On the 31st of January, the crypto market experienced one of its largest sell-offs, losing more than $200 billion in market value. Altcoins posted significant losses, falling below $200 billion in market capitalization.

Amid this dip, smaller altcoins such as ASTER were hit the hardest. After the market crash, ASTER fell to a four-month low of $0.507 before slightly rebounding.

As of this writing, Aster [ASTER] traded at $0.552, down 7% on the daily charts, extending its week-long bearish trend. Following this market slump, AsterDex rushed in to rescue the altcoin from further slippage.

AsterDex activates strategic reserve buyback fund

Following ASTER’s recent low, AsterDex activated the Strategic Reserve Buyback Fund. Under the program, daily platform fees and the remaining funds will be allocated directly to targeted buybacks.

In doing so, the team aimed to support the token’s long-term value while also offering incentives to ASTER holders. In fact, AsterDEX has aggressively repurchased tokens over the past four months to absorb market pressure.

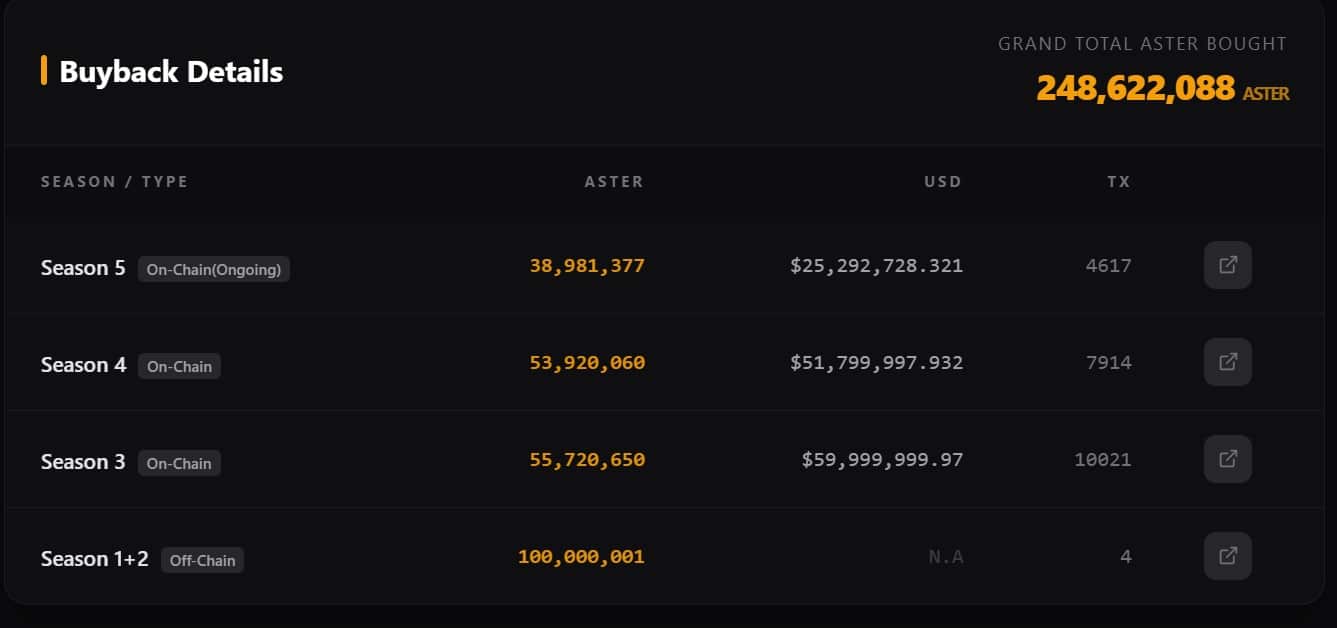

As a result, the team purchased 248.08 million ASTER tokens, valued at $137 million, representing 1.6% of the circulating supply excluding burns.

Source: Asterlify

During the ongoing season 5, they purchased 38 million ASTER for $24 million. Over the past 24 hours, the team bought 2.9 million ASTER for $1.6 million.

The continued buyback, especially during a period of extreme market stress, demonstrates the team’s commitment to the projects and long-term conviction.

Selling pressure persists across the market

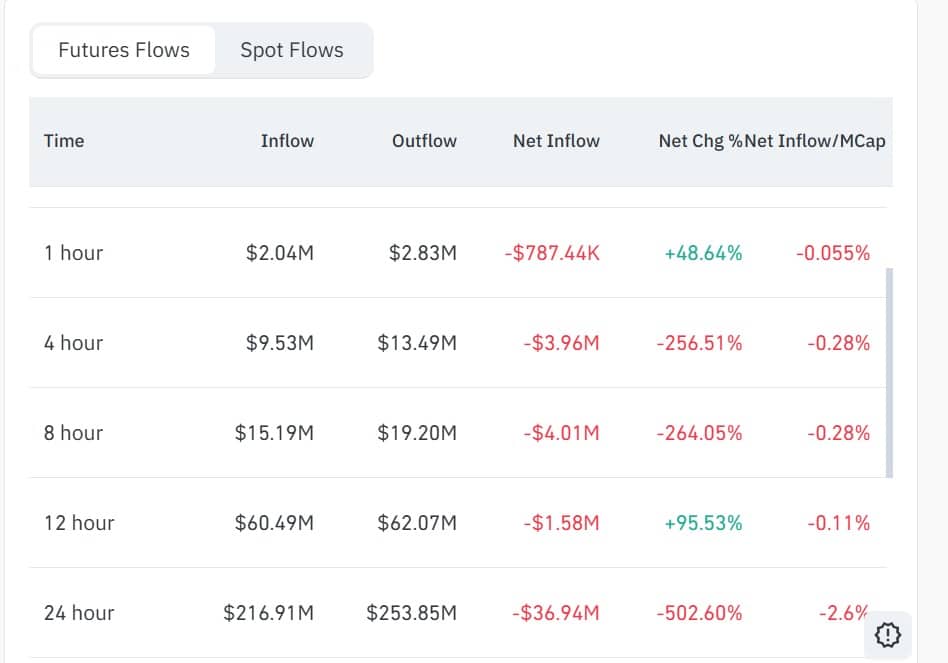

Despite the token buyback initiative, market participants remain unconvinced, particularly given recent events. As such, traders across the Futures and Spot sides have continued to exit the market.

Source: CoinGlass

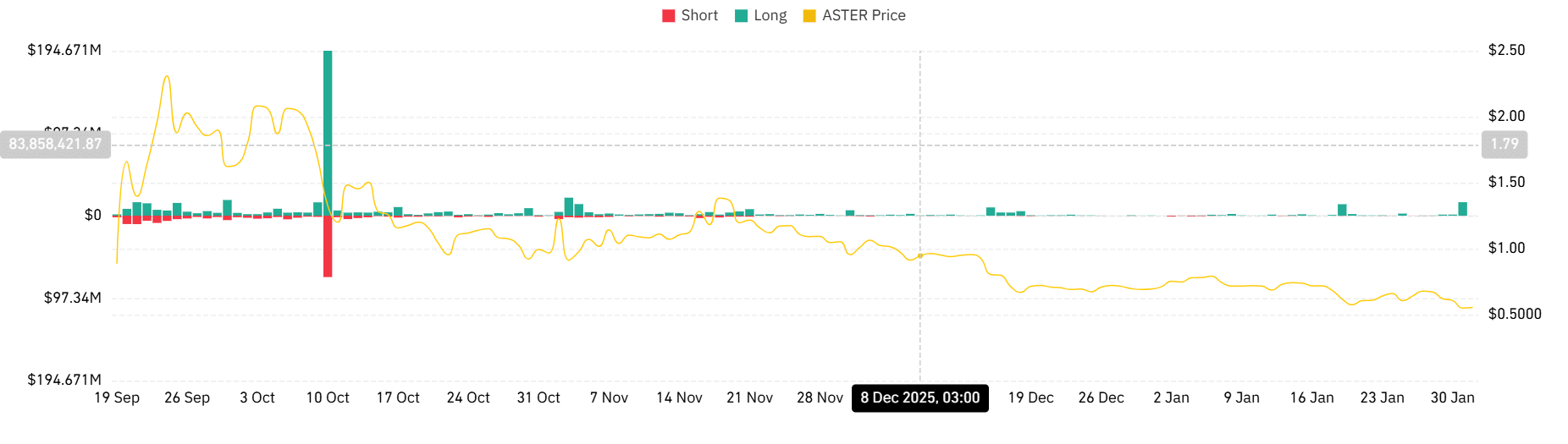

Following ASTER’s decline, investors holding long positions experienced substantial liquidations. According to CoinGlass data, long liquidation surged to a three-month high of $15 million.

The soaring liquidation accelerated ASTER’s downside pressure, leading to further losses. In response to a weakening market, investors panicked and began closing positions.

In fact, the altcoin saw $253.8 million in Futures outflows, compared to $216 million in inflows. As a result, Futures Netflow fell 502% to -$36.9 million, a clear sign of aggressive Futures dumping.

Source: CoinGlass

On the spot side, sellers extended their week-long dumping spree with sell volume jumping to 79.6 million over the past 24 hours.

The last time ASTER saw such a high sell volume was more than a month ago, reflecting significant bearish dominance.

Source: Coinalyze

With sellers dominating both spot and futures markets, ASTER is in a weakened position and could slip further.

Can buybacks absorb pressure?

Despite continued token buybacks and activation of the reserve fund, downward pressure has overwhelmed the market. In the short term, the team’s demand appears insufficient to absorb the rising selling pressure.

In fact, the altcoin’s Relative Strength Index (RSI) made a bearish crossover and dropped deeper into the bearish zone. At press time, the RSI stood at 35, near the oversold region, indicating seller dominance.

Source: TradingView

Likewise, ASTER traded below all three Moving Averages (20.50, 100, and 200 EMA), indicating sustained downside momentum.

These market conditions suggest ASTER could continue the trend, potentially breaching the $0.5 support level. If token buybacks are effective and strengthen short-term demand, the altcoin could reverse the trend.

For a significant trend reversal, the altcoin must cross above the 20- and 50-day EMAs at $0.64 and $0.73, respectively.

Final Thoughts

- Aster dropped to a five-month low of $0.507, following the market crash, then rebounded slightly.

- AsterDex officially activated the Strategic Reserve Buyback Fund for ASTER.

Source: https://ambcrypto.com/analyzing-asters-5-month-low-can-the-0-5-support-hold/