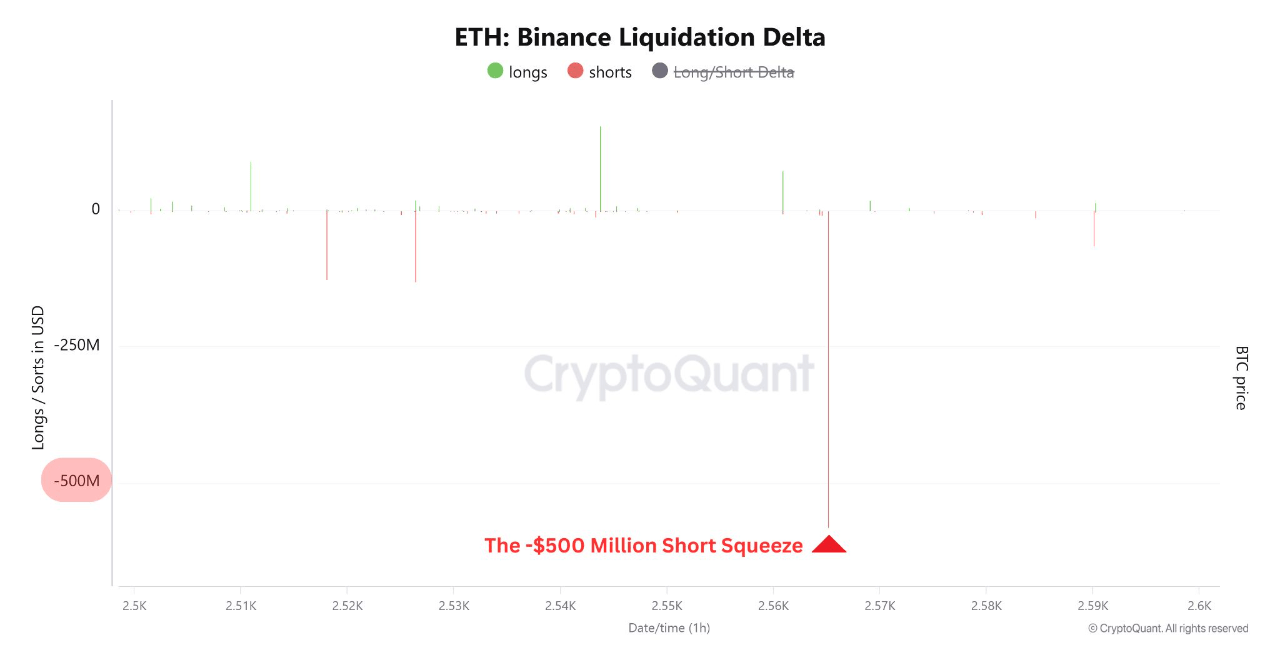

According to a new report shared by CryptoQuant, Ethereum’s sharp rebound above $2,670 has led to over $500 million in short liquidations on Binance, marking one of the most significant squeeze events in recent months.

The liquidation wave was driven by aggressive short positioning and a sudden price rally that forced late sellers to exit their trades at a loss.

According to the report the liquidation cascade was primarily triggered by overcrowded leveraged short positions. As Ethereum began recovering from recent lows, traders who entered short positions too late were caught off guard.

Their forced closures activated market buy orders to cover those positions, creating upward pressure and accelerating the rally. This dynamic rapidly flipped funding rates into positive territory, signaling a shift toward bullish momentum in the derivatives market.

Rising ETH Deposits to Derivative Exchanges

In parallel with the short squeeze, CryptoQuant noted a substantial increase in Ethereum transfers to derivative exchanges. Starting June 13, multiple transactions surpassed 30,000 ETH each—indicating a strategic influx of capital into futures and margin platforms.

These inflows may serve several purposes:

- Hedging Activity: Traders could be depositing ETH to hedge existing spot exposure through derivative instruments.

- Short Position Setup: The ETH could also be used to establish new short positions if traders expect a pullback following the squeeze.

What Comes Next?

The interplay between liquidations, funding rates, and exchange flows will be crucial in shaping Ethereum’s next move. While a short-term correction may occur to reset overheated funding rates, the increasing ETH balances on exchanges suggest a new phase of market volatility could emerge.

Whether this fuels further upside or sets up bearish positioning depends on how derivatives traders respond in the coming sessions.

Traders are advised to keep a close watch on funding rate shifts and ETH netflows, as these signals will likely determine the strength and direction of Ethereum’s price trajectory in the near term.

Source: https://coindoo.com/short-squeeze-on-binance-triggers-market-shock-amid-rising-derivatives-activity/