Circle’s stock surged to a new high of $165.60 on June 16 before settling at $151.06, pushing its market capitalization to $33.617 billion.

This represents a 434% increase from its IPO price of $31, underlining soaring investor interest in the stablecoin issuer behind USDC.

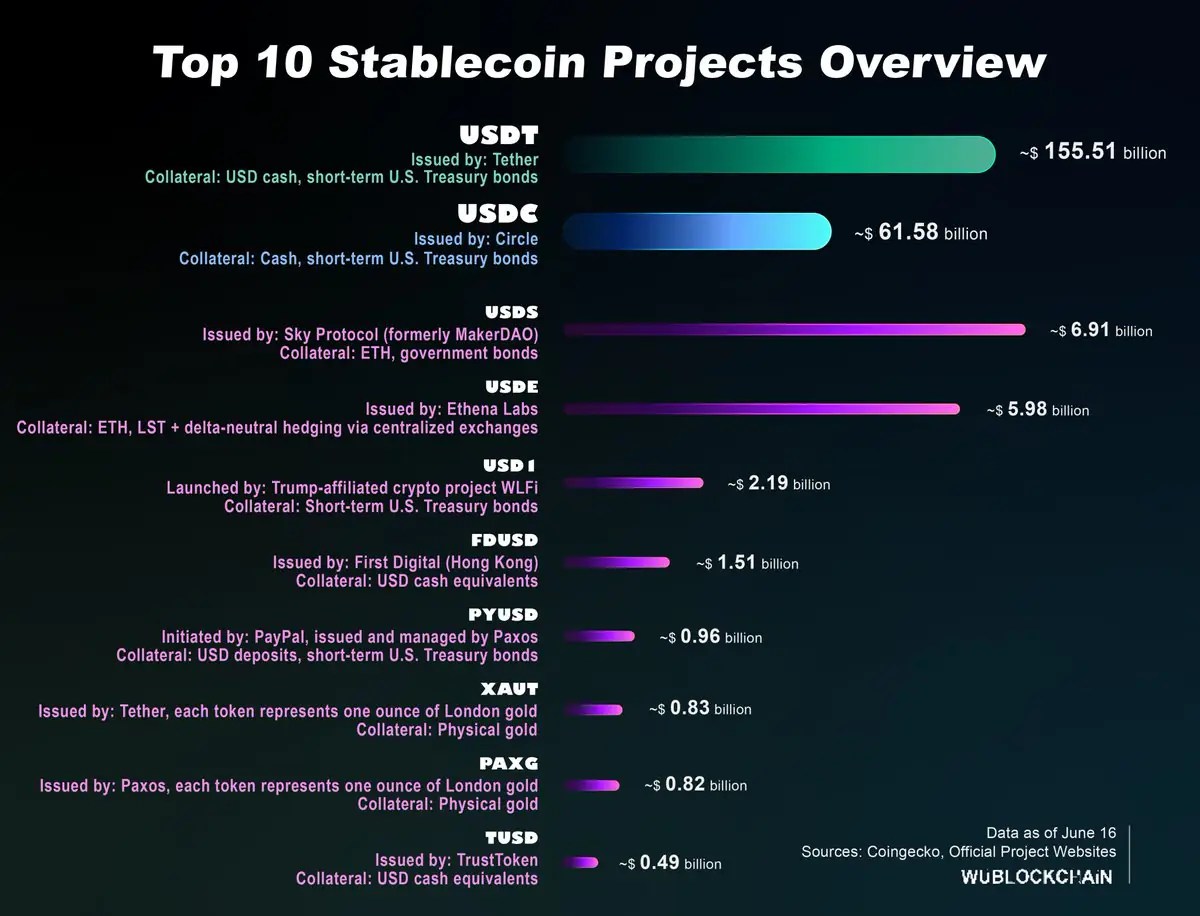

According to data compiled by Wu Blockchain, Circle’s growth parallels the broader expansion of the stablecoin market.

USDC remains the second-largest stablecoin, with $61.58 billion in market cap, trailing only Tether’s USDT, which dominates the sector with $155.51 billion.

Breakdown of the Top 10 Stablecoins

Wu Blockchain presented a comprehensive overview of the leading stablecoins based on market cap, issuers, and collateral structures. The report covers 10 major projects:

- USDT (Tether): $155.51B; backed by USD cash and U.S. Treasuries.

- USDC (Circle): $61.58B; collateralized by cash and short-term Treasuries.

- USDS (Sky Protocol, formerly MakerDAO): $6.91B; backed by ETH and government bonds.

- USDE (Ethena Labs): $5.98B; collateral includes ETH, LSTs, and delta-neutral hedging.

- USD1 (WLFI): $2.19B; tied to short-term Treasuries.

- FDUSD (First Digital, Hong Kong): $1.51B; backed by USD cash equivalents.

- PYUSD (PayPal via Paxos): $0.96B; supported by deposits and Treasuries.

- XAUT (Tether): $0.83B; gold-backed.

- PAXG (Paxos): $0.82B; gold-backed.

- TUSD (TrustToken): $0.49B; USD cash-backed.

A Market Poised for Growth

Circle’s meteoric valuation underscores how centralized stablecoin issuers are benefiting from rising institutional demand and increasing regulatory clarity. As governments worldwide draft frameworks for stablecoin compliance, the market is shifting toward transparency and collateral quality.

The total market cap of these top 10 stablecoins signals a robust and maturing sector, with Circle and Tether remaining dominant forces shaping its trajectory.

Source: https://coindoo.com/top-stablecoin-projects-ranked-by-market-size-and-collateral/