As the crypto market continues to recover for the second consecutive day, the bullish attention over Solana is increasing. As the SOL price trend continues above the $200 psychological mark, the recovery run is shaping up to a potential bullish rally.

With the technical indicators and whale activity hinting at a recovery run, will SOL price trend rise back to $257?

Solana Price Analysis Targets V-shaped Reversal

In the daily chart, the SOL price trend ends the three consecutive bearish days near the 200-day EMA line. Along with the dynamic support, a short-term local trendline helps in the bullish comeback.

With a Morning Star pattern forming near the $190 support, SOL price trend is making its fifth consecutive bullish candle. This hints at a V-shaped recovery in the SOL price trend as it exceeds above the $200 mark.

Currently, Solana trades at a market value of $204.83 with an intraday recovery of 2.14%. Amid the recovery trend, the MACD indicator is on the verge of signaling a trend reversal.

This is because of the drop in bearish histograms and the increased chances of a bullish crossover in the MACD and signal lines.

Whale Activity: Rising Bets on Solana

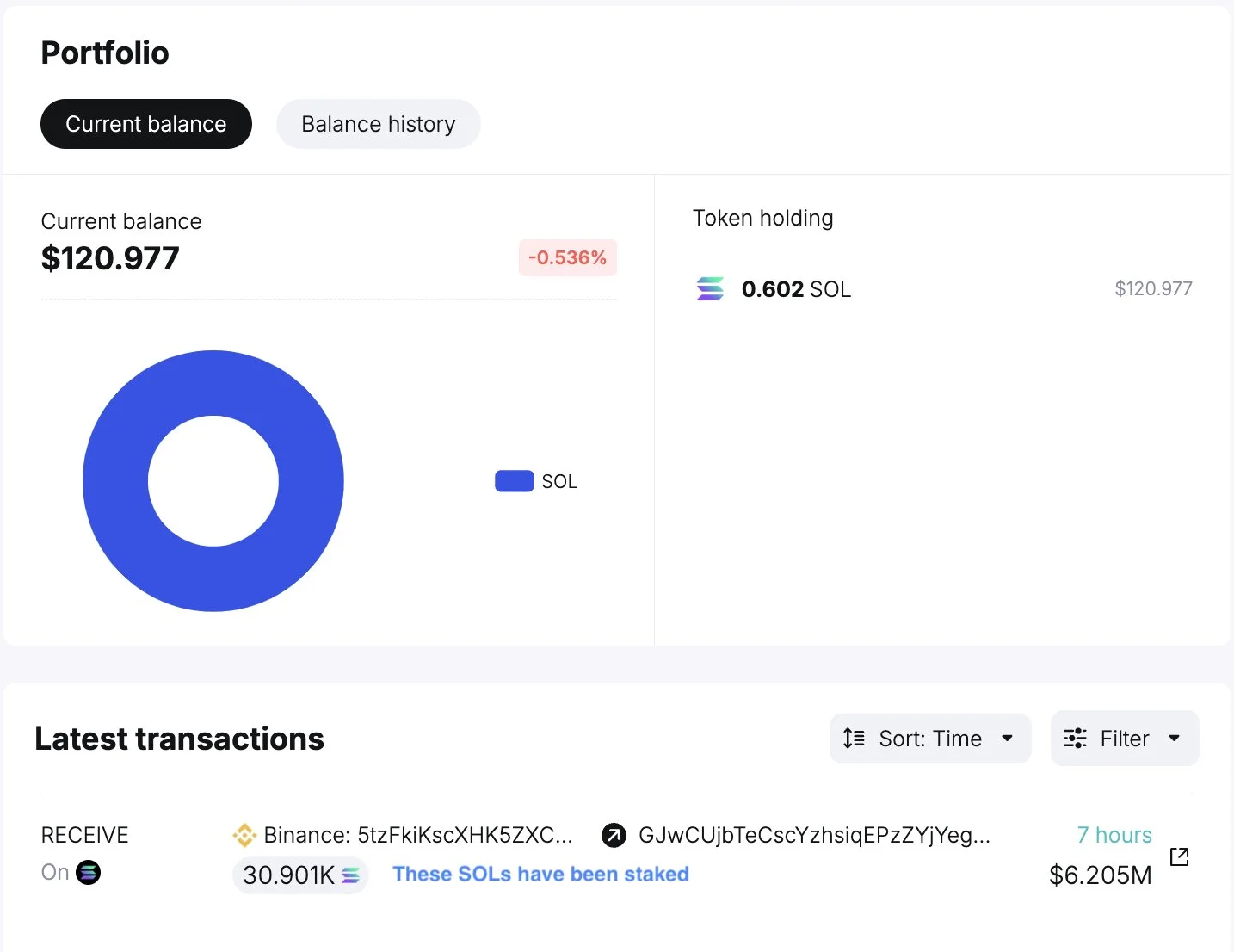

Amid the possibility of a bullish reversal gaining momentum, the dominant whales are coming back for SOL. In a recent tweet from SpotOnChain, a whale, GJWCU, has come after a year of dominance.

With its return to the crypto market, the whale has purchased 30,901 SOL tokens from Binance worth $6.24 million. Prior to the current bullish take on SOL, the whale has completed another positive trade to make a profit of $8.15 million, accounting for a return of nearly 22%.

Furthermore, a different whale has resurfaced to withdraw 61,319 SOL tokens worth $12.4 million. The whale took the entry at an average price of $202.53 by accumulating SOL tokens from Binance and OKExchange.

Prior to the current trade, the whale has a 100% win rate in Solana with two successful trades. The earnings from the trades account for a profit of nearly $8.5 million between December 2023 and November 2024.

Derivative Sentiments Turn Bullish Gradually

Amid the growing bullish whale support, sentiments over the Solana derivatives market are gradually improving. The long-to-short ratio has equalized after being constantly at 0.9 levels. This marks a significant rise in the bullish positions.

Furthermore, the liquidations over the past 24 hours account for $5.38 million, with the long-to-short liquidations at near-equal levels. However, the funding rate marks another success for bulls. The rate has improved from -0.015% to -0.0012%.

This marks a potential end in the bear cycle in the derivatives market. The current open interest of Solana is standing at $5.41 billion, reflecting the high interest of traders.

Solana Price Target: Can SOL Reach $257?

As the recovery rally in Solana gains momentum, the price action analysis hints at a potential surge to the 50 EMA line at $213. Beyond this, SOL price trend could find a smooth sail towards the $257 overhead resistance.

On the flip side, the 200 EMA line remains a crucial support at $190.

Source: https://www.cryptonewsz.com/whale-buying-spikes-as-solana-hits-200-will-sol-rally-to-257/