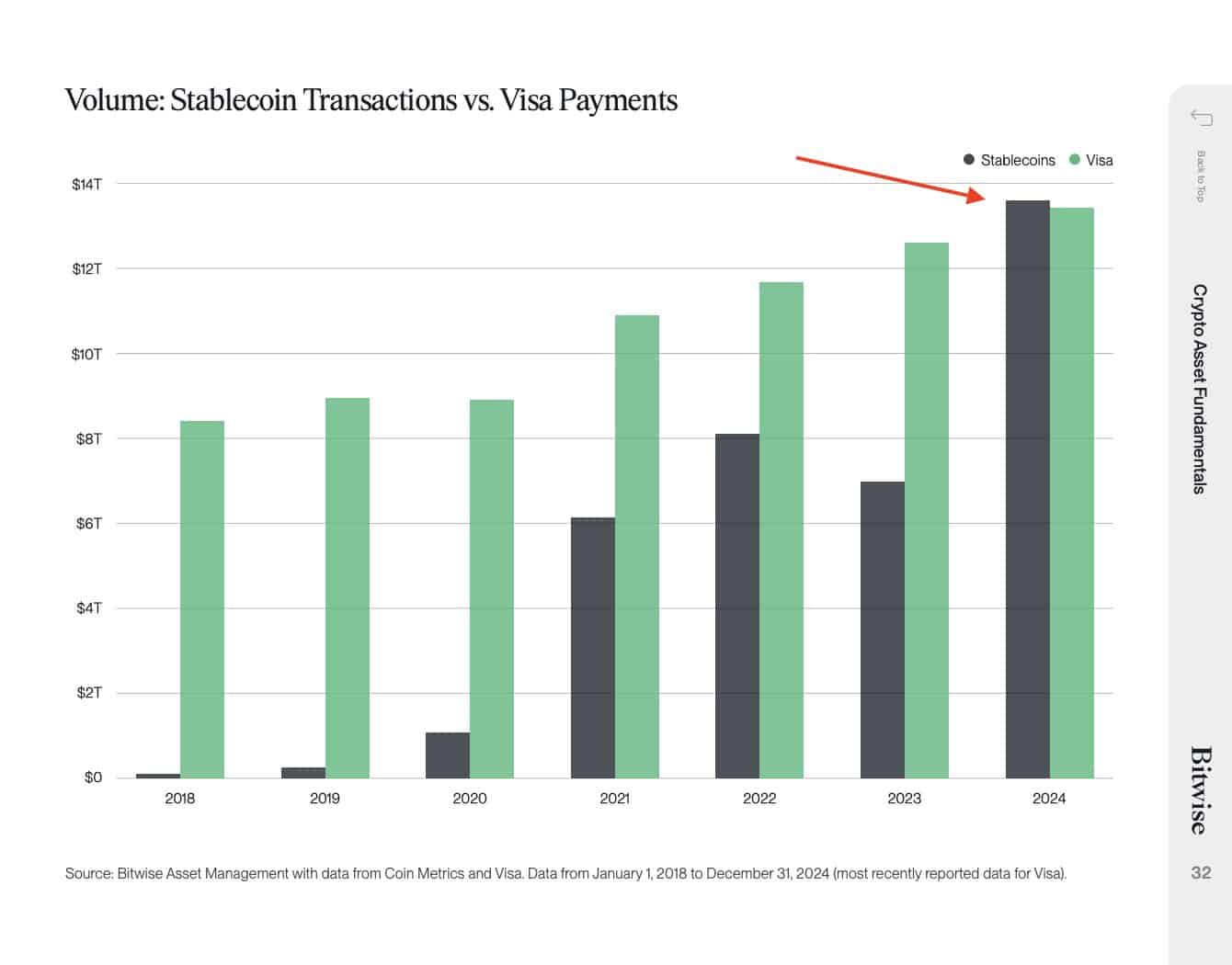

- Stablecoins total market capitalization crossed $233 billion as processed volume hit $27.6 trillion transactions in 2024—higher than Visa.

- Altcoin market troubles suggest capital is entering stable assets in periods of volatility.

The stablecoin market has hit a milestone as its total market capitalization crossed $233 billion.

This surge in stablecoin market cap comes as the broader altcoin market is still under pressure, dipping steadily on the weekly charts.

The contrasting movements raise a key question — if the market is seeing rising adoption of stablecoins or a widespread exit from volatile crypto assets?

From fringe utility to financial backbone

A few years ago, stablecoins were primarily used for fast trades and arbitrage. Fast-forward to today, they are backstop infrastructure for crypto finance.

Stablecoins alone enabled a staggering $27.6 trillion in volume in 2024, more than Visa processed during the same period. Almost all of that volume was settled on Ethereum, solidifying the chain’s lock on stablecoin trading.

The numbers speak loudly, stablecoins are no longer a niche as they are becoming the foundation of digital value transfer.

Source: Bitwise

Are stablecoins a safety net?

The growing market capitalization of stablecoins does not merely indicative of wider usage – it is also a signal of investor attitude.

In times of high volatility or downturns in the crypto market, investors often rotate capital from altcoins into stable assets like USDT, USDC and DAI.

Stable tokens serve as a haven while still allowing participation in the world of cryptocurrencies without having to dip into other spaces.

This behavioral trend is more pronounced in bear cycles, where risk appetite is secondary to the need to preserve capital. The result is an increased inflow into stablecoins and away from high-beta assets like altcoins.

Altcoins are squeezed as liquidity flows

As stablecoins rise, altcoins are doing the opposite. The total altcoin market cap has been losing ground for a few weeks since early December.

This is a sign that the supply increase may not be reflecting net new capital entering crypto—but rather capital cycling within the market.

As more altcoins are converted into stablecoins, there is less liquidity available to assist in fueling altcoin rallies. That can stifle price action and extend recovery times.

It is a dynamic that can amplify a bearish momentum in the altcoin universe.

Source: TradingView

If stablecoins continue their current trajectory, their role in the crypto economy will expand further. And with volume already surpassing Visa in 2024, it is clear that this is just the beginning.

The next few years could make today’s $27.6 trillion figure look modest.

Source: https://ambcrypto.com/altcoins-struggle-while-stablecoins-shine-is-this-the-new-normal/