Polkadot price analysis confirms that a bearish trend has been dominating the charts for the past few days. A decrease in price levels has been observed in the last 24 hours as well, which is quite discouraging for the buyers. The price has been corrected down to the $5.15 level, as the bearish momentum continues for the third day in a row.

Resistance at the $5.28 level is currently posing a major hurdle for the price, while key support has been set at $5.14. If the sellers continue to pressure prices lower, there could be more downside in store for Polkadot.

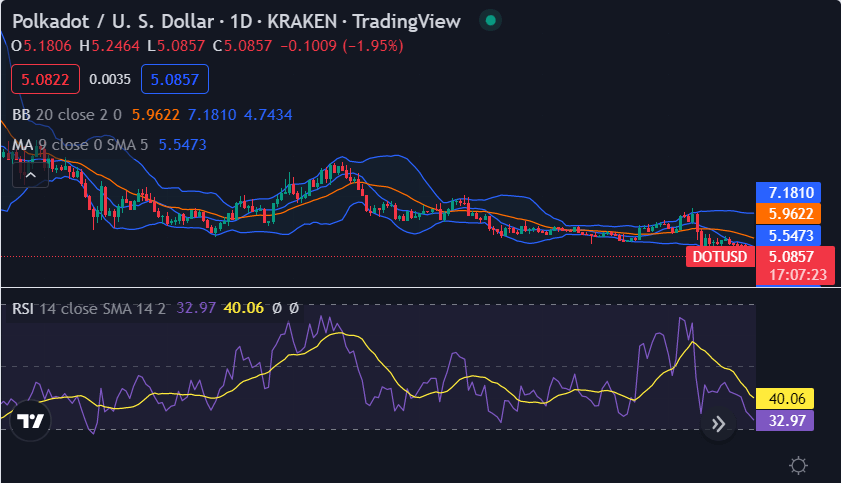

The one-day Polkadot price analysis dictates that a decrease in price has taken place in the last 24 hours. The circumstances have been going favorably for the bulls for the past week. But the last few days of this week have seen a fluctuation in price movements, as well as the bears were struggling to regain their position. Today’s trend, however, has been extremely supportive for the sellers as the price has decreased up to the $5.15 level.

The moving average (MA) value in the one-day price chart is at the $5.54 level. Whereas the Bollinger band’s average is maintained at $5.14, the upper Bollinger band is touching $0.851 7.18, and the lower Bollinger band is touching $4.74 point. The Relative Strength Index (RSI) score has slightly decreased up to index 40.06, but the downward curve is not steep.

Polkadot price analysis: Recent developments and further technical indications

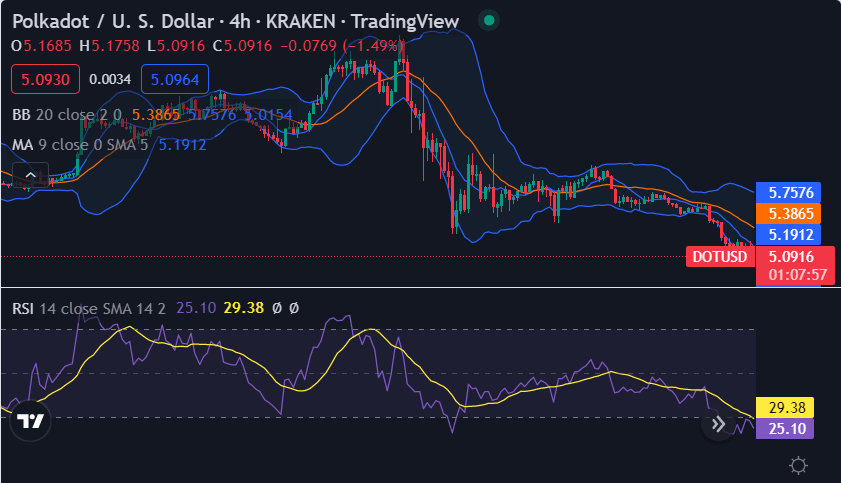

The hourly Polkadot price analysis dictates that a decrease in price has taken place in the last 4 hours. The circumstances have been going favorable for the bulls for the past few days, as the price had made a jump above the $6.00 level. However, it couldn’t maintain its bullish momentum and has faced bearish pressure, resulting in DOT/USD trading at $6.64 currently.

The volatility is comparatively mild on the 4-hour chart as the Bollinger bands are covering less area and don’t show any considerable change in their movement. The upper Bollinger band value for the four hours price chart is at $5.75, whereas the lower Bollinger band value is at $5.01. The RSI score is in the neutral zone, as it shows the figure of 29.38 just above the centerline of the neutral zone.

Polkadot price analysis conclusion

To conclude the Polkadot price analysis shows that a bearish trend has been dominating the market, causing a decline in price levels. However, key support at $5.14 is currently a major barrier for the sellers and could provide some level of stability to the market in the short term.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Source: https://www.cryptopolitan.com/polkadot-price-chart-2022-11-22/