- Dogecoin consolidates in an ascending channel with support at $0.24 and resistance near $0.275.

- On-chain data shows $1.85M positive net inflows, signaling early retail accumulation.

- Rumors of SEC-approved 401(k) inclusion drive speculation about DOGE’s mainstream adoption.

Dogecoin price today trades around $0.253, holding steady after rebounding from support near $0.24. The meme coin is tracking within a broad ascending wedge pattern, signaling a slow grind higher while market attention turns to speculation that the U.S. SEC may allow 401(k) providers to include DOGE.

The rumor, circulating widely on social media, has reawakened bullish sentiment across the Dogecoin community after weeks of subdued flows and low volatility.

Dogecoin Price Holds Trendline Support

The daily chart shows DOGE trading within an ascending channel since June, with the lower boundary providing consistent support near $0.23. The upper channel resistance stands around $0.33, creating a wide trading band as buyers and sellers jockey for control.

DOGE remains above all major EMAs, with the 20-day EMA near $0.248, 50-day EMA at $0.241, and 100-day EMA at $0.230. This alignment reflects a constructive mid-term structure, though the Supertrend indicator near $0.275 continues to act as a cap for momentum rallies.

Related: Cardano Price Prediction: ADA Consolidates as Coinbase Reserves Surge 462%

A daily close above $0.275 would flip the short-term bias bullish, targeting $0.30 and $0.33, while failure to hold $0.24 could trigger a slide toward $0.23 and $0.22 support levels.

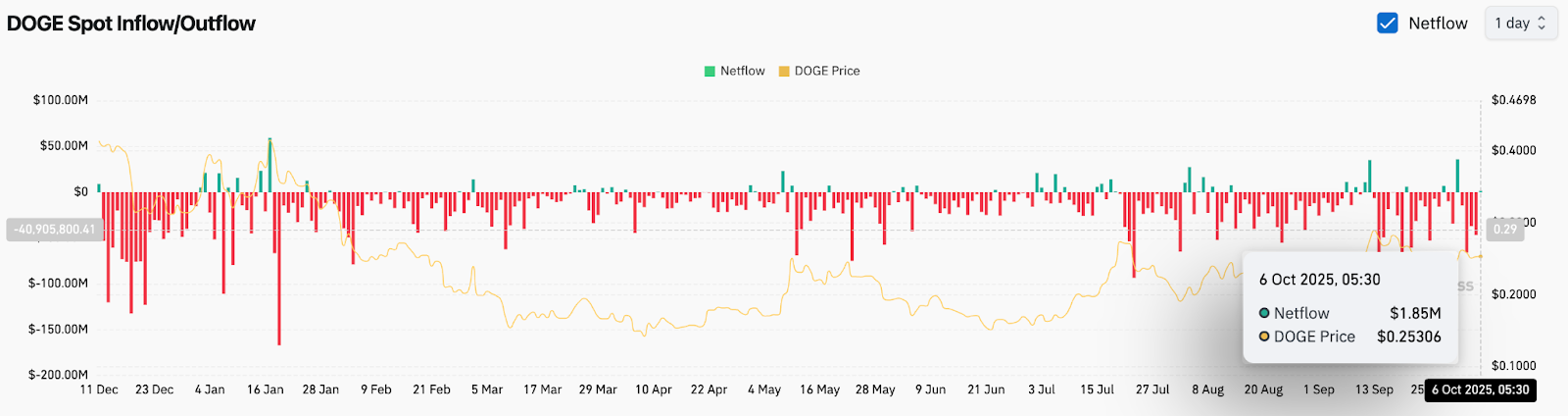

On-Chain Data Shows $1.85 Million Net Inflow

Coinglass data shows Dogecoin recorded a $1.85 million positive netflow on October 6, marking a sharp improvement after multiple days of moderate outflows. The data suggests small-scale accumulation from retail holders as prices stabilize above $0.25.

The inflow is still far below the high-volume days of August but stands out as a rare positive reading in October. This shift hints at an early repositioning by spot traders anticipating potential catalysts. Futures open interest remains relatively unchanged, signaling that the move is primarily driven by the spot market rather than leverage.

If inflows stay positive this week, it could support a retest of the mid-channel zone around $0.28–$0.29.

Speculation Builds Around SEC 401(k) Approval

Adding to the bullish tone, crypto outlet Coinvo reported a circulating rumor that the U.S. SEC may approve 401(k) providers to include Dogecoin this week. While no official confirmation has been issued, the report quickly went viral, surpassing 90,000 views within hours.

The speculation has sparked renewed debate about DOGE’s legitimacy as a long-term investment asset. Analysts note that even a partial inclusion or pilot program could significantly enhance mainstream adoption, similar to the inflows seen in Bitcoin and Ethereum-based retirement products earlier this year.

Traders are monitoring official SEC communication for verification. If confirmed, this would represent a historic milestone for Dogecoin and potentially drive a surge in institutional exposure.

Technical Outlook For Dogecoin Price

Dogecoin price prediction for the short term remains balanced between bullish speculation and technical caution.

- Upside levels: $0.275, $0.30, and $0.33 as breakout targets if buying pressure expands.

- Downside levels: $0.24, $0.23, and $0.22 as near-term supports if momentum cools.

- Trend confirmation: A daily close above $0.275 would mark the first bullish Supertrend signal since late September.

Outlook: Will Dogecoin Go Up?

The next move for Dogecoin price will likely depend on the authenticity and timing of the rumored SEC development. The $1.85 million inflow adds a short-term positive tilt, while the ascending structure continues to favor higher lows.

Related: Bitcoin Price Prediction: Analysts Target $130K As U.K. ETF Decision Sparks Inflows

If DOGE closes above $0.275, the setup opens room for a move toward $0.30–$0.33, aligning with mid-channel resistance. Conversely, losing $0.24 would invalidate the current recovery pattern and refocus attention on the $0.23–$0.22 support zone.

For now, Dogecoin remains in a cautiously optimistic phase, awaiting clarity from regulators and sustained volume confirmation before any decisive breakout.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/dogecoin-price-prediction-401k-inclusion-rumor-sparks-bullish-buzz/