Key Takeaways

Why did altcoins see a sharp decline in Open Interest?

Altcoin Open Interest dropped by $8 billion as Binance stablecoin trade volume fell below the key $150B level.

Is BTC gaining strength while altcoins struggle?

Yes, BTC dominance is rising as traders shift away from riskier altcoins amid heavy liquidations and stablecoin market changes.

Binance’s stablecoin trade volume has slipped back to $150 billion.

This comes right as the altcoin market took a hit, with $8 billion in Open Interest wiped out. At the same time, Circle’s USDC [USDC] is gaining ground on Tether [USDT], adding tension to the story.

A shift in altcoin momentum

Stablecoin Pair Trade Volume on Binance fell back to $150 billion, down from its July 2025 peak above $203 billion.

Patterns show that when volumes rise above this threshold, Ethereum [ETH] and the broader altcoin market tend to benefit. Once volumes slip below that line, performance weakens.

Source: CryptoQuant

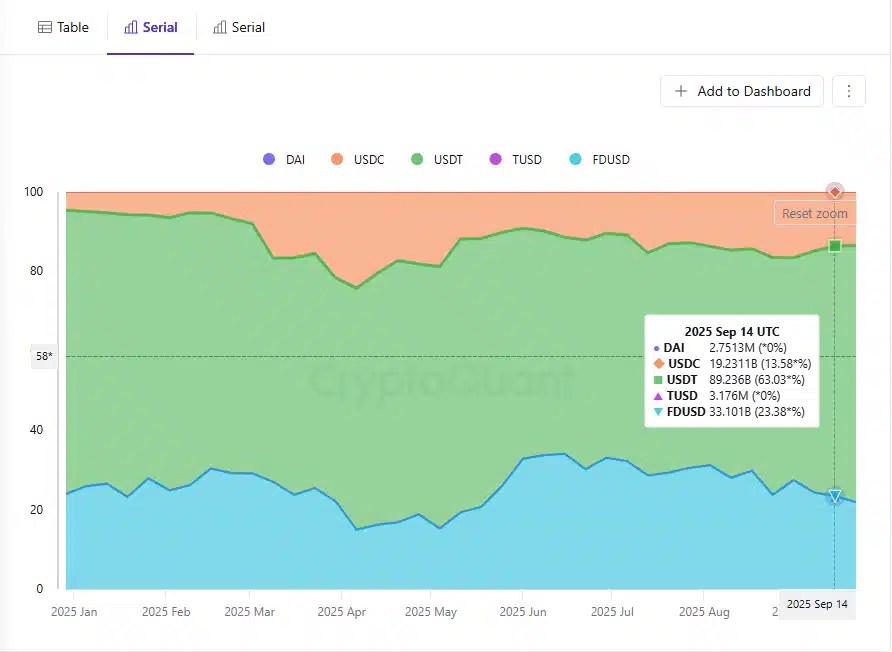

Meanwhile, USDC has grown from 5% at the start of the year to 13.58%, while USDT’s dominance has slipped from 69.2% to around 63%.

FDUSD now accounts for 23.3%. The competition is intensifying, with stablecoin flows increasingly shaping liquidity and price action across altcoins.

Altcoins take a heavier hit

Altcoin Open Interest dropped by $8 billion, a wipeout more than five times greater than Bitcoin’s [BTC] $1.5 billion decline. This contraction means that altcoins unwound at a much faster pace than in BTC.

Source: X

The gap between Bitcoin and the rest of the market narrowed as alt traders bore the brunt of liquidations. This showed weaker conviction in riskier assets compared to the relative stability of Bitcoin.

But BTC is regaining ground

BTC Dominance rose to 58.56% at press time, showing a steady climb from the mid-month low near 57%.

This recovery came even as the Altcoin Season Index held high at 68, a sign of a clear disconnect. Traders favored Bitcoin’s relative strength, while alts faced sharper unwinds.

Source: TradingView

With dominance climbing and altcoin Open Interest falling by $8 billion, risk appetite shifted back toward Bitcoin. That left alts more exposed in the near term.

Source: https://ambcrypto.com/altcoins-crumble-as-8b-wiped-out-but-this-stablecoin-shakeup-stings-more/