- Staking activity over the past month has grown by nearly $100 million within just three months.

- Despite the market slowdown, nearly $1 billion worth of SOL has been accumulated by spot traders.

The past week has been difficult for Solana [SOL] holders as the asset dropped 10.95%, with sellers overshadowing buyers.

However, recent activities suggest SOL could be on the brink of turning bullish. Its 24-hour gain was 0.01% at press time, even though on-chain metrics indicated that bullish momentum was building.

Staked SOL surges over three months

Nansen reports that the amount of SOL staked has surged from $7.7 million to $62.3 million over the past three months.

Staking involves traders depositing assets with validators to help secure the network, earning an APY in return.

Source: Nansen

When significant staking surges occur, especially with yields remaining at a low of 11.71%, as seen in the case of SOL.

It typically indicates a bullish market sentiment, as traders use staking as a long-term holding strategy that allows them to earn while holding.

With staked SOL nearing $100 million, buying activity also rose as traders accumulated more SOL.

Buying and trading activity surges

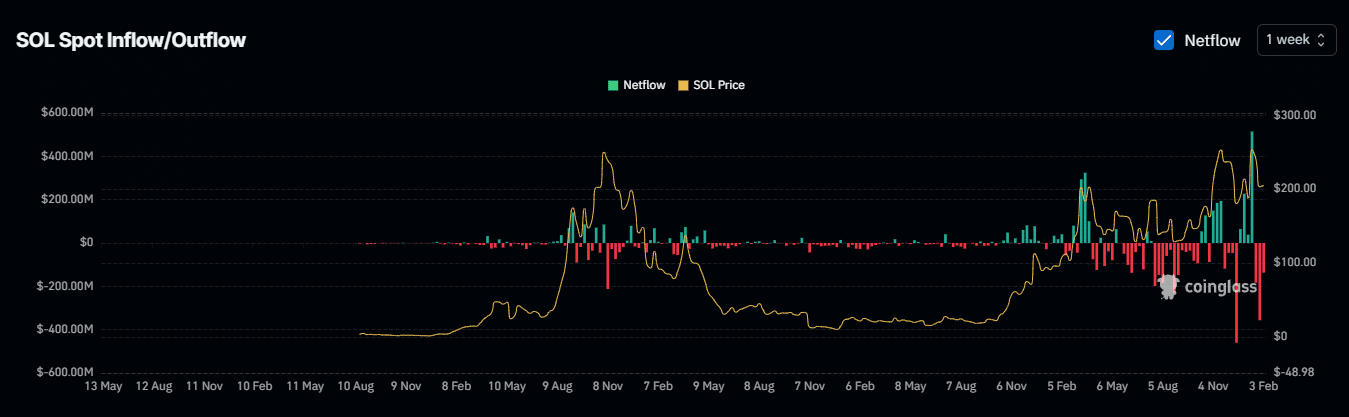

According to Coinglass, there’s been a surge in the amount of SOL purchased in the past three weeks.

During this period, a total of $674.75 million worth of SOL was potentially bought from the market and transferred into private wallets for long-term holding.

Moves like this signal market optimism as traders take advantage of the price dump to purchase SOL at lower prices.

Source: Coinglass

Similarly, the number of daily active addresses in the past three days has increased, growing from 4.4 million to 5.8 million, per Artemis data.

When a surge in buying action is followed by a gradual increase in gains, it suggests that buyers have outpaced sellers, with the possibility of a further rally.

Liquidity gradually climbing

The Total Value Locked (TVL), which is used to determine the amount of SOL moved into various Solana protocols, has seen a gradual increase in recent days.

A surge in TVL positively impacts price, while a decline negatively affects it.

Read Solana’s [SOL] Price Prediction 2025–2026

DeFiLlama reported a growth from $9.705 billion on the 3rd of February to the press time level of $10.22 billion, meaning SOL may likely follow suit soon.

Overall, market sentiment points to a bullish possibility for SOL, and the asset could see a major price rally in upcoming trading sessions.

Source: https://ambcrypto.com/674m-solana-bought-in-3-weeks-will-sol-finally-turn-bullish/