- ENA flashed a buy signal with key resistance levels ahead, testing its demand zone support

- Daily active addresses and transaction counts underlined moderate growth

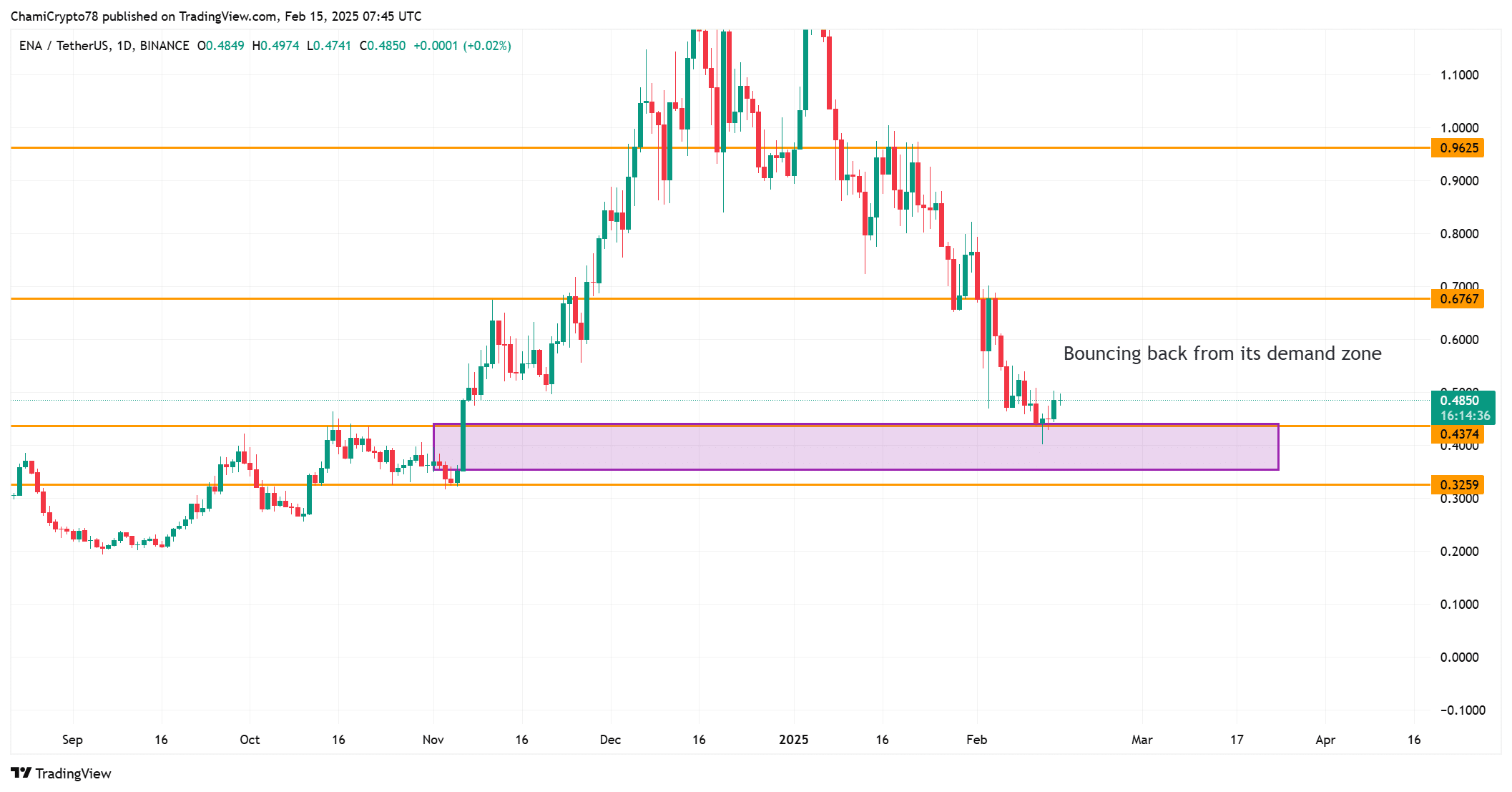

Ethena [ENA] recently flashed a buy signal on the 12-hour chart via the TD Sequential indicator, hinting at a potential rebound after a period of decline. At press time, ENA was trading at $0.4838, up by 4.49% in the last 24 hours.

However, despite the positive technical signal, the road ahead is filled with resistance levels that may halt the price’s upward momentum. Therefore, investors are watching closely to see if the asset can break through these key obstacles and maintain its bullish momentum.

What are the key resistance levels to watch for Ethena?

ENA, at the time of writing, was bouncing back from its demand zone which was located near $0.4374. This level seemed to provide some support after the altcoin’s latest price drop. However, the next major resistance lay around $0.5249, which could be challenging for the price to overcome.

If ENA manages to surpass this resistance, it will likely encounter another at $0.6770. Therefore, these resistance levels will play a critical role in determining whether the ongoing bullish trend can be sustained or not.

In fact, ENA will need to break these key levels if it aims for a more prolonged rally.

Source: TradingView

A look at the daily active addresses

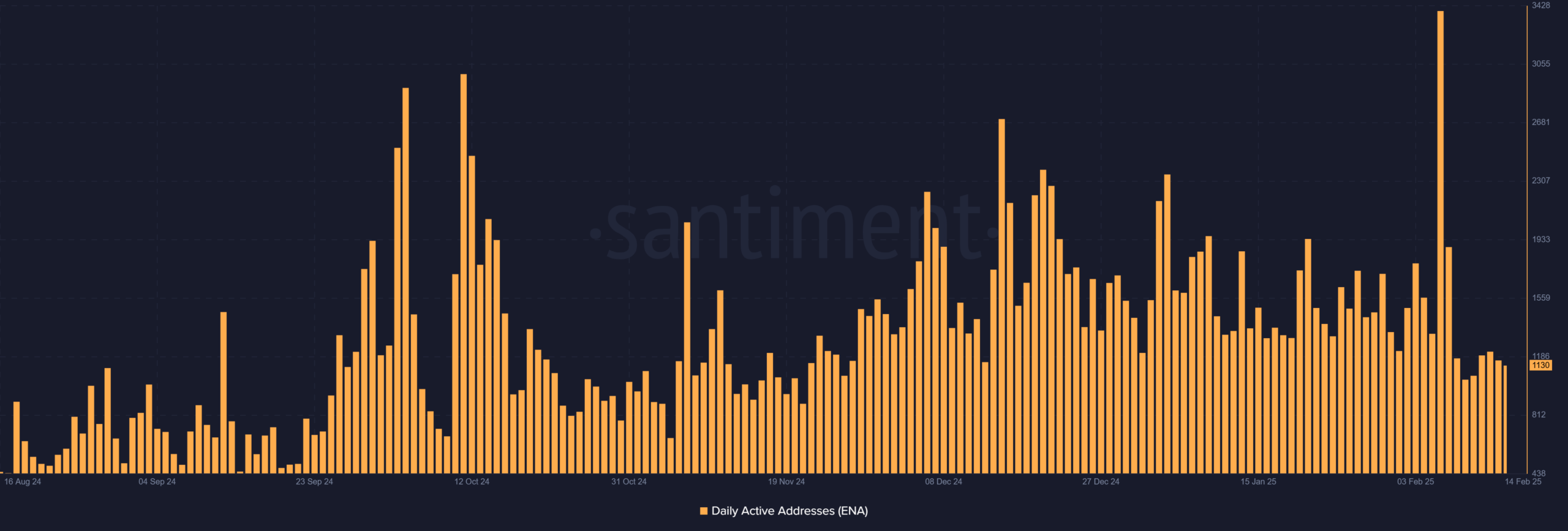

The daily active addresses for ENA peaked at 1130, reflecting moderate user engagement. This hike suggested that interest in ENA has been growing, albeit at a steady pace. Additionally, rising network activity can contribute to the overall bullish sentiment if it sustains over time.

However, this uptick alone may not guarantee further price appreciation unless it is backed by other indicators such as transaction volume. Therefore, the steady growth in active addresses could signal that ENA is building a solid foundation for future price gains.

Source: Santiment

Can Ethena’s transaction count support its upside?

Transaction counts for ENA also revealed a moderate hike, reaching 1120. While not a massive surge, this increase suggested that there is still consistent demand for ENA. As the ENA’s price moves north, additional transaction activity could provide the momentum necessary to drive the price past its resistance levels.

However, if transaction volume falls again, the price could struggle to maintain its upside. Therefore, transaction activity might play a crucial role in supporting ENA’s price in the short term.

Source: Santiment

In/Out of the Money – A favorable position for bulls?

At the press time price of $0.4838, most Ethena holders were “in the money,” with nearly 70% of holders sitting with profits. This is a promising sign for potential bullish momentum, as more holders are likely to remain invested if the price continues to rise.

However, the percentage of addresses “out of the money” seemed to be relatively low, indicating that sellers may remain cautious as they wait for higher prices.

Source: IntoTheBlock

Source: https://ambcrypto.com/all-about-enas-latest-buy-signal-and-whether-you-should-jump-in-now/