The cryptocurrency market is again heating up, and Jupiter (JUP) has positioned itself as a project with high prospects of intensified gains. According to the technical analysis shared by market analyst CryptoPilotu, Jupiter seems ready to break out of a bullish cup-and-handle pattern, offering a compelling opportunity for traders and investors.

In CryptoPilotu’s analysis, two key levels are critical for JUP’s price action. The first is the support level at $0.64, which has been tested multiple times and consistently held, forming a strong base for upward momentum. On the other hand, the resistance level at $1.30 serves as a major hurdle that needs to be broken for the next leg up.

#Jupiter ( $JUP ) YÜKSELİŞE HAZIR

🎯 Destek ve Direnç Seviyeleri:

🔸 Destek: 0,64$

🔸 Direnç: 1,30$Önümüzdeki süreçte 2,10$ hedefi mümkün,unutmayın #JUPITER #SOLANA‘nın en gözde projesidir.#Jup #jupusdt #SOL pic.twitter.com/gFizL5dtGN

— CryptoPilotu (@CryptoPilotu) January 24, 2025

These levels are part of a larger cup-and-handle pattern, a bullish indicator often preceding heightened price increases. If JUP breaks above the $1.30 resistance level with strong volume and momentum, the next price target is $2.10. This marks a probable 146% increase from the token’s price of $0.8530.

Besides, the cup-and-handle formation, along with consistent higher lows during the consolidation phase, highlights growing buyer confidence and sets the stage for a breakout. Jupiter’s connection with Solana further bolsters its appeal. As one of the most scalable and efficient blockchain ecosystems, Solana’s growth can have ripple effects on projects like JUP.

Jupiter Sets Stage for Long-Term Value Creation

Adding to its bullish narrative, Jupiter recently announced the launch of its multi-blockchain network, Jupnet, at the Catstanbul conference. This network will allow users and DeFi apps to hold funds and transact across multiple blockchains while maintaining decentralization, showcasing the project’s focus on advancement and cross-chain functionality.

The announcement positions Jupiter as a leading player in the DeFi ecosystem, aligning with broader industry trends favoring interoperability. Additionally, the cryptocurrency has outlined plans to use 50% of its fees to buy back JUP tokens from the market, a move aimed at reducing market supply and increasing token value.

Furthermore, the project plans to burn 3 billion JUP tokens, equivalent to $3.63 billion at the current rate, to reduce emissions, increase certainty, and lower the fully diluted valuation (FDV). With the current price of $1.21 and an FDV of $8.48 billion, these measures will likely create positive sentiment and further drive value for JUP cryptocurrency.

Growing On-Chain Activity Boosts Market Optimism

On-chain data further validate the bullish momentum building up around the JUP cryptocurrency. For instance, the volume chart reveals a sharp increase in trading activity beginning on January 19, coinciding with the price breakout.

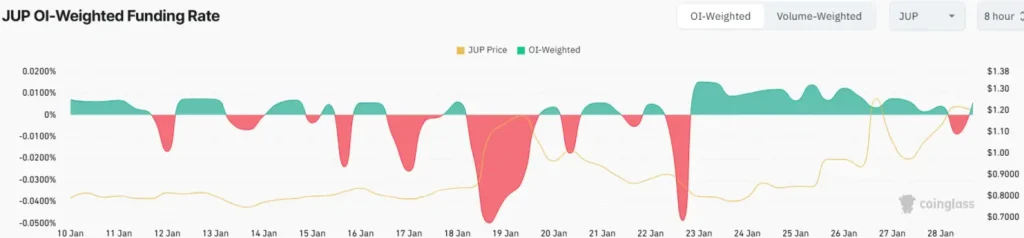

This surge in volume indicates strong market participation, supporting the bullish thesis and reinforcing the likelihood of a sustained uptrend. Meanwhile, the Open Interest (OI)-Weighted Funding Rate chart shows fluctuating sentiment among derivatives traders. Negative funding rates earlier in the month suggest bearish sentiment or short positions.

However, the recent shift towards neutral and positive funding rates aligns with the token’s price recovery, indicating that the market sentiment is turning bullish. Positive funding rates typically signal that traders are willing to pay a premium to maintain long positions, a key indicator of confidence in further price appreciation.

Also Read: LTC Forms a Bearish Black Crow Pattern; Is $100 Retrace Next?

Source: https://www.cryptonewsz.com/jupiter-price-forecast-will-jup-hit-new-ath/