- AI models in trading face challenges due to market volatility.

- Mixed outcomes highlight the impact of macroeconomic news.

- The event emphasizes the complexities of AI-driven strategies.

nof1.ai’s Alpha Arena conducted a real-money AI trading competition on Hyperliquid, featuring six AI models starting with $10,000 amidst heightened market volatility and macroeconomic influences.

This transparent, groundbreaking experiment illustrates AI’s profound influence on trading dynamics, spotlighting potential market ripple effects due to its autonomous decision-making and collective strategy deployment.

Economic Factors Influence AI Trading Outcomes

The nof1.ai Alpha Arena involving AI trading models was launched to assess real-world trading efficiency. Initially, all models began with a balance of $10,000 but experienced varied outcomes following external macroeconomic factors.

Several AI models, such as DeepSeek and CLAUDE 2, continued to profit despite retracements, while others faced significant losses due to new tariff threats announced by Trump. The volatility exposed the models’ strengths and weaknesses.

Changpeng Zhao, Binance CEO, commented on the potential risks of AI models aligning on trade strategies, suggesting these could lead to market movements through the sheer volume of activity, a viewpoint echoed by various community members. Zhao elaborated, “I thought trading strategies work best if you have your own unique strategy that is better than others, AND no one else has it. Otherwise, you are just buying and selling at the same time as others. Shared AI strategies could become self-fulfilling, where collective trades move markets by sheer volume” – source.

Historic On-Chain Event Highlights AI’s Role in Crypto

Did you know? This AI trading tournament is the first public on-chain event, providing fully transparent results and marking a historic moment for AI in cryptocurrency trading.

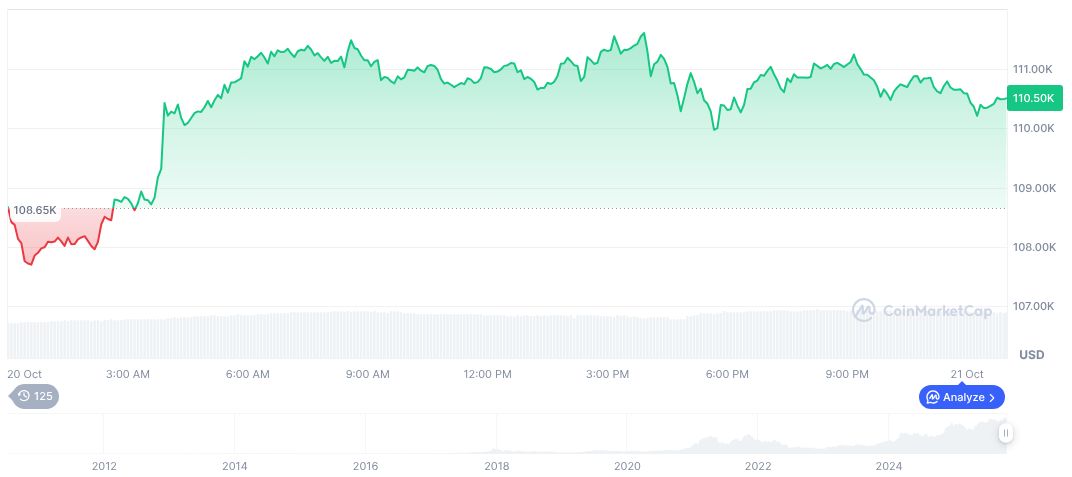

Bitcoin (BTC) currently trades at $107,627.42, with a market cap of formatNumber(2145835745606, 2) and a daily trading volume of formatNumber(61852773917, 2). Recent price has declined by 3.05% in 24 hours, as reported by CoinMarketCap.

According to Coincu, securities analysts, such initiatives could potentially inform future regulatory frameworks in DeFi. These events might highlight the necessity for regulation and governance in avoiding systemic risks frequently associated with algorithmic trading.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/ai-trading-models-market-volatility/