SEI is showing signs of consolidation near a crucial support zone, with traders closely monitoring whether the token can hold above $0.267 before triggering a potential bullish reversal.

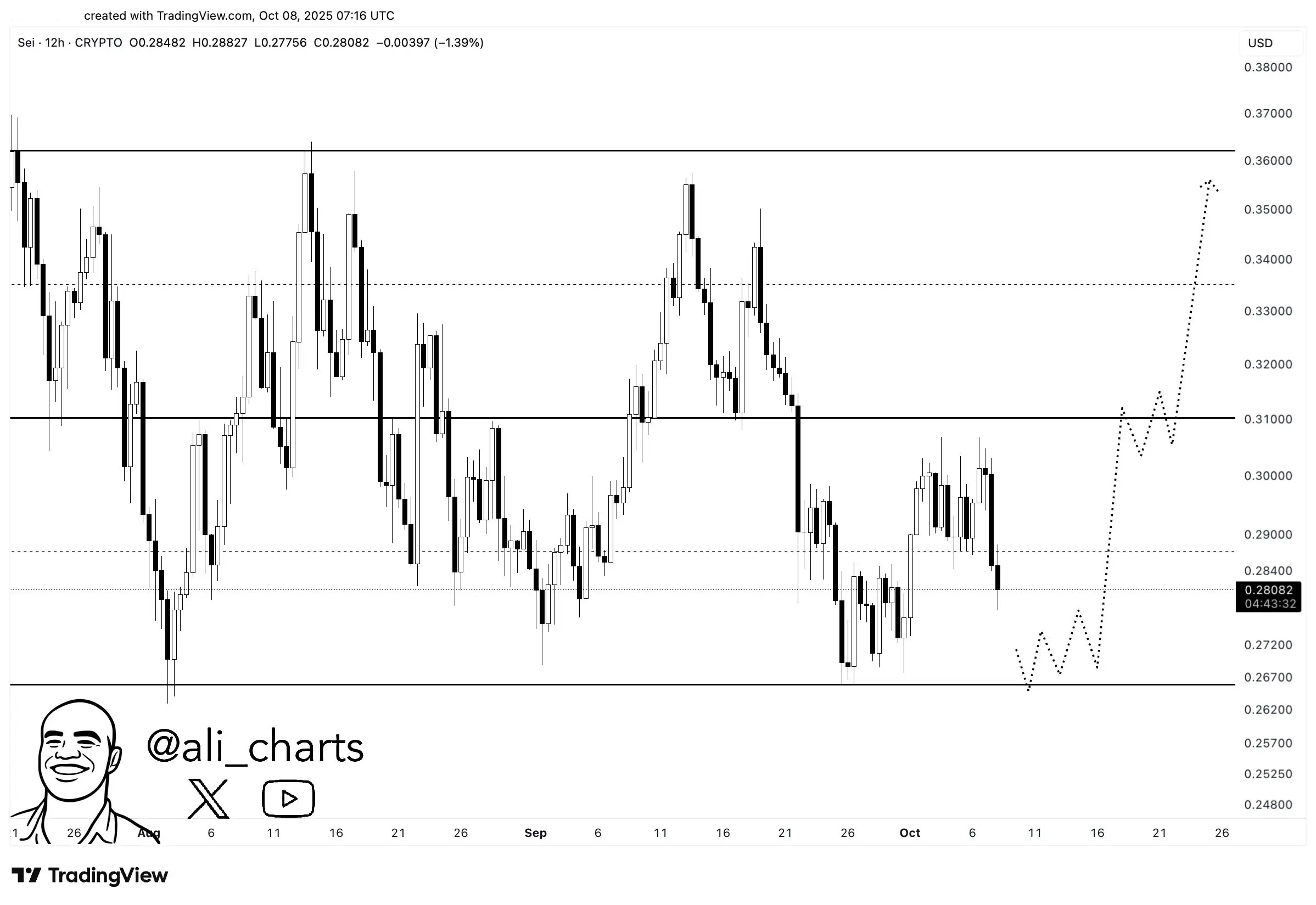

According to a recent analysis by Ali Martinez, a well-known crypto strategist, maintaining the $0.267 level could open the door for a move toward $0.36. The analyst shared a chart suggesting that SEI’s current range between $0.27 and $0.31 represents a key accumulation area before the next leg up.

On the daily chart, SEI is trading around $0.285, showing modest recovery attempts after a brief pullback. The Relative Strength Index (RSI) hovers near 45, reflecting neutral momentum and hinting that traders are waiting for confirmation before taking new positions.

Historically, the $0.26-$0.27 zone has served as strong support, repeatedly preventing deeper declines. If buyers can defend this area again, analysts believe it could signal the end of the current consolidation phase. A breakout above the $0.31 resistance could then set the stage for a steady climb toward the $0.35-$0.36 range, as forecasted by Martinez.

However, a close below $0.26 might invalidate this scenario, exposing SEI to a deeper correction. Despite recent volatility, trading volumes remain relatively stable, indicating that market participants are positioning cautiously ahead of the next directional move.

In the broader market, altcoins have shown mixed performance as Bitcoin’s rally pauses near key resistance. SEI’s ability to sustain its current structure could determine whether it joins the next wave of upward momentum or faces another retest of lower supports.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.