Tokenized funds could reshape asset management, driving billions in value for both investors and financial institutions. A report, co-authored by Boston Consulting Group (BCG), Aptos Labs, and Invesco, projects that tokenized fund assets under management (AUM) could reach over $600 billion by 2030, equivalent to 1% of the global AUM for mutual and exchange-traded funds.

As of late 2024, tokenized funds have already attracted over $2 billion in AUM. This rising adoption reflects increasing demand from investors drawn to the flexibility and innovative potential of tokenized funds.

“We see a pattern of growing investor demand in the tokenized funds space,” noted David Chan, Managing Director and Partner at BCG. “We anticipate this trend will persist, particularly as regulated stablecoins, tokenized deposits, and central bank digital currency (CBDC) projects come to fruition.”

The whitepaper identifies strong interest from traditional financial institutions like asset and wealth managers, who are eyeing tokenization as a method to engage new investor pools, retain existing clients, and diversify business models. This growing adoption is expected to spark new fund distribution channels, including secondary tokenized brokerages and embedded investing platforms.

Advantages of On-Chain Money and Fractional Investment Access

Key features of on-chain money, such as programmability and atomic settlement, are likely to further accelerate growth. Alexandre Tang, Head of Institutions for APAC at Aptos Labs, highlights these attributes as a core advantage, noting,

On-chain money allows for 24/7 transfers and fractionalized ownership, which reduces barriers to entry and allows instant collateralization—provided regulatory frameworks support it.

Beyond flexibility, tokenized funds offer a significant appeal for fund managers, who can leverage smart contracts to create highly tailored, hyper-personalized portfolios. By improving distribution and operational efficiency, the technology unlocks opportunities for lower investment thresholds and enhanced investor access.

The Role of Regulatory Standards in the Tokenization Surge

To support these advances, industry experts underscore the importance of global regulatory standards, particularly in ensuring a seamless ecosystem for tokenized funds.

“Wealth and asset managers are navigating a shifting landscape,” noted Ken Lin, Head of Hong Kong and Southeast Asia Intermediary Business at Invesco. “Establishing regulatory frameworks can help solidify a globally connected industry, easing fund distribution across borders.”

David Chan further emphasized that regional financial centers are already making strides to adopt fund tokenization, with Hong Kong’s initiatives, such as Project e-HKD+ and Project Ensemble, aimed at promoting real-world asset tokenization. “We hope this whitepaper helps drive the tokenized finance ecosystem forward, reducing costs for firms exploring tokenized funds,” he added.

Rexas Finance: A Leader in RWA Tokenization

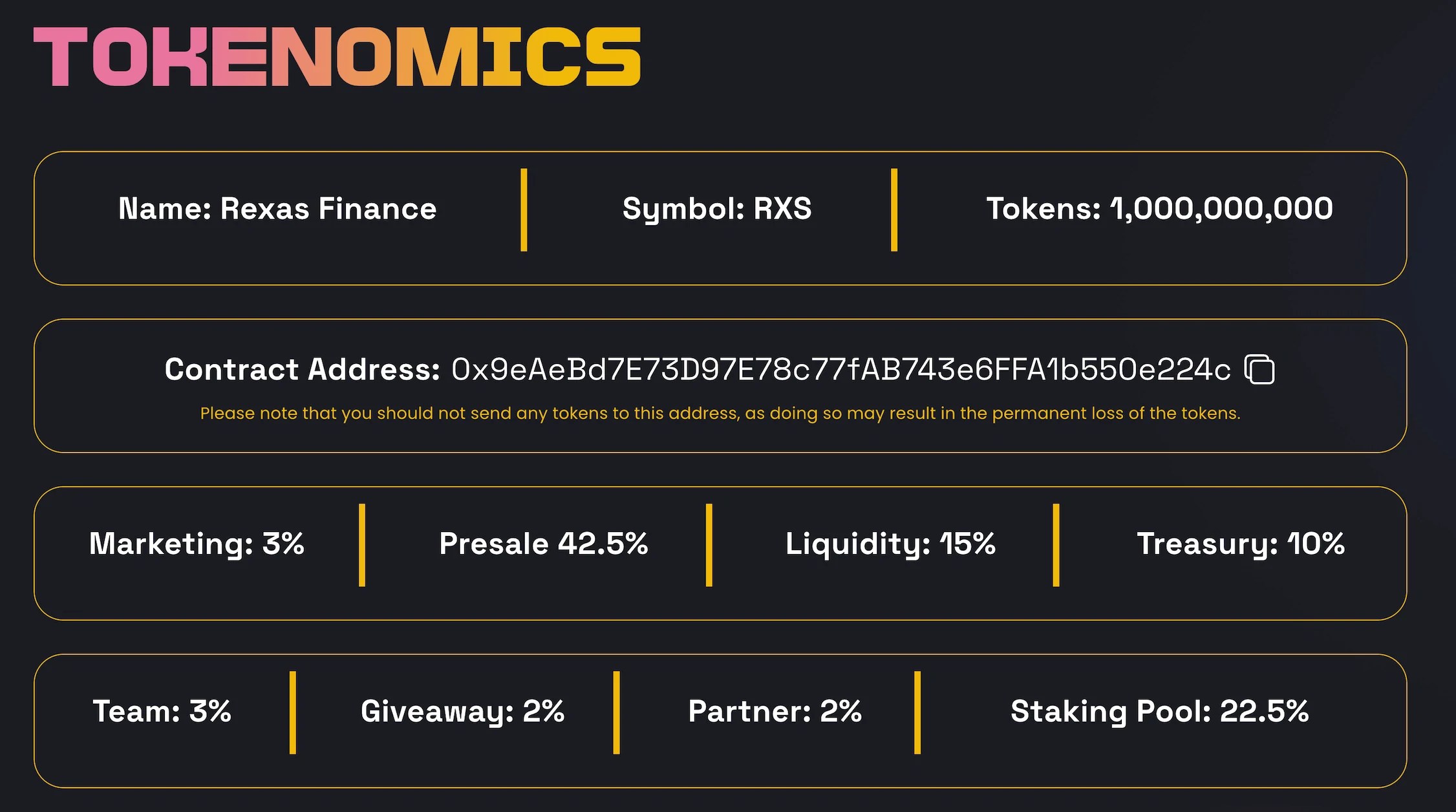

In this rapidly evolving landscape, Rexas Finance (RXS) is emerging as one of the best RWA crypto projects in 2024. By simplifying the process of tokenizing real-world assets, Rexas Finance aims to make investment opportunities accessible to everyone. The platform features tools like the Rexas Token Builder, which allows users to easily create tokens representing their assets without requiring extensive technical knowledge.

With a current price of around $0.060, experts forecast significant potential growth for RXS, with the possibility of reaching up to $17 by 2025. Rexas Finance is democratizing investment opportunities and eliminating traditional barriers by allowing fractional ownership of valuable assets.

Visit Rexas Finance (RXS)

The forward-looking report by BCG, Aptos Labs, and Invesco, suggests that tokenized funds are on the cusp of becoming a transformative force in the asset management industry. The full whitepaper, now available to the public, offers further insights into the future of this nascent yet highly promising field.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/tokenized-funds-set-to-transform-asset-management-600-billion-opportunity-by-2030/

✓ Share: