- The Solana price develops a double bottom reversal pattern at $125 support.

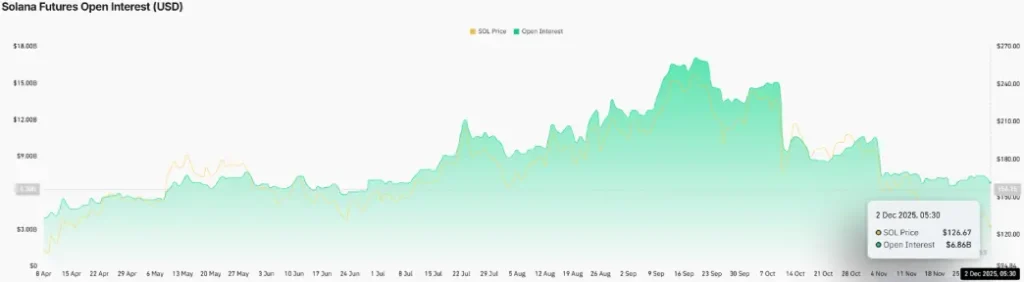

- A 7.3% drop in Solana futures open interest suggests a cooling phase from speculative positioning, implying that the current rally is being driven more by spot demand and on-chain participation.

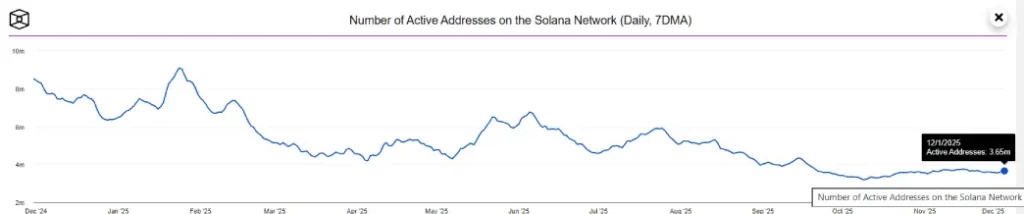

- The Solana network recorded a 3% bounce in active addresses, suggesting renewed user engagement.

SOL, the native cryptocurrency of the Solana blockchain, recorded a double-digit gain of 11.8% on Tuesday to trade at $139.2. The buying pressure is spread across the broader crypto market as Bitcoin jumps over 8% following the end of quantitative tightening by the U.S. Federal Reserve. The renewed recovery in Solana’s price shows the potential formation of a traditional reversal pattern amid the growing user engagement in its network activity.

Solana Price Hold at $125 as On-Chain Activity Rebounds

Over the past ten weeks, the Solana price has experienced a significant correction from $253 to $139, registering a 51% loss in value. Consequently, the asset market cap has plunged to $77.82 billion.

However, the coin price has recently stabilized above the $125 support, as the broader crypto market witnessed renewed recovery. Today, the Bitcoin coin finally recovered $90,000 with an 8% surge as the Fed officially ended its quantitative easing program named “quantitative tightening” on December 1, 2025, which has been depleting liquidity in financial markets since mid-2024. This move injected an estimated $6.6 trillion in potential liquidity back into the system, which acted as a “de facto easing” to boost risk assets, including cryptocurrencies.

However, the recent surge in Solana price is also backed by renewed user participation on its network. According to TheBlock data, the number of active addresses has jumped from $3.53 million to $3.63 million—a 3.39% increase—in the last five days. This surge indicates a pickup in real on-chain activity, suggesting that users are returning to decentralized applications, trading venues, and ecosystem projects after months of muted engagement.

However, the derivative data still shows hesitation among trades as open interest associated with Solana futures contracts continues to decline. Recent data from Coinglass shows that SOL OI value has plunged from $7.4 billion to $6.86 billion in the last two days, accounting for a 7.3% decline. The downtick suggests traders are reducing their leveraged exposure in Solana amid current market uncertainty.

SOL Price Rebounds With Double Bottom Pattern

For nearly three weeks, the Solana price has been consolidating between two horizontal levels, $145 and $125, acting as firm resistance and support, respectively. A better look at the daily technical chart shows this lateral trend developing into a traditional reversal pattern called a double bottom.

The chart setup is characterized by two price reversals from a single support region, suggesting strong demand pressure from below. The momentum indicator RSI supports the bullish narrative of this pattern with a fresh higher-low formation in its slope, currently wavering at the 45.6% mark.

If the pattern holds true, the Solana price is poised for another 5.5% surge and will challenge the overhead resistance of $145. Completing this pattern would foster a stronger recovery of nearly 18% in price before challenging a key downsloping trendline at $171.

If the sellers continue to defend the $145 barrier, the coin price could reverse again and prolong consolidation. Until, the price wavers within this rangle, a risk of support breakdown and contiued correction persists.

Also Read: Forward Industries to Launch New Staking Token ‘fwdSOL’

Source: https://www.cryptonewsz.com/solana-price-double-bottom-structure-bulls-145/