XRP, the native token of Ripple Labs, is garnering massive attention from crypto enthusiasts amid ongoing market uncertainty due to millions of tokens being transferred from unknown wallets. Recently, the whale transaction tracker Whale Alert posted on X (formerly Twitter) that 150 million XRP tokens had been transferred from an unknown wallet.

This substantial token transaction is sparking curiosity across the crypto space, raising questions about whether it is the first step toward a dramatic shift in XRP’s price or just another routine move with no impact.

Current Price Momentum

XRP is currently trading near $2.34 and has experienced a price drop of over 6% in the past 24 hours. During the same period, its trading volume declined by 15%, indicating lower participation from traders and investors compared to the previous day.

XRP Technical Analysis and Upcoming Levels

According to expert technical analysis, XRP’s recent price drop has brought it to a crucial support level of $2.30, creating a make-or-break situation.

Based on current market sentiment and historical patterns, if the asset manages to hold this level, there is a strong possibility it could soar by 20% to reach $2.79 in the coming days.

On the other hand, if the price continues to fall, breaches the support level, and closes a four-hour candle below $2.24, there is a strong possibility of a 15% decline, bringing the asset down to $1.90 in the future.

At present, XRP is trading below the 200 Exponential Moving Average (EMA) on the daily timeframe, indicating a downtrend. Most traders and investors use this indicator to make informed decisions.

Traders’ Over-Leveraged Levels

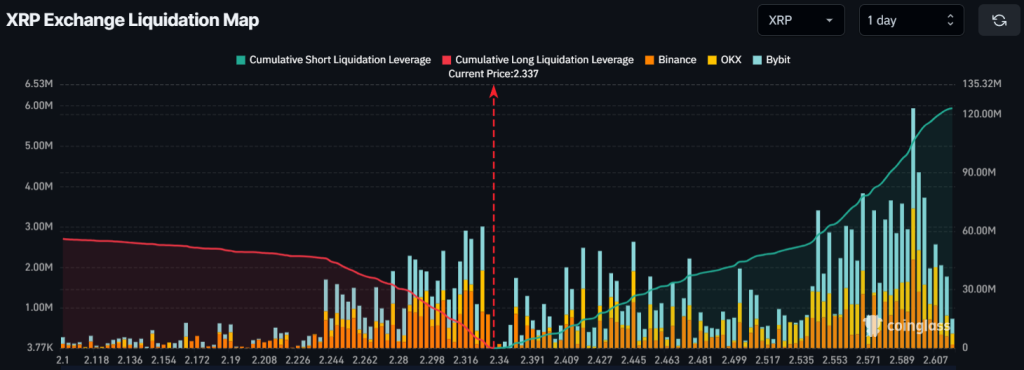

Besides the make-or-break situation, traders appear to hold a bearish sentiment, strongly betting on a lower price as they believe it won’t rise soon, according to on-chain analytics firm Coinglass.

Data from the XRP exchange liquidation map reveals that traders are over-leveraged at $2.241 on the lower side and $2.6 on the upper side. They have built $46 million worth of long positions and $106 million worth of short positions at these respective levels in the past 24 hours.

When combining this on-chain metric with technical analysis, it appears that bears are dominating, and there is a high likelihood that the price will continue to move in a downward trajectory.

Source: https://coinpedia.org/price-analysis/150-million-xrp-on-the-move-major-price-swing-coming/