- The probability of a rate cut has decreased to 92.1% as per CME’s “FedWatch”.

- The crypto market responded with inflows and price changes in major assets like Bitcoin and Ethereum.

- Regulatory commentary is absent, leaving uncertainty about market directions.

On August 17, 2025, CME’s “FedWatch” data revealed a 92.1% probability of a 25 basis point Fed rate cut in September.

The adjusted rate cut likelihood influences major cryptocurrencies, affecting investor sentiment but lacked official confirmation or statements from key financial figures in the crypto or regulatory space.

FedWatch Data Shifts Market Dynamics, Crypto Volatility Rises

FedWatch data provides a probability estimate that a rate cut in September might not be as certain as previously thought. This adjustment signifies subtle shifts in market confidence. There has been a discernible lack of direct comments from Federal Reserve officials or major crypto leaders on this specific update.

Investors now face increased uncertainty, which could lead to enhanced volatility in crypto markets. Significant movements include on-chain fund flow data showing $2.0 million into Base and $2.7 million out of Ethereum. Cryptocurrency stakeholders note the marked absence of decisive commentary from figures like Jerome Powell or major industry leaders.

As of August 17, 2025, there were no verifiable, primary statements from key players or leadership that directly referenced the CME “FedWatch” data or related interest rate expectations. Here is a summary of the lack of quotes or direct commentary regarding the likelihood of a Fed rate cut.

Bitcoin and Ethereum Navigate Rate Cut Uncertainty

Did you know? Similar shifts in Federal Reserve rate expectations in 2023–2024 led to notable volatility in BTC and ETH prices, often driving investors towards stablecoins for risk minimization.

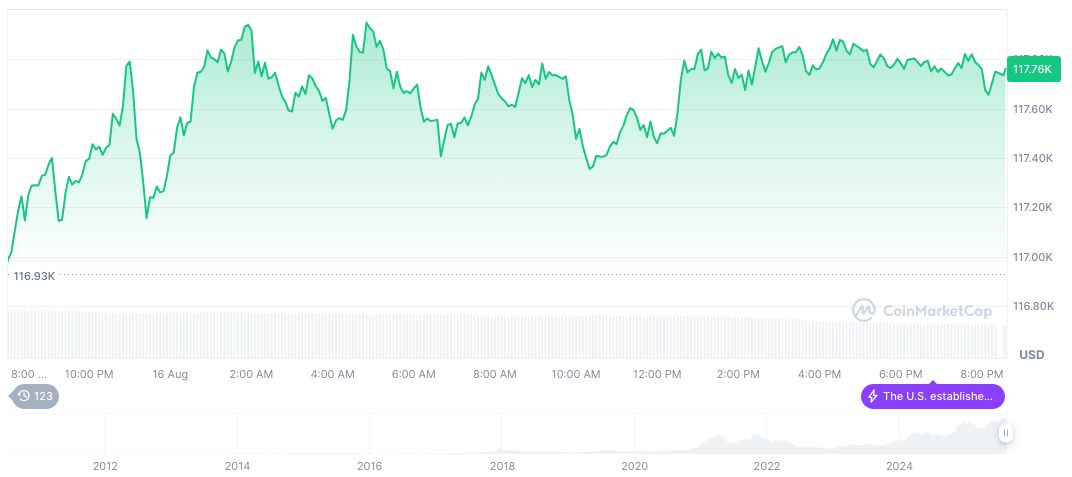

CoinMarketCap data from August 17, 2025, reveals Bitcoin (BTC) is priced at $118,098.00, with a market cap of $2.35 trillion, reflecting a market dominance of 58.73%. The 24-hour trading volume is reported at $47.64 billion, a decrease of 27.69%. Recent changes include a slight 0.33% rise over 24 hours, with a 14.77% increase over the past 90 days. Bitcoin’s current circulating supply amounts to 19,907,487 BTC.

Insights from the Coincu research team suggest that the decreased rate cut probability could mitigate regulatory pressures, potentially driving stablecoin liquidity. Analysts observe a historical parallel where reduced rate cut incentives led to diversified asset allocations and stablecoin inflow advantages.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fedwatch-rate-cut-september-2025/