- Conflict between Aave and WLFI regarding token allocation.

- AAVE token experienced a 5% dip due to the dispute.

- Highlights issues of transparency in DeFi governance.

A controversy has emerged between Aave Inc. and World Liberty Financial (WLFI) over conflicting claims about token allocations after a proposal approval on Ethereum, leading to significant AAVE price fluctuations.

The dispute highlights transparency issues in decentralized finance (DeFi) governance, demonstrating potential risks and volatility in high-stakes crypto partnerships, impacting market confidence.

Market Volatility Amid Aave-WLFI Controversy

A dispute recently took place between Aave and WLFI regarding token allocation. Aave was expected to receive 7% of WLFI tokens, providing significant benefits to its treasury. However, WLFI team members, including a pseudonymous account, publicly denied such claims, citing misinformation. [“The claim that ‘Aave will receive 7% of the total WLFI token supply’ is untrue and is fake news.”](https://intellectia.ai/news/crypto/aave-partnership-with-wlfi-sparks-controversy-over-token-allocation) These conflicting narratives created ambiguity around the official agreement and protocol execution status.

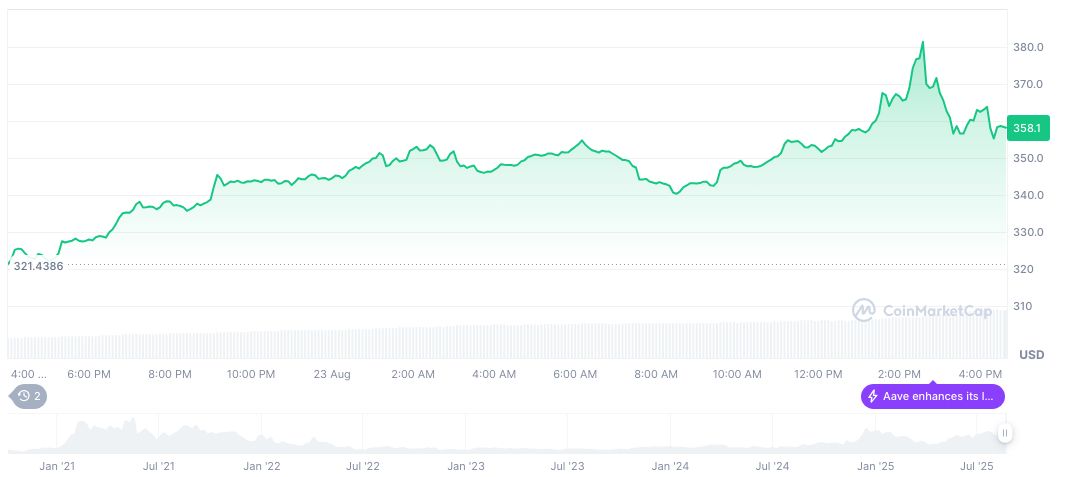

This has resulted in increased market volatility for AAVE. Following the denial, the AAVE token lost over 5% of its value temporarily, reflecting the market’s sensitivity to governance clarifications and trust in official communications. As a consequence, investor confidence took a significant hit, reigniting concerns on transparency within the industry.

Key figures offered statements amidst the unfolding controversy. Aave’s founder, Stani Kulechov, assured the ongoing validity of the protocol partnership, stating: “At the current price, the Aave treasury will receive WLFI worth $2.5 billion, making it one of the biggest winners in this cycle.” Nevertheless, uncertainty remains high, bolstered by WLFI’s firm denials and the absence of verifiable on-chain confirmation. These events continue to underscore the critical nature of clear, accountable governance processes in decentralized finance.

Market Impact and Future Outlook

Did you know? The AAVE token is a key player in the DeFi ecosystem, often influencing market trends and governance discussions.

The AAVE token’s price dropped by over 5% in response to the unfolding situation, highlighting the volatility associated with governance disputes in the DeFi space.

Experts suggest that the incident may lead to increased scrutiny of governance practices within DeFi projects, emphasizing the need for transparency and clear communication to maintain investor trust.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/aave-wlfi-token-dispute-2025/