Cardano price today is trading at $0.83, consolidating inside a tightening structure after pulling back from the $0.92 zone last week. Price action is compressing within a symmetrical triangle, with immediate support layered near $0.81–$0.82. Traders now weigh fresh governance news against technical resistance as ADA approaches a decisive breakout.

Cardano Price Consolidates Inside Triangle

The daily chart highlights ADA’s squeeze inside converging trendlines, with price holding above key moving averages. The 20-day EMA at $0.84 and 50-day EMA at $0.81 are providing short-term support, while the 100- and 200-day EMAs at $0.77 and $0.74 remain critical on the downside.

Related: Solana (SOL) Price Prediction: Can Bulls Push Through $220 After Alpenglow Approval?

The RSI at 48 reflects neutral momentum, showing neither overbought nor oversold conditions. A break above the $0.92 resistance could lead to $1.01 and potentially $1.14, which are the 0.618 and 0.786 Fibonacci retracement levels from the previous downtrend. Failure to defend $0.81 could expose ADA to a deeper test of $0.77 and $0.74.

Governance Shift Marks Historic Decentralization

Cardano made headlines this week after becoming what analysts call the most decentralized blockchain in the world. TapTools confirmed that all founding entities are no longer members of the Constitutional Committee, transferring governance power fully to the community.

More than 74% of dReps and 60% of stake pool operators voted in favor of the transition, surpassing thresholds with broad participation. This governance overhaul marks a turning point for ADA’s ecosystem, positioning it as a fully community-led network, which some argue could enhance long-term adoption and institutional trust.

Supertrend And DMI Signal Mixed Pressure

The Supertrend indicator currently sits around $0.75, holding a bullish bias while price trades above it. However, the Directional Movement Index (DMI) shows a weakening trend, with ADX near 16 and +DI and –DI lines converging. This suggests the market is in consolidation mode, awaiting a clear breakout catalyst.

If bullish momentum resumes, Supertrend would provide a trailing floor for ADA to build on. Conversely, a decisive move below $0.75 would flip the bias bearish and confirm a breakdown from the broader triangle.

Related: XRP (XRP) Price Prediction: Analysts Eye $3.60 Breakout As ETF Speculation Heats Up

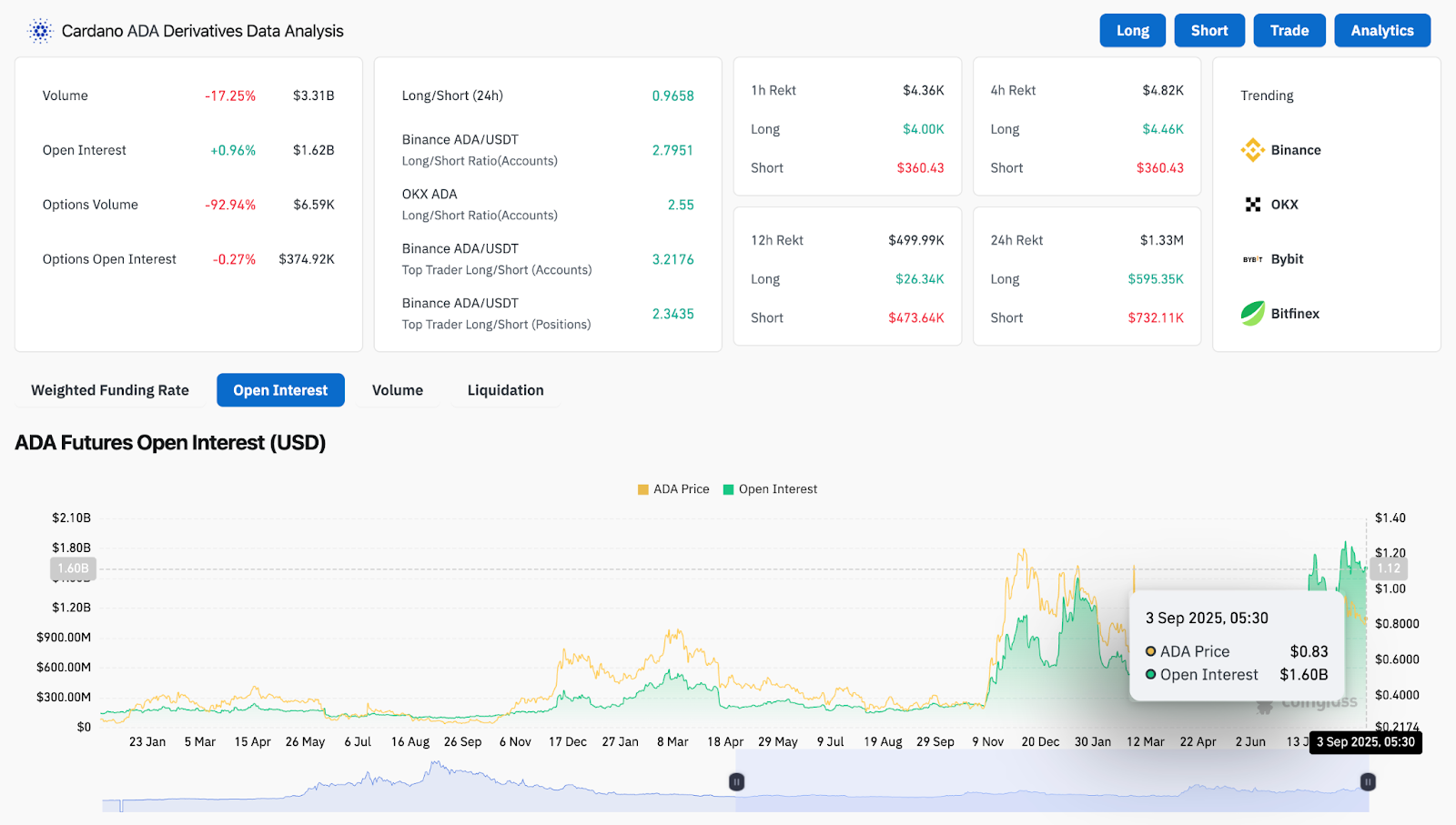

Derivatives Data Shows Stable Positioning

Futures market data offers a cautiously constructive backdrop. Open interest has climbed to $1.62 billion, near multi-month highs, while trading volumes dipped by 17% to $3.3 billion. The options activity remains thin, as trading volumes have fallen sharply.

The long/short ratio across exchanges stays above 2.3, showing a clear bullish tilt in positioning. However, funding rates and liquidation data reflect reduced leverage, indicating traders are approaching ADA with caution until a breakout above $0.92 confirms direction.

Technical Outlook For Cardano Price

Cardano’s immediate roadmap centers on the $0.81–$0.83 demand zone and the $0.92 ceiling. A breakout above $0.92 would likely accelerate momentum toward $1.01 and $1.14, while a breakdown under $0.81 risks unwinding gains back toward $0.77 and $0.74.

With governance catalysts aligning and open interest remaining strong, the broader structure continues to favor bulls as long as ADA holds above $0.81.

Related: World Liberty Financial (WLFI) Price Prediction 2025–2030

Outlook: Will Cardano Go Up?

Cardano enters September at a pivotal moment. Technical compression points toward an imminent breakout, and the governance milestone has strengthened its decentralization narrative.

Analysts remain cautiously optimistic that ADA could retest $0.92 in the near term, with $1.01–$1.14 as the next upside targets if buying volume returns. On the downside, failure to hold $0.81 would weaken sentiment and delay the breakout case, leaving traders watching $0.77 and $0.74 as critical defenses.

Cardano Price Forecast Table

| Level | Support | Resistance | Indicator Bias |

| Near-term | $0.81–$0.83 | $0.92 | Neutral |

| Short-term | $0.77 | $1.01 | Mixed momentum |

| Medium-term | $0.74 | $1.14 | Governance-driven bullish bias |

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.