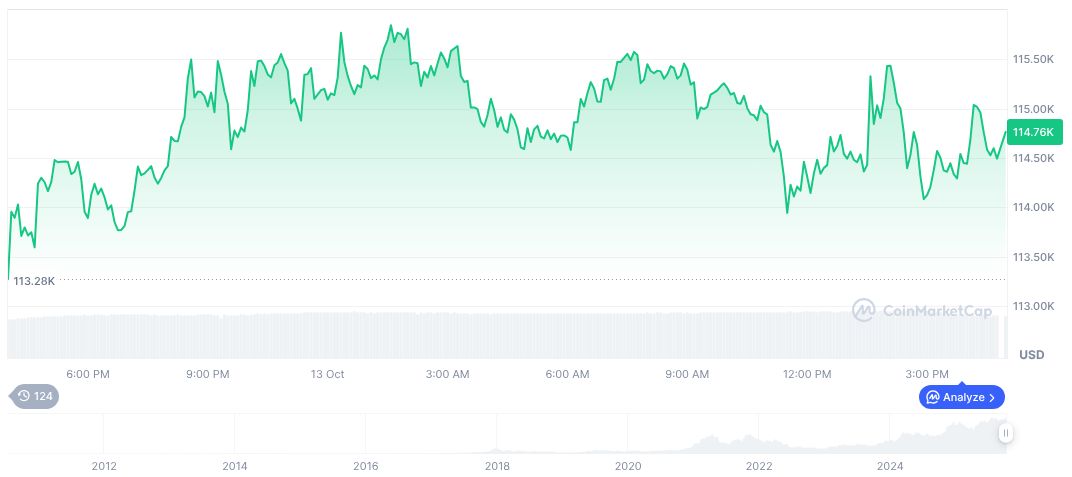

Bitcoin (BTC) currently trades at $114,708.54, with a market cap of $2.29 trillion and dominance at 58.22%. According to CoinMarketCap, BTC’s trading volume declined by 26.27% in 24 hours. Price changes in the past week fell by 7.93%.

Insights from Coincu indicate that further easing could foster a bullish trend for both cryptocurrencies and traditional markets. Risk assets might witness increased engagement as financing conditions relax. Analysts note that historically, rate cuts enhance market appetite, potentially driving crypto interest and metrics like Total Value Locked.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-rate-cuts-2025-paulson-support/