XRP price today is trading around $2.83, holding firm after repeated defenses of the $2.77–$2.80 support zone. Traders are watching closely as technical compression, on-chain flows, and speculation over U.S. spot ETF approvals converge to set the stage for the next decisive move.

XRP Price Struggles But Finds Support

The daily chart shows XRP trapped within a descending triangle, with price pressing against the apex. Immediate resistance sits near $2.92–$2.95, where the 20-day EMA overlaps with the downtrend line. Buyers have stepped in repeatedly around $2.77, preventing a breakdown and turning the level into a crucial accumulation zone.

Related: World Liberty Financial (WLFI) Price Prediction 2025–2030

Momentum indicators highlight the standoff. The RSI hovers near 45, reflecting neutral sentiment. MACD signals are flattening, suggesting sellers are losing control, while narrowing Bollinger Bands point toward a volatility expansion. A breakout on either side of this compression pattern is now in focus.

ETF Speculation Fuels Optimism

Market attention turned sharply after a joint statement by the SEC and CFTC clarified that exchanges may facilitate spot crypto asset products under existing law. Prominent analyst @AltcoinBale noted, “The SEC is about to approve all of the XRP Spot ETFs,” fueling strong market speculation.

ETF approval would mark a turning point for XRP, offering institutional investors direct exposure and potentially replicating the liquidity boost seen in Bitcoin and Ethereum. Traders argue that confirmation could be the catalyst needed to break XRP out of its consolidation and retest the $3.30–$3.60 levels.

On-Chain Flows Reveal Cautious Buying

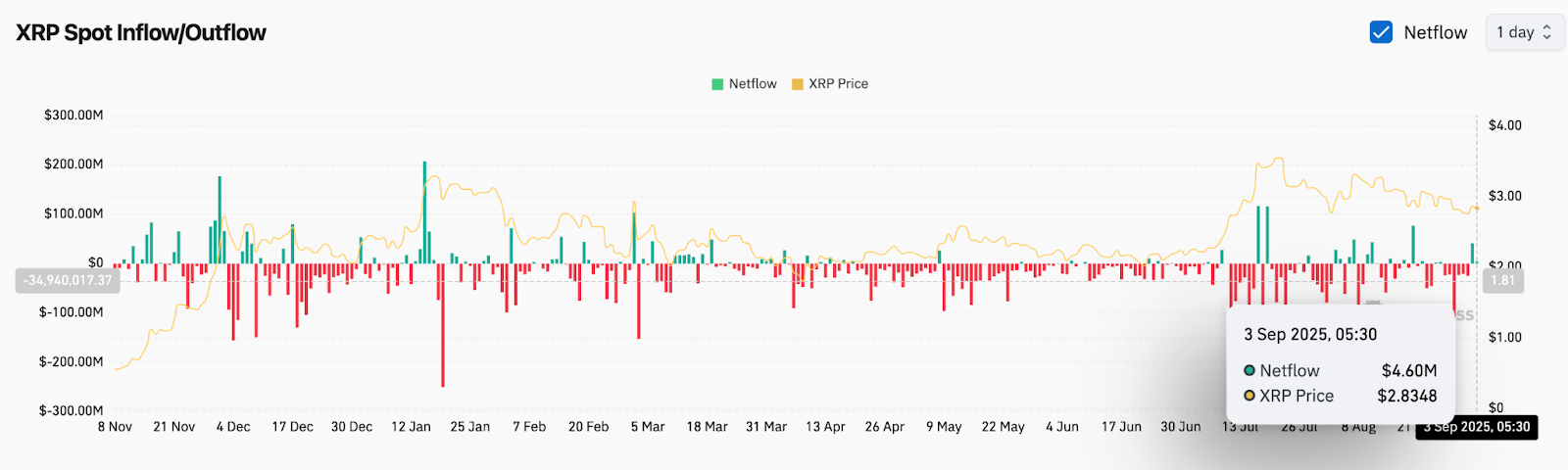

On-chain data shows a $4.6 million net inflow into exchanges on September 3, signaling a shift after weeks of persistent outflows. This uptick suggests that investors are positioning ahead of potential ETF headlines, though activity remains below July’s peaks.

While accumulation has reappeared, participation levels are still muted. Active addresses and futures open interest have declined since midsummer highs, reflecting a market that remains cautious. Analysts warn that without stronger inflows, XRP may struggle to sustain any breakout attempt.

Bollinger Bands And Supertrend Signal Pressure

Additional technical indicators highlight XRP’s fragile equilibrium. Bollinger Bands have tightened around current levels, with the upper band near $3.16 and the lower band at $2.71. This compression underscores the likelihood of a sharp move in the coming days.

The Supertrend indicator currently sits at $3.23, maintaining a bearish bias as long as price trades below this threshold. A decisive break above $3.23 would flip the indicator bullish for the first time since August, potentially validating a rally toward $3.35 and beyond. Until then, XRP remains under pressure, with traders wary of another rejection near resistance.

Related: Dogecoin (DOGE) Price Prediction: Analyst Eyes $0.22 Test as Outflows Threaten Market

Technical Outlook For XRP Price

Key levels remain well-defined. On the upside, a clean break above $2.95 could invite momentum buyers, opening the door to $3.20 and $3.35. A further push may extend toward $3.60 if ETF optimism translates into capital inflows.

On the downside, losing $2.77 would break the accumulation structure, exposing XRP to the $2.60 area, with the 200-day EMA at $2.51 acting as the last major line of defense. Failure here could see price revisit the $2.40 zone, unwinding gains from July’s rally.

Outlook: Will XRP Go Up?

The immediate path for XRP hinges on whether bullish ETF headlines arrive before technical pressure forces a breakdown. With Bitcoin stabilizing near $108,000 and Ethereum defending $4,300, broader market resilience provides some cushion.

Analysts remain cautiously optimistic. As long as XRP holds above $2.77, the setup favors a potential upside breakout, with $3.35–$3.60 as the first major targets. Without a catalyst, however, consolidation may persist, leaving traders waiting for clarity on whether September delivers the spark for the next rally.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/xrp-xrp-price-prediction-analysts-eye-3-60-breakout-as-etf-speculation-heats-up/