- AAVE formed a bearish divergence, possibly signaling a temporary recess from its impressive rally.

- On-chain data indicated a shift in exchange flow dynamics as a nod to the bears.

Aave [AAVE] was one of the few cryptocurrencies that managed to evade the bearish market conditions in the last few weeks. However, what goes up must come down, and AAVE’s rally might be over, at least for now.

AAVE has been bearish for the second half of this week. It extended its downward momentum in the last 24 hours to become the second-biggest loser among the top coins in the last 24 hours.

It tanked by over 6% during the trading session.

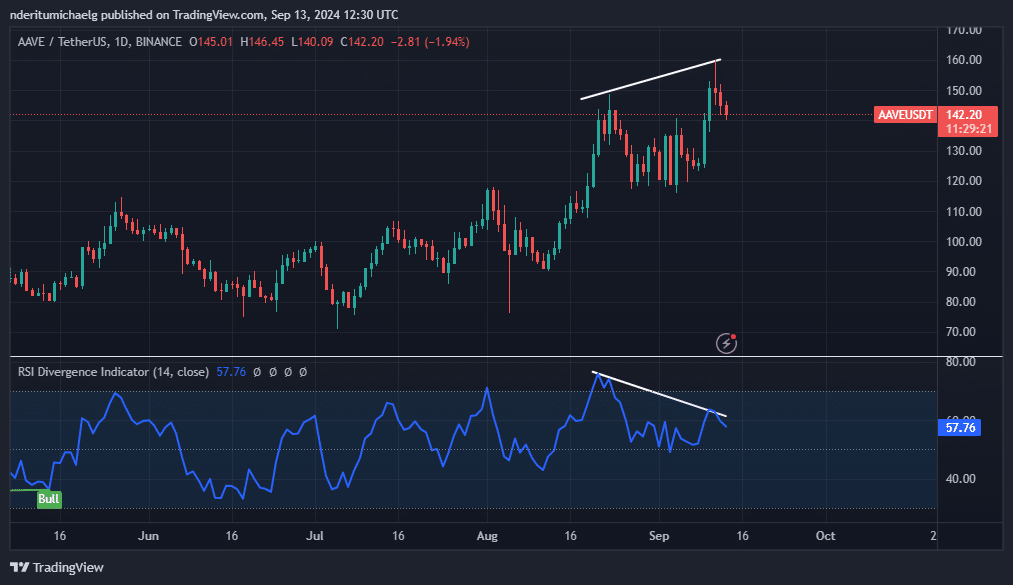

The bearish outcome was not surprising for AAVE, considering that it recently flashed a major bearish sign. The cryptocurrency achieved a higher high this month compared to its August top.

Meanwhile, the RSI achieved a lower high compared to its August top, thus forming a bearish divergence.

Source: TradingView

The divergence signaled that the bullish momentum was running out of steam. It has since paved the way for an 11.95% correction to its 147.20 press time price level.

This could be the start of a significant correction, considering its gains from August lows.

Will AAVE bears push lower?

AAVE traded at an 85% premium from its lowest price in August, despite the recent pullback. The next major support zone to keep an eye out for is just below $120 if the bears continue to push lower.

That would be equivalent to another 16% pullback from press time levels.

Note, however, that a shift in market dynamics in favor of a bullish outcome could lend momentum to the bulls.

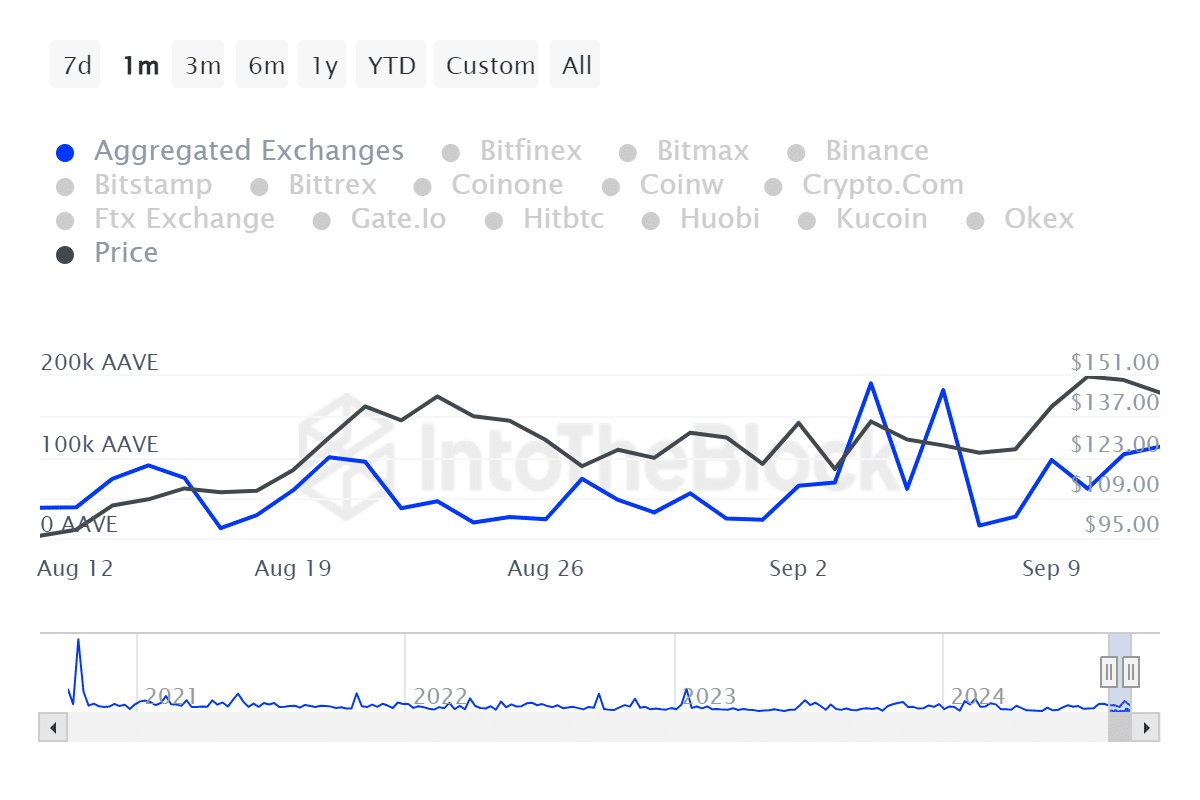

On-chain data indicated a pivot in exchange inflows, confirming the buildup of sell pressure. The aggregated exchange flows soared from 15,340 AAVE on the 7th of September to 112,780 AAVE by the 12th of September.

Source: IntoTheBlock

Exchange outflow volumes peaked at 182,040 AAVE on the 4th of September to 85200 AAVE by the 12th of October.

This confirmed a decline of the demand that was previously responsible for the DeFi token’s latest explosive outburst.

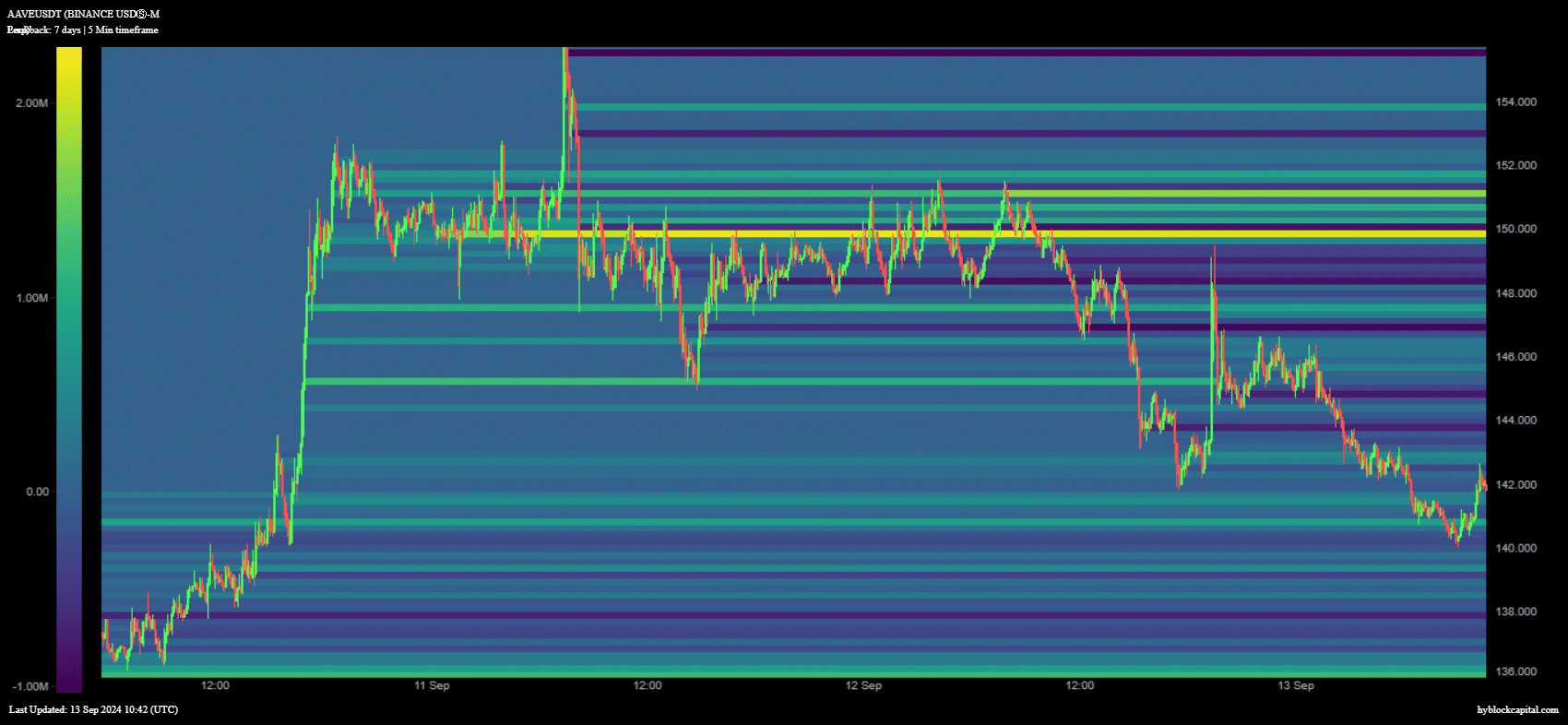

AMBCrypto also observed noteworthy activity in the derivatives segment. There was a surge in short positions at the $149 price range.

There were 2.19 million short positions recorded within that price range, which coincided with significant resistance.

Source: IntoTheBlock

Read Aave’s [AAVE] Price Prediction 2024–2025

Heatmaps also revealed as much as 2.90 million net longs at the $151 price level on the 12th of September.

This suggested that there may have been a significant amount of liquidations after the price started tanking, potentially contributing to the sell pressure.

Source: https://ambcrypto.com/aave-faces-bearish-correction-is-a-major-sell-off-coming/