- GameSquare acquires “Cowboy Ape” NFT for $5.15M.

- Robert Leshner becomes a strategic partner.

- NFT integrated into GameSquare’s treasury strategy.

GameSquare Holdings acquired the rare “Cowboy Ape” CryptoPunk NFT from Compound founder Robert Leshner for $5.15 million in preferred stock, initiating its first direct NFT investment strategy.

This acquisition exemplifies GameSquare’s strategic expansion into digital assets, aiming to integrate NFTs with a targeted 6-10% yield, highlighting growing institutional interest in blockchain investments.

GameSquare’s $5.15M NFT Investment Sets New Precedent

GameSquare Holdings’ acquisition of the “Cowboy Ape” NFT signals a shift in their strategic focus towards digital assets. This acquisition, involving Robert Leshner, creates an important precedent for NASDAQ-listed firms directly investing in high-value NFTs. GameSquare plans to use the NFT as part of a multifaceted treasury strategy.

The immediate implications of this acquisition suggest a bold move by GameSquare into the growing on-chain finance space. The firm expands its crypto holdings by adding 12,913 ETH to its treasury. Market and industry reactions to this move have been largely positive, acknowledging the innovative approach GameSquare has taken. By teaming up with Robert Leshner, a respected DeFi pioneer, GameSquare not only gains a significant asset but also a key strategic partner.

“I am thrilled to announce our first ‘grail’ NFT investment as part of the differentiated treasury management strategy GameSquare is pursuing. In addition, we are excited to welcome Robert Leshner, one of crypto’s most respected investors and a pioneer of decentralized finance as a shareholder. This relationship demonstrates the unique, forward-thinking strategy we have developed to expand into the fastest growing edges of onchain finance.” — Justin Kenna, CEO, GameSquare.

Digital Asset Strategies and Market Response Analysis

Did you know? GameSquare is among the first NASDAQ-traded firms to incorporate high-value NFTs directly into their treasury strategy, positioning itself at the forefront of corporate digital asset integration.

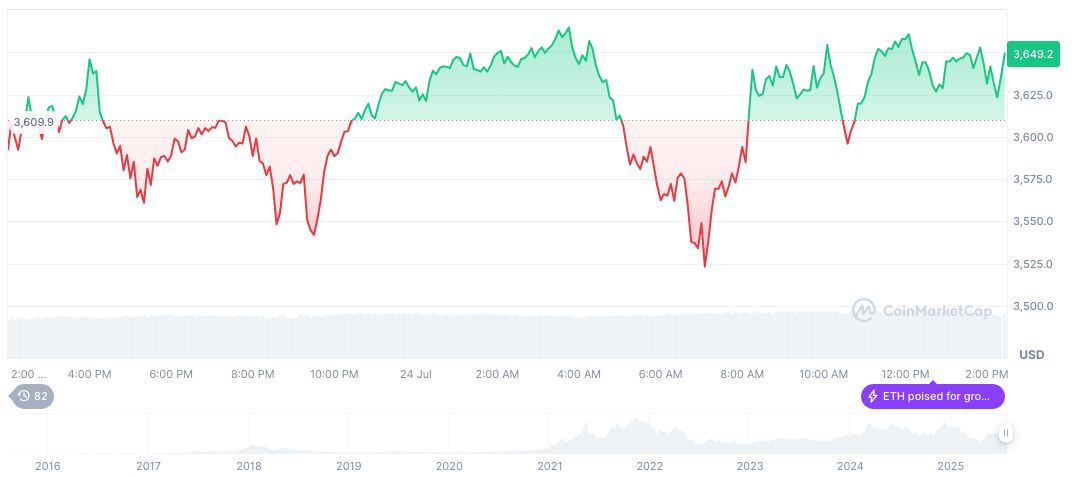

As of the latest data, Ethereum (ETH), part of GameSquare’s strategic assets, maintains its market presence with a price of $3,632.82. ETH’s current market capitalization stands at $438 billion, with a 24-hour trading volume of $40.52 billion. In the last 90 days, ETH has experienced a 104.30% increase in price, illustrating strong resilience and investor confidence. These data points are sourced from CoinMarketCap.

According to insights from the Coincu research team, integrating significant NFT investments into corporate treasury strategies could potentially lead to increased financial innovation and risk resilience. However, this also necessitates robust governance frameworks to manage valuation risks and explore tokenized share markets effectively. GameSquare has been expanding its crypto treasury program, as detailed in their recent expansion to $250 million.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/nfts-news/gamesquare-cowboy-ape-nft-acquisition/