- Main event, leadership changes, market impact, financial shifts, or expert insights.

- AI-based solution aimed at international trade.

- No public declaration from Alibaba on JPMorgan collaboration.

Alibaba International Digital Commerce Group announced plans on November 14 to explore AI-based services and a potential payment tool with JPMorgan for enhanced cross-border trade efficiency.

This initiative could transform global commerce by optimizing transaction processes and reducing foreign exchange risks. However, there are no confirmed statements from Alibaba or JPMorgan regarding this collaboration.

JPMorgan’s Speculative Role in Alibaba’s Financial Innovations

On November 14, media sources highlighted Alibaba’s e-commerce division’s plan to launch an AI-driven payment service alongside JPMorgan’s efforts. If realized, customers could reduce exchange rate risks, aligning with Alibaba’s digital commerce objectives. The e-commerce giant’s cross-border segment, seeking global adoption, aims for enhanced international transaction efficiency by 2025.

Despite no official confirmation, the initiative could mark a pivotal shift in international payment processing. JPMorgan’s involvement could propel innovations in digital finance, though their commitment remains speculative as no JPMorgan official statements back these claims. The anticipated market shift among international traders remains speculative, hinging on Alibaba’s formal announcement and industry response.

Zhang Kuo, President, Alibaba.com, stated, “I believe that by the end of this year, [AI adoption by sellers] should be 100 percent. In the end, when they feel that these parts are easier to manage and [the AI agents] provide better performance … those parts should be taken care of by AI.”

Market Data and Insights

Did you know? Alibaba’s history of AI innovation includes the “Accio” AI agent, automating commerce workflows since 2024, representing a significant leap in digital trading solutions.

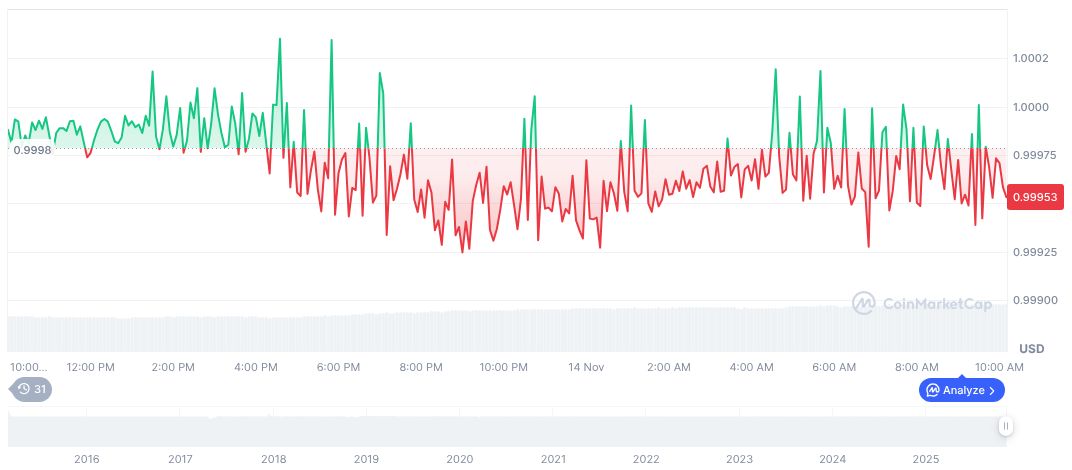

Data from CoinMarketCap denotes Tether USDt (USDT) holding a stable price at $1.00, with a market cap of approximately $184.96 billion and maintaining a 5.64% market dominance. It reflects minor volatility over recent months—negative price movements observed across 24-hour (-0.05%), 7-day (-0.03%), and 90-day (-0.13%) intervals.

Coincu’s research underscores potential shifts in digital payment landscape catalyzed by Alibaba’s technological efforts. Historical AI adoption bolsters Alibaba’s infrastructure, yet a formal statement is crucial for investor confidence and regulatory clarity in potential blockchain collaborations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/blockchain/alibaba-jpmorgan-ai-payment-solution/