Solana (SOL) showcased a promising rebound on Wednesday, climbing 4.95% intraday to reclaim the $230 level. This recovery comes after a challenging three-day losing streak that saw the token dip by 15%, weighed down by macroeconomic uncertainties.

The broader crypto market received a boost following the U.S. Federal Reserve’s decision to pause interest rate hikes, fueling a wave of optimism across digital assets. Solana’s price recovery aligns with this improved sentiment, as traders appear eager to capitalize on its recent dip.

Market Data Points to Bullish Sentiment

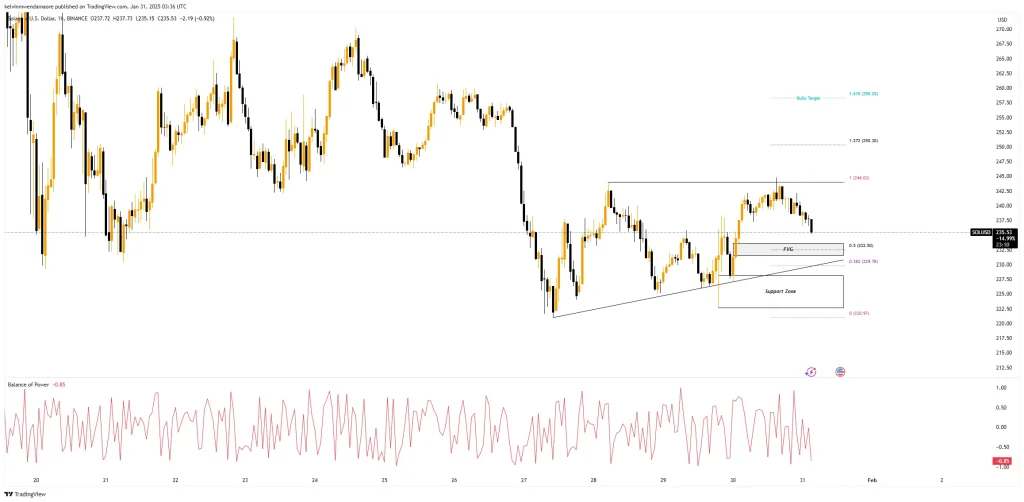

According to TradingView data, the SOL token opened the day at $227, briefly rallying to $238 before stabilizing near $232. This move could indicate the formation of a local bottom, setting the stage for a sustained uptrend. Derivatives market data adds weight to the bullish case.

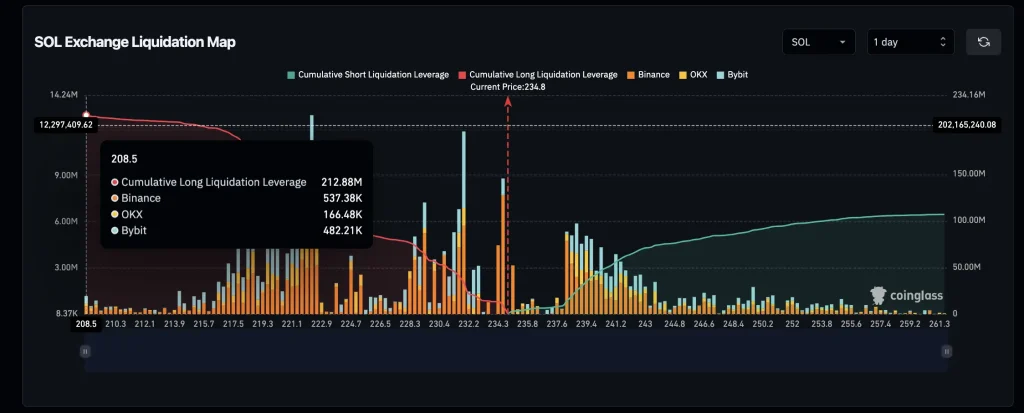

Coinglass’s liquidation map reveals an uptick in leveraged long positions for the Solana token, with $212.88 million in long contracts compared to $106 million in short positions. This bullish skew, where long positions account for nearly 66.7% of leverage, suggests growing confidence among traders betting on further upside.

Importantly, when long leverage surges after a prolonged decline—as seen with the cryptocurrency’s recent 15% drop—it often signals a potential bottom. Market makers could take advantage of this imbalance by driving higher prices to liquidate short positions, adding momentum to an upward move.

Key Levels to Watch

Market analyst 52kskew highlighted on Twitter that Solana’s price is consolidating above a previous lower high (LH), a critical level that triggered the recent swing low. The analyst notes that reclaiming the weekly open near $240 is vital for bulls to build momentum toward $250.

$SOL 4H

Constructive chart I thinkPrice currently consolidating above previous LH with led to the swing low

~ Potential HL developingNote weekly open here, very key to reclaim the open as this would allow buyers to establish a push back towards $250

Acceptance above VAH &… pic.twitter.com/P7WTyr5ahN

— Skew Δ (@52kskew) January 30, 2025

The chart also shows a volume profile, indicating that the cryptocurrency’s value area high (VAH) and the $270 level serve as key resistance zones. Breaking above these thresholds could pave the way for a significant rally.

On lower timeframes, the Solana token consolidates after its recent rebound, holding above a critical support zone between $222 and $230. This area, reinforced by Fibonacci retracement levels, acts as a key defense for buyers and suggests a potential base for further upside.

A key technical feature is the Fair Value Gap (FVG) just above the support zone, which represents a liquidity pocket. If the cryptocurrency stays above this gap, it could trigger a rally toward $244, the next resistance. Breaking this level may push prices toward $250 and potentially higher to $258.

Currently, sellers have slight control, as shown by the Balance of Power indicator, but buyers could regain momentum by holding key support levels. For traders, watching $230 for support and $244 for resistance is essential. A breakout above $244 would confirm a bullish move, while losing $230 could risk further declines.

Also Read: Bitcoin’s Bull Run Mirrors 2015–2018 Cycle—Is History Repeating Itself?

Source: https://www.cryptonewsz.com/solana-sol-price-analysis-why-250-may-be-next/