Key Highlights

- An independent investigator allegedly pointed a finger towards members of World Liberty Financial, including Donald Trump Jr., in the Hyperliquid controversy

- The investigator has given a clean chit to Garrett Jin, denying his direct involvement in the short trading on Hyperliquid

- The advanced information of Trump’s tariff announcement was sent forward by aides with access to the POTUS to a group of insiders, according to an on-chain sleuth

In the latest investigation in the Hyperliquid case, Eye, an on-chain investigator, has allegedly pointed fingers toward the World Liberty Financial (WLFI) team, a cryptocurrency venture from the U.S. President Donald Trump’s family. However, this investigation is based on information from an independent on-chain investigator and has not received official confirmation from government officials.

3/ The crucial information given to the HL whale most likely comes from a group of insiders who have long been exploiting confidential information from the White House rumors and official announcements ahead of time. pic.twitter.com/n4yr233h7T

— Eye (@eyeonchains) October 13, 2025

Hyperliquid Whale Shorting before Trump’s Tariff Announcement

Some on-chain investigators have reportedly uncovered evidence that claims a massive bet placed on the Hyperliquid exchange was made using leaked information, also known as insider trading.

The short position was placed just before President Donald Trump declared 100% tariffs on Chinese imports. After this news, the whale made a profit estimated at over $150 million from the market crash. This crash wiped out $1.1 billion in other traders’ positions on the platform.

The case first came into the light after an on-chain investigator, Eye, posted a thread on X. In a post, the investigator shared details on how privileged information appears to have moved from the White House to private cryptocurrency traders.

The tweet reads: “After posting the White House pictures, I have been contacted by various entities and after further researching, I decided to compress everything into a new post. It appears that some of the privileged info obtained by parts of the Hyperliquid whales shorting before the announcement came by tracking an insider ring of crypto traders inside the White House.”

This tweet has sparked a discussion in the crypto community that the market crash on October 11 was not a random event but was strategically planned by those with advanced knowledge, with possibly internally leaked information about tariffs on China.

After Trump announced a heavy tariff on China, the cryptocurrency market reacted with a sharp and sudden drop. The price of Bitcoin fell dramatically from $125,000 to below $102,000 in a matter of minutes.

This sharp drop triggered a chain reaction of automatic sell-offs, known as liquidations, on Hyperliquid.

This is where the Hyperliquid whale enters the story. This whale deposited a colossal amount of USDC stablecoin as collateral. Just minutes before President Trump shared his announcement on social media, this whale opened multiple high-leverage short positions against Bitcoin and Ethereum.

Trump’s Eldest Son and other WLFI Members are Behind Hyperliquid Insider Trading: On-Chain Sleuth

Earlier today, there was a buzz on the internet that Garrett Jin, the former CEO of now-defunct cryptocurrency exchange BitForex, is the whale behind the short trading on Hyperliquid. However, he came forward and refuted this allegation with a tweet.

Hi @cz_binance, thanks for sharing my personal and private information. To clarify, I have no connection with the Trump family or @DonaldJTrumpJr — this isn’t insider trading.

— Garrett (@GarrettBullish) October 13, 2025

Eye has also denied the direct involvement of Garrett in these insider trading allegations, saying “Garret doesn’t seem to be the main actor. He is probably just a frontman, but this was the starting point for tracking the real insider trading ring.”

In the latest post, investigators affirmed that the crucial information provided to the Hyperliquid whale most likely comes from a group of insiders who have long been exploiting confidential information from the White House rumors and official announcements ahead of time.

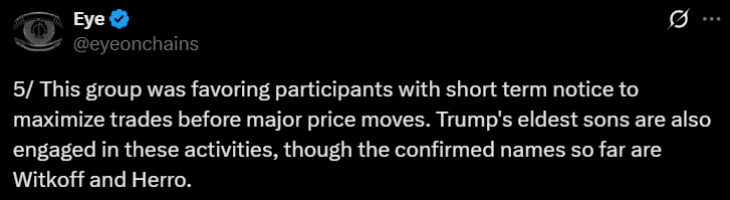

Also, they allegedly stated that the information was sent forward “by aides with access to the POTUS to a group of insiders to open extremely favorable trading positions.”

(Source: Eye on X)

In the investigation, they disclosed two names so far: Zach Witkoff and Chase Herro. The investigator also allegedly mentioned the name of Trump’s eldest son, Donald Trump Jr., in insider trading activities. These all person are all involved in the World Liberty Financial project, a platform that promoted itself for “decentralized financial liberty”

Due to the potential threat, Eye decided to go silent for a while, tweeting, “I went too deep in the rabbit hole, and I don’t feel it’s safe for me to keep going.”

Source: https://www.cryptonewsz.com/wlfi-allegedly-hyperliquid-short-position/