Key Takeaways

How many top 100 cryptocurrencies have recovered to their all-time highs?

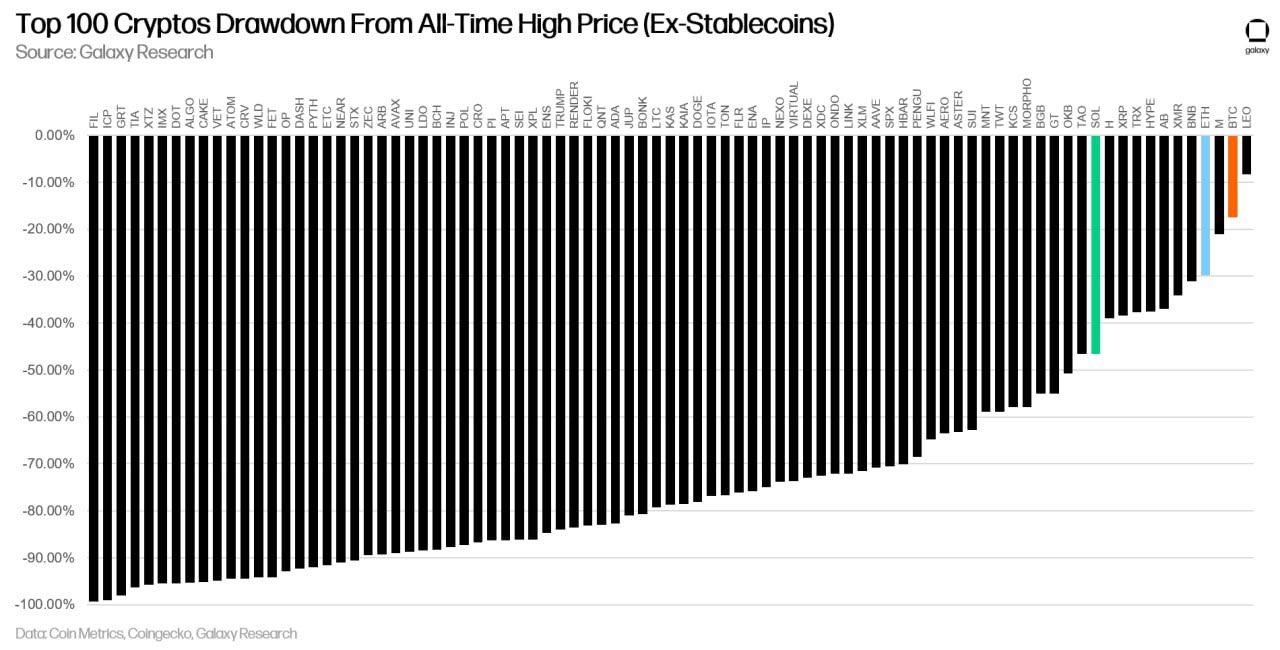

Just one: PENGU. The remaining 99 top-100 cryptocurrencies trade between 30% and 95% below their peak prices.

Which major cryptocurrencies are furthest from their highs?

FTX Token [FTT], Terra Luna Classic [LUNC], and Internet Computer [ICP] are leading the carnage, with prices 95%-99% below their peaks.

Galaxy Research data reveals the harsh reality behind cryptocurrency’s purported recovery.

Source: Galaxy Research

Analysis of the top 100 cryptocurrencies by market capitalization reveals that 99% remain underwater from their all-time highs, with only the recently launched PENGU token showing positive returns.

PENGU, the lone survivor

PENGU stands alone in green territory. The Pudgy Penguins meme token launched in December 2024 via a $1.5 billion airdrop and currently ranks 73rd by market cap.

Its position as the only top-100 crypto above its reference high reflects timing more than triumph. PENGU simply lacks the 2021 peak baggage that crushes older projects.

The token’s success stems from the Pudgy Penguins brand’s mainstream appeal. With toys available at Walmart, a viral TikTok presence, and billions of social media impressions, Pudgy Penguins established real-world recognition before launching its token.

PENGU currently trades at around $0.015 with a market cap of $900 million.

Crypto blue-chip devastation

The chart reveals carnage across established projects.

Cardano trades approximately 80-85% below its peak. Polkadot sits similarly depressed. Chainlink, Avalanche, and Uniswap all show 80-90% drawdowns despite being considered “safe” infrastructure plays.

Even Bitcoin and Ethereum appear on the right side of the chart, relatively better positioned but still 30-40% below their respective all-time highs.

The gap between crypto’s two giants and altcoins widens dramatically.

The 2021 ghost

Most top-100 cryptocurrencies set their peaks during the 2021 bull market. Ethereum was able to hit another ATH in August 2025 when it rose to over $4900, and Bitcoin did the same in October when it went over $126,000.

However, four years later, the vast majority have failed to recover despite multiple rally attempts.

Projects abandoned during the bear market face the worst outcomes. FTX Token, Terra Luna Classic, and Internet Computer show declines of 95%-99%.

Will Altcoin Season ever come?

The data validates the “altcoin season is dead” narrative. Recent analysis showed the Altcoin Season Index at 24, indicating extreme Bitcoin dominance.

Galaxy Research’s drawdown chart confirms this from a different angle: altcoins haven’t just underperformed recently, they’ve failed to recover for years.

DeFi tokens particularly suffered. Uniswap, Aave, Compound, and other decentralized finance protocols are trading 70%-85% below their peaks, despite the total value locked remaining relatively healthy.

The disconnect between protocol usage and token price suggests fundamental valuation questions persist.

What it means

The chart demonstrates that surviving the crypto bear market doesn’t mean recovering from it. Even top-100 market cap status provides no protection from catastrophic long-term drawdowns.

Only Bitcoin and Ethereum show relative resilience, and even they remain significantly underwater from peaks.

PENGU’s solitary green bar highlights how timing beats tenure in crypto markets.