- AAVE is set to continue its dominance in the DeFi protocols.

- Aave expanding in stablecoins and multichain integration.

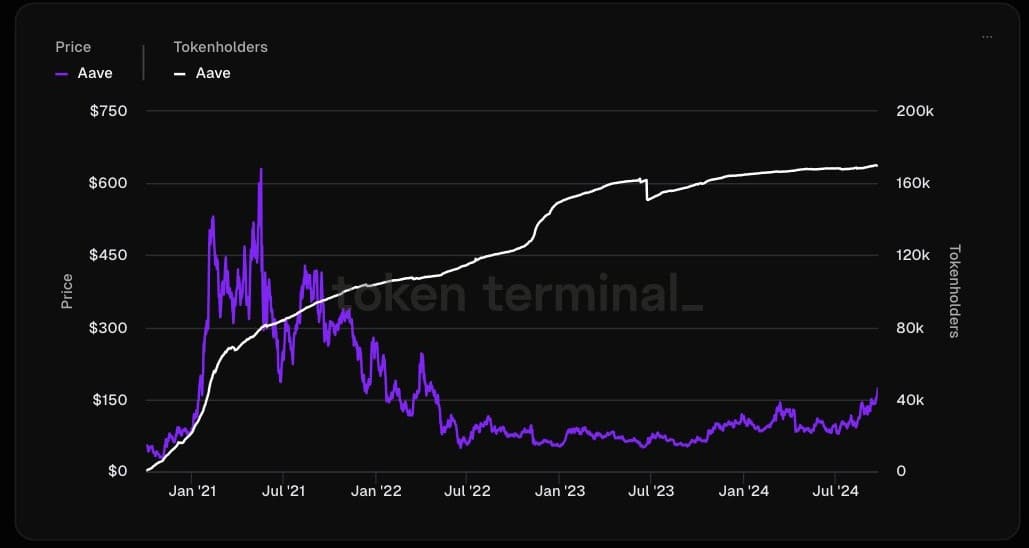

Aave [AAVE], arguably the leading DeFi protocol, has reached a new all-time high in token holders and boasts close to $20 billion in user deposits. Aave continues to solidify its position as a market leader.

Despite the complexity of the DeFi sector and a temporary downturn following the Terra Luna and Celsius crashes, Aave remains one of the best investment opportunities in the crypto space.

Aave offers a comprehensive platform where users can deposit, borrow, and earn interest on their crypto holdings. It’s tokens incentivize users, and its standardized on-chain financial metrics reveal consistent growth in deposits and borrowing, further driving Aave’s dominance in the market.

Source: Token Terminal

Bullish GHO stablecoin metrics

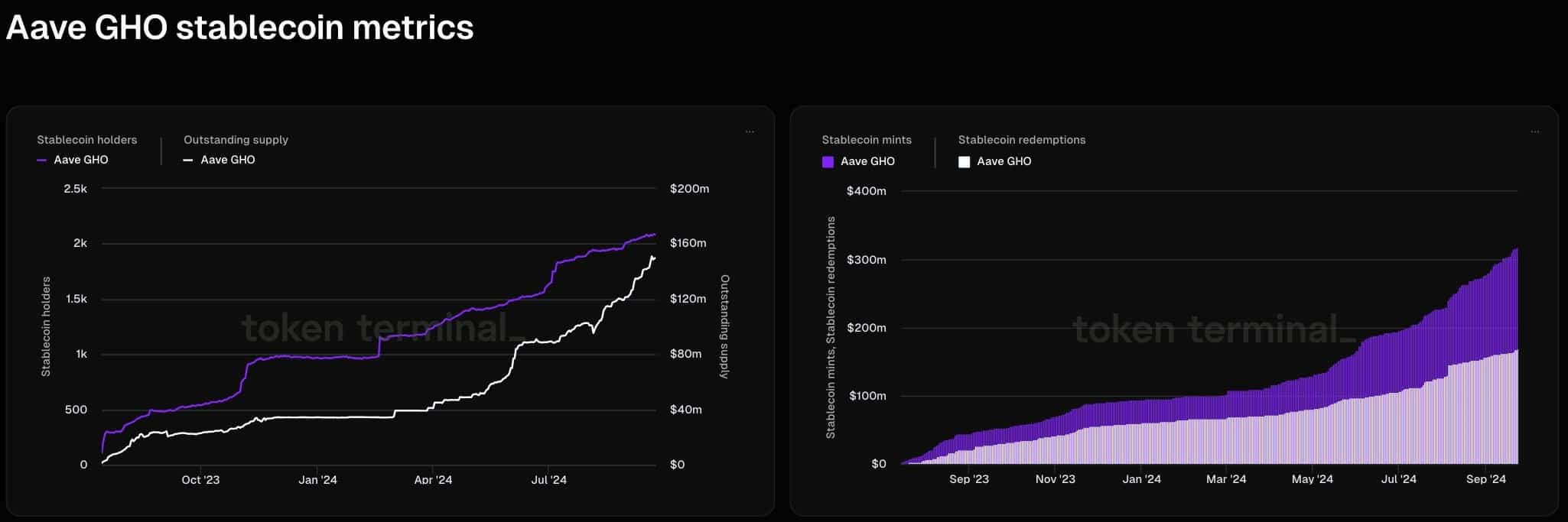

Aave’s GHO stablecoin continues to perform strongly, with metrics reaching all-time highs. The outstanding supply of GHO, as well as monthly transfer volume and sender activity, has consistently increased.

This reflects positive sentiment and further strengthens the bullish outlook for Aave. The growing success of Aave’s second business line, GHO, is a key factor in maintaining the protocol’s long-term growth potential.

Source: Token Terminal

As institutional players increasingly enter DeFi, the coin is well-positioned to sustain its market leadership.

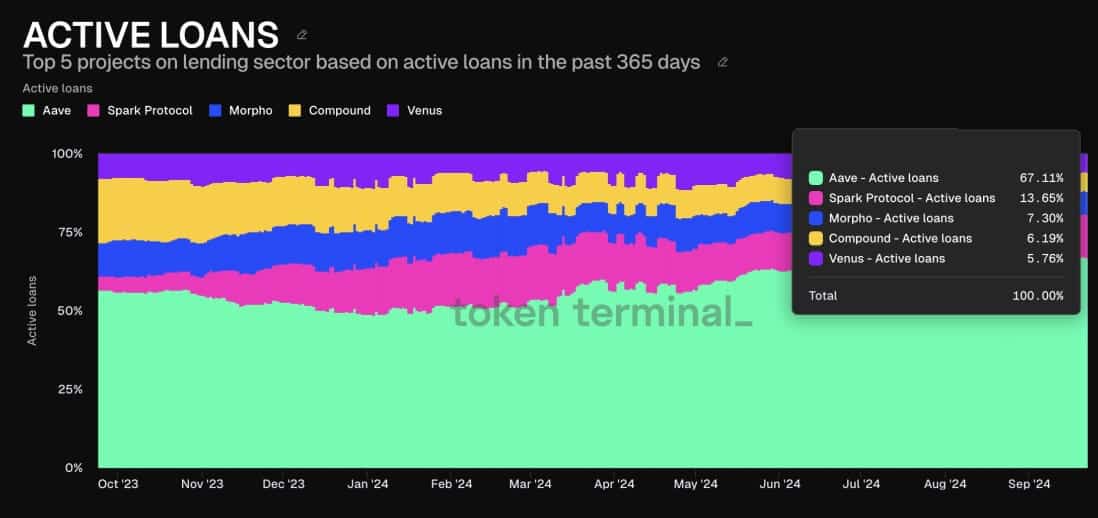

Aave leading in lending sector

Active loans in the DeFi sector have reached $11 billion, with $7.4 billion coming from Aave. The sector is steadily approaching its previous all-time high of $20 billion from 2021.

Currently, its holds 67% of the market share in the lending sector, and its dominance is expected to continue. Compared to traditional finance, where margin loans total around $800 billion, Aave and DeFi as a whole have significant room for growth.

Source: Token Terminal

Borrowing on Aave requires collateral, and individuals, confident in the market’s rise, often use BTC or ETH as collateral to borrow in stablecoins and exchange for other crypto, allowing them to profit when prices increase.

As crypto adoption increases, Aave’s dominance in this space will likely grow, positioning it to capture a larger share of the financial market.

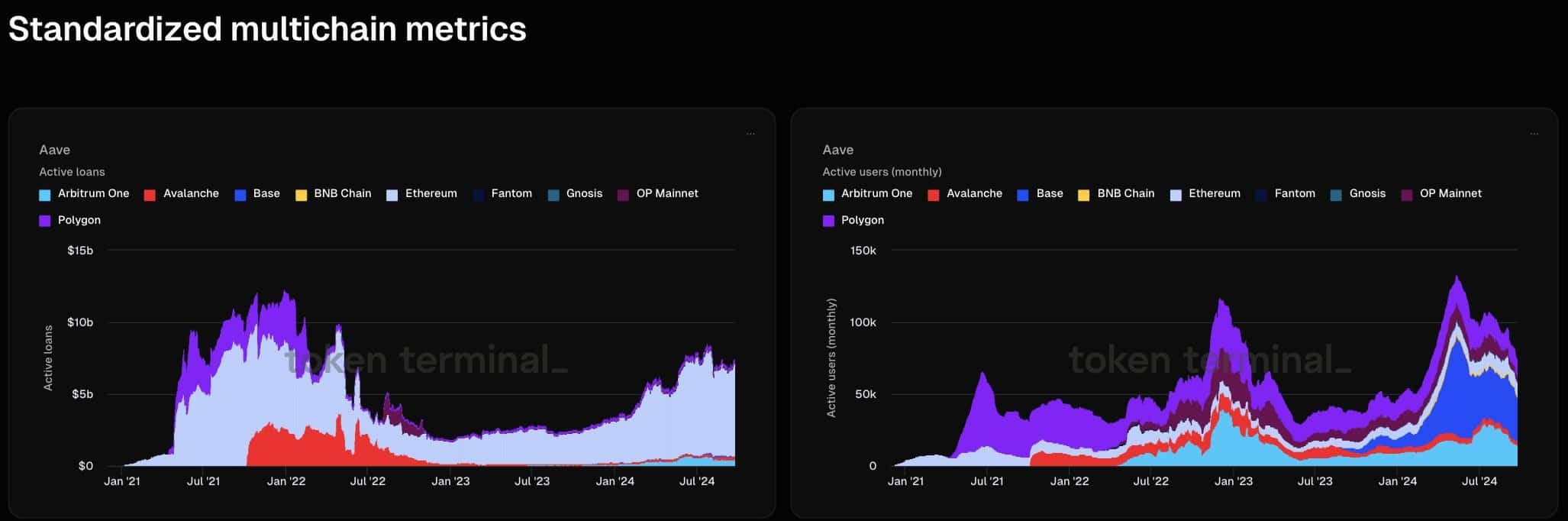

Aave’s multichain expansion

Aave’s expansion across multiple chains, including Arbitrum, Avalanche, Base, BNB Chain, Fantom, Optimism, and Polygon, further highlights its growth potential.

Metrics such as unique depositors, borrowers, and repayers show bullish trends across multiple blockchains. This multichain approach increases Aave’s reach and solidifies its position in DeFi, ensuring it continues to thrive.

Source: Token Terminal

Is your portfolio green? Check out the Aave Profit Calculator

In conclusion, Aave’s dominance, combined with its growing GHO stablecoin, solidifies its position in the DeFi space.

With bullish metrics, multichain expansion, and significant institutional interest, the altcoin’s price could rise even higher, cementing its role as a leader in this crypto bull run.

Source: https://ambcrypto.com/aave-takes-67-of-defi-lending-market-as-gho-soars-what-now/