Key Highlights

- The New York Stock Exchange (NYSE) has unveiled its plan to launch a platform for trading and settling tokenized securities using blockchain technology, need regulatory approval

- The announcement comes at a time of intense debate over the Digital Asset Market Clarity Act, started after the Coinbase CEO withdrew support for the bill

- On the other hand, some groups like the World Federation of Exchanges and Citadel Securities demand a clear, SEC-aligned regulatory framework

On January 19, the New York Stock Exchange unveiled its plan to launch a first-of-its-kind platform to trade and settle tokenized securities on the blockchain.

💥BREAKING:

🇺🇸 NYSE to launch 24/7 US stock trading through new on-chain tokenized exchange. pic.twitter.com/ZCZXbylV37

— Crypto Rover (@cryptorover) January 19, 2026

According to the official press release, the new platform is expected to integrate advanced blockchain technology to boost speed and efficiency for stock trading.

If approved by regulators like the U.S. Securities and Exchange Commission (SEC), the platform could launch later this year. The platform will allow for trading nearly 24 hours a day, 7 days a week. By using this platform, users can settle this trade instantly instead of the current 1-day settlement standard.

The platform is also expected to accept USD-denominated orders and allow funding through stablecoins.

NYSE Prepares to Adopt Tokenized Stocks, But Regulatory Uncertainty Still Persists

This announcement comes amid the boom in the world of tokenized securities. These are digital tokens on a blockchain that show ownership in traditional assets like company stocks or exchange-traded funds (ETFs). These tokenized securities or stocks can make markets more efficient, reduce costs, and allow for fractional ownership of high-value assets.

The NYSE platform would list both tokenized versions of existing stocks and new securities born directly on the blockchain.

Lynn Martin, President, NYSE Group, stated in the press release, “For more than two centuries, the NYSE has transformed the way markets operate. We are leading the industry toward fully on-chain solutions, grounded in the unmatched protections and high regulatory standards that position us to marry trust with state-of-the-art technology. Harnessing our expertise to reinvent market infrastructure is how we’ll meet and shape the demands of a digital future.”

“Since its founding, ICE has propelled markets from analog to digital,” Michael Blaugrund, Vice President of Strategic Initiatives, ICE, said. “Supporting tokenized securities is a pivotal step in ICE’s strategy to operate on-chain market infrastructure for trading, settlement, custody, and capital formation in the new era of global finance.”

However, the announcement comes in the middle of a regulatory chaos in Washington over how to regulate digital assets. The debate revolves around the proposed Digital Asset Market Clarity Act, which is a major bill expected to establish federal rules for cryptocurrencies and tokenized assets.

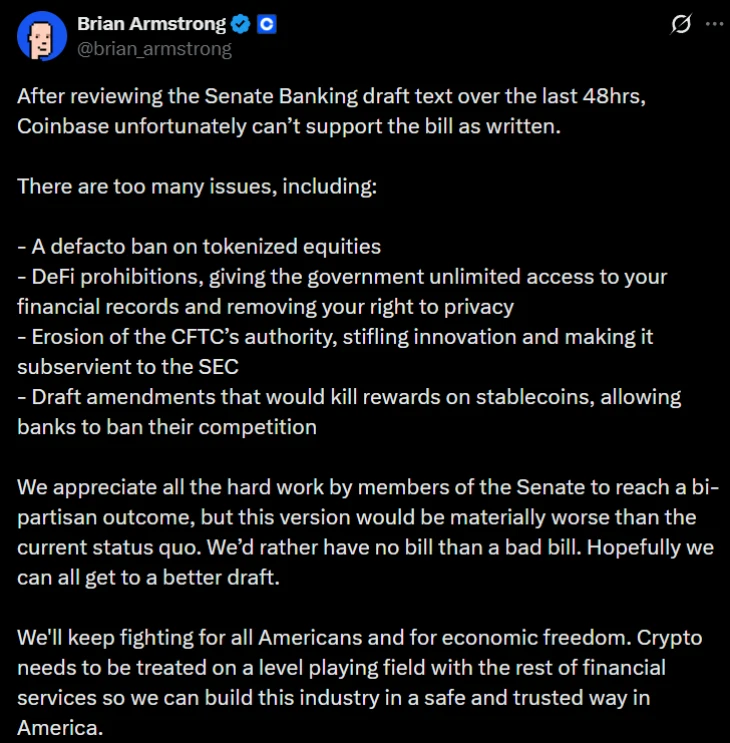

A few days ago, the debate started. Coinbase CEO Brian Armstrong publicly withdrew his company’s support for the current Senate draft of the bill.

(Source: Brian Armstrong on X)

In a post on X, Armstrong called the draft “materially worse than the current status quo.” He affirmed that it would impose a “de facto ban” on tokenized equities by placing them strictly under SEC control, which he believes could curb innovation.

Armstrong also raised objections to other parts of the bill. He said that it would prohibit many decentralized finance activities, weaken the Commodity Futures Commission’s role, ban rewards on stablecoin holdings, and give the government too much access to user financial data.

His sudden reversal forced the Senate Banking Committee to postpone a major markup on the bill.

Ongoing Debates around Tokenized Securities Split the Community

Armstrong’s statement has divided the digital asset industry into two. While some companies, like Ripple, have supported the bill for providing clearer rules, others agree with Coinbase’s concerns.

Yet, a major group directly involved in tokenization has countered Armstrong’s “de facto ban” claim.

Leaders of firms that specialize in creating regulated digital securities say that the bill actually helps them. Carlos Domingo, CEO of Securitize, stated that the draft clarified that tokenized equities are securities under existing law, calling it a “key step” for bringing blockchain into the traditional financial world.

Glabe Otte of Dinari and executives from Superstate also rejected the idea of a ban, noting that the legislation brings crucial investor protections.

Also Read: Uniswap On-Chain Signals Turn Bullish Amid Soft Spot Demand

Source: https://www.cryptonewsz.com/nyse-to-launch-tokenized-securities-platform/