- U.S. Treasury anticipates significant tariff increases for over 100 nations.

- Trade deals expected to be finalized by July 9.

- Market volatility rises amid uncertainty over trade policies.

U.S. Treasury Secretary Janet Yellen announced plans to finalize numerous trade agreements, affecting over 100 countries, by July 9, 2025. These nations may face a 10% tariff hike. Markets brace for potential disruptions as the deadline approaches, with stakeholders closely monitoring prospects for global trade policy shifts.

U.S. Treasury Secretary Janet Yellen has spearheaded efforts to finalize trade agreements with over 100 nations by July 9. These agreements are crucial as countries face tariffs of at least 10% if negotiations fail. Yellen’s leadership and proactive strategy underscore the significance of these talks in global trade dynamics.

Yellen’s Deadline for Trade Agreements by July 9, 2025

If agreements remain elusive, tariffs are expected to affect the global economy. The increase could exacerbate existing trade tensions, impacting market stability and economic outlook. As businesses and policymakers assess implications, the U.S. economy’s response remains a focal point amid ongoing negotiations.

President Donald Trump commented, “We understand, we have all the numbers,” emphasizing confidence yet highlighting ongoing negotiation challenges (source).

According to Coincu research, the broader implications of rising tariffs may influence regulatory shifts and impact financial markets, although immediate effects on technology or blockchain remain speculative. Historical responses to tariffs suggest varied impacts depending on industries’ reliance on global trade networks.

Impact of Tariffs on Global Markets and Cryptocurrencies

Did you know? The anticipated tariff surge echoes historical patterns, notably the “Liberation Day” tariffs. Past attempts to rapidly implement tariffs influenced equity markets significantly yet exhibited less impact on major cryptocurrencies.

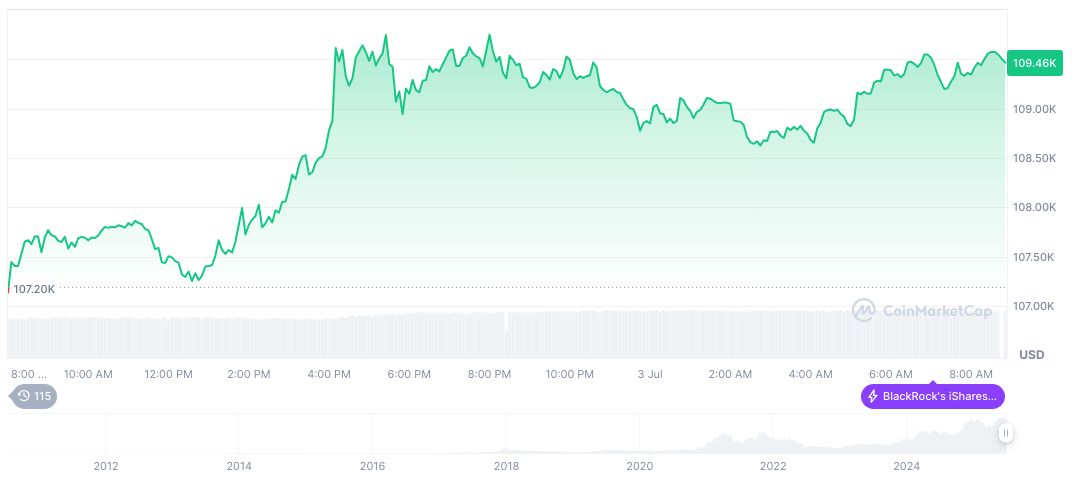

Bitcoin’s market position remains strong, with its price recently at $109,455.56, supported by a market cap of formatNumber(2176748936637.41, 2). It holds a market dominance of 64.46%, with price fluctuations showing a 0.19% change over 24 hours. As June ended, BTC observed a marked growth of 30.63% over the past 90 days, as reported by CoinMarketCap.

According to Coincu research, the broader implications of rising tariffs may influence regulatory shifts and impact financial markets, although immediate effects on technology or blockchain remain speculative. Historical responses to tariffs suggest varied impacts depending on industries’ reliance on global trade networks.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/346665-trade-agreements-100-countries-tariffs/