| Key Points: – Crypto market rally driven by Trump’s softened stance on the Fed and China trade war. – Bitcoin reclaims $93K, total crypto market cap returns above $3 trillion. – Over $530M in short positions liquidated amid altcoin surge. – AVAX, DOGE, ADA, and SUI lead breakout gains across major and mid-cap assets. |

Crypto market rally surges as Trump signals tariff relief and Fed policy shift, sparking optimism across altcoins and boosting total market capitalization above $3T.

Global crypto markets are rebounding sharply following a wave of political recalibration from President Donald Trump, who signaled a de-escalation in the U.S.–China trade war and dialed down rhetoric against the Federal Reserve. These shifts have sent Bitcoin surging past $93K and ignited a broad-based crypto market rally, with altcoins like ADA, ETH, and DOGE notching double-digit gains. More than $530 million in short liquidations further fueled upward momentum, as traders pivoted to risk-on sentiment amid renewed macro optimism.

Crypto Market Rally Strengthens on Trump’s Policy U-Turn

The crypto market rally on April 23, 2025, was ignited by surprising remarks from President Donald Trump regarding two major macroeconomic flashpoints. Speaking to the press, Trump confirmed progress in trade negotiations with China and indicated a willingness to reduce the current 145% tariff rate, abandoning his previously aggressive tone.

At the same time, he retracted recent threats to fire Federal Reserve Chair Jerome Powell, instead expressing hope for more assertive rate cuts as inflation cools.

This shift in tone triggered a wave of risk-on sentiment across financial markets. U.S. equities rebounded after a jittery Monday session, gold hit $3,500/oz, and crypto surged across the board.

Bitcoin broke through $93,500 during Asian trading hours, marking its highest point since early March and cementing its narrative as a store of value amid fiat instability.

Altcoins Explode as Short Sellers Get Wrecked

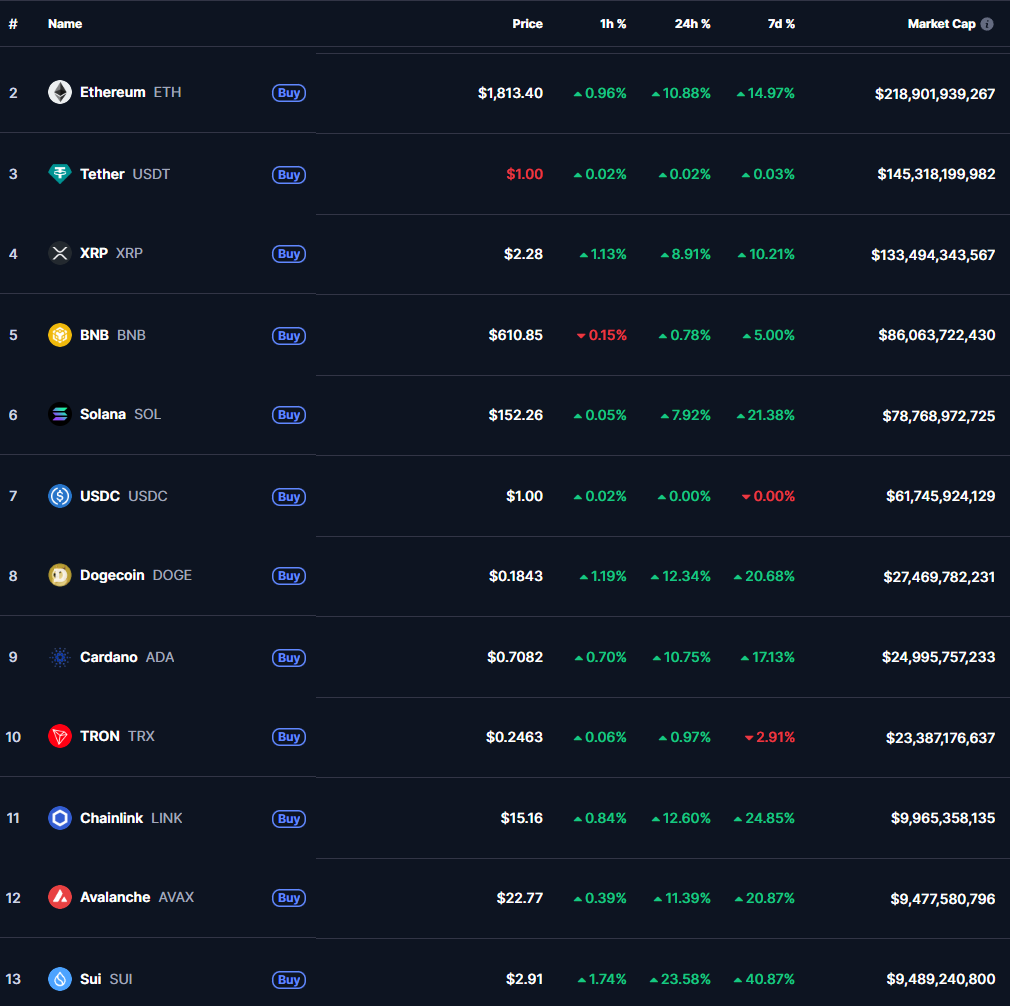

As confidence returned to the market, the crypto market rally extended well beyond Bitcoin. Ethereum (ETH), Cardano (ADA), and Solana (SOL) each posted gains between 7% and 14%. Mid-cap tokens like SUI, UNI, and NEAR also rallied strongly, with SUI climbing over 30% in 24 hours.

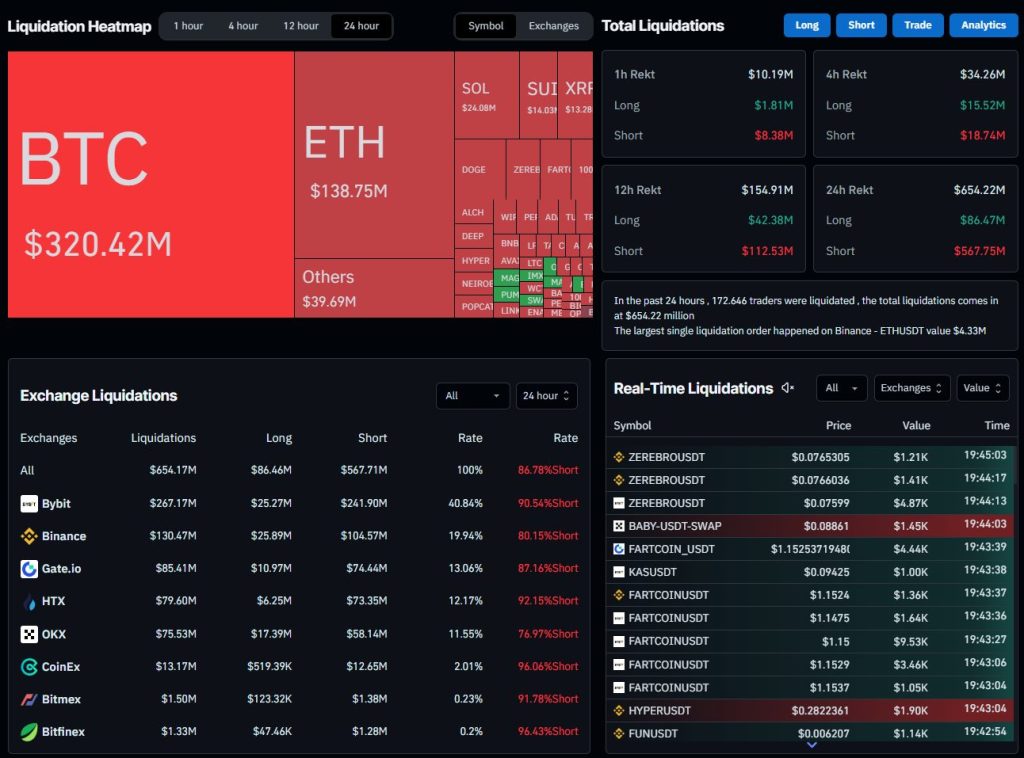

This surge led to the most significant short squeeze in six months. Over $650 million in leveraged short positions were liquidated. Bybit accounted for the largest liquidation volume at $267 million, followed by Binance ($130M) and Gate ($85M). Analysts attributed the mass liquidation to renewed optimism that a de-escalation in trade tensions would support risk assets.

Jeff Mei of BTSE noted that the anticipated decline in the U.S. dollar, driven by dovish Fed expectations, has increased demand for BTC as a hedge: “If the U.S. dollar weakens, few alternatives exist — crypto becomes the natural store of value.”

Bitcoin Decouples From Equities Amid Digital Gold Narrative

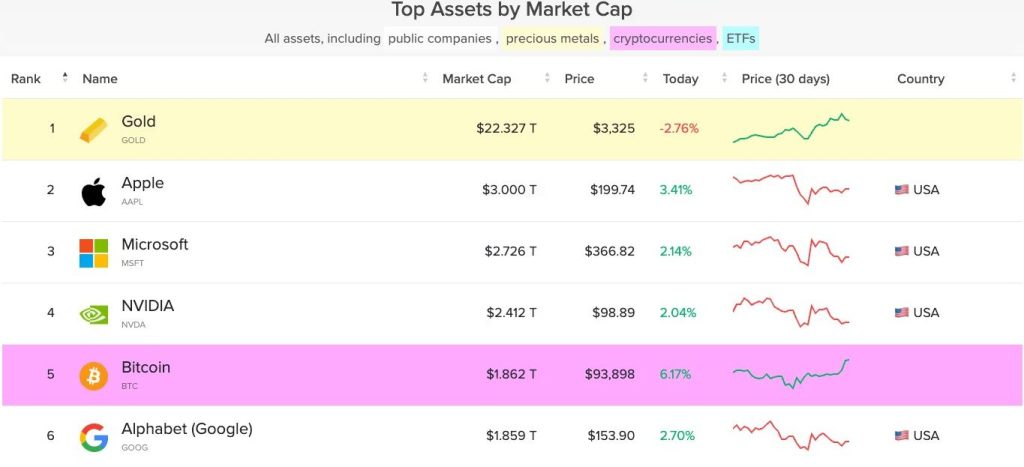

Analysts highlighted that the crypto market rally marks a continued divergence between crypto and traditional equity markets. Historically correlated with U.S. tech stocks, Bitcoin is now increasingly moving on its own fundamentals. Experts like Nick Ruck from LVRG Research suggest that BTC’s role as a “digital gold” is strengthening, with its price reacting to macro uncertainty independently of equities.

Jupiter Zheng of HashKey Capital echoed this sentiment, suggesting Bitcoin may finally be shedding its “leveraged Nasdaq proxy” label: “We’re seeing a definitive shift toward BTC being evaluated as a long-term store of value, especially as gold hits all-time highs.”

This decoupling is particularly visible during Asian trading hours, where both gold and Bitcoin have shown outsized performance – Bitcoin becomes the fifth largest global asset, surpassing Google’s market cap.

AVAX, SUI, and Meme Tokens Lead Technical Breakouts

Amid the broader crypto market rally, Avalanche’s AVAX stood out with a 10.7% gain, fueled by a technical breakout from its consolidation pattern. The token surged from $18.87 to $22.2 over the past two days, with a bull flag formation and breakout above $20.40 indicating continued upside. High-volume trades supported this move, pushing AVAX toward Fibonacci extension targets of $23.

Other standouts include meme coin MOG surging 30%, DOGE rising nearly 11%. Even Fartcoin, a low-cap novelty token, blasted 20% up the charts, underscoring the risk appetite returning to the altcoin space.

Traders are now watching whether crypto market rally breakouts will sustain or face the Trump tariff policy uncertainty.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/333858-crypto-market-rally-altcoins-soar/