The technology giant Microsoft (NASDAQ: MSFT) suffered one of its worst sessions of the 2020s, seeing its stock crash nearly 10% in 24 hours and its market capitalization collapse by almost $360 billion.

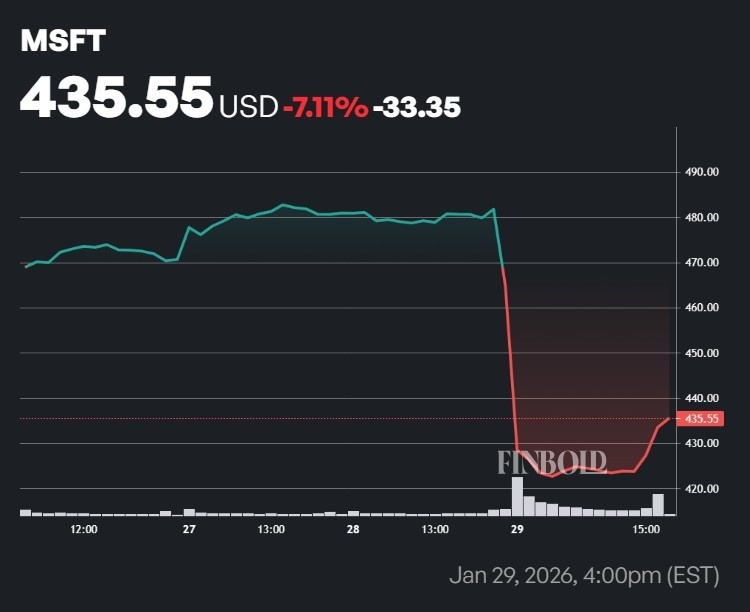

Specifically, after mostly maintaining their value since 2026 started and even enjoying a notable rally from $444 on January 21 to almost $482 on January 28, MSFT shares fell off a cliff starting in the extended session on Wednesday afternoon.

By press time on Friday, January 30, Microsoft stock is trading at $435.55 following a calamitous 10% drop. Simultaneously, the company’s market capitalization crashed from about $3.58 trillion to approximately $3.22 trillion.

Microsoft’s downfall is among the biggest in the last 12 months and among the largest recorded in the stock market.

Microsoft stock collapsed despite strong earnings

At face value, MSFT stock’s January 29 collapse is counterintuitive since it came shortly after the blue-chip company published a strong earnings report for its second quarter (Q2) of 2026.

Indeed, Microsoft beat both the earnings per share (EPS) – with $4.14 adjusted instead of $3.97 expected – and revenue – at $81.27 billion and not $80.27 billion – forecasts.

Azure and its kindred cloud services grew 39%, which, while not a clear beat of forecasts, still mostly fell in line with expectations.

Why Microsoft earnings underwhelmed MSFT stock investors

Despite the apparently strong results, several key data points showcased both a degree of contraction and heightened risks that many investors evidently found uncomfortable.

To begin with, Microsoft’s implied fiscal third-quarter operating margin came in at 45.1%, below the 45.5% consensus, and the technology giant’s gross margin diminished to a three-year low of 68%.

Though a 9.5% drop in gaming revenue might have unnerved some traders, the bigger news was, arguably, the revelation that as much as 45% of Microsoft’s backlog is directly linked to OpenAI.

Is this the key danger for Microsoft stock?

For months, OpenAI has been at the epicenter of the discussion about a supposed artificial intelligence (AI) bubble.

Along with being the most recognizable name in the sector, many observers have noted the gap between the firm’s burning of billions more than it earns each year and the vast investment commitments it has made.

Sam Altman’s previous comments implying a government bailout would be in order and his seemingly reneging on his previous antagonistic comments about commercials via the introduction of advertisements into ChatGPT have done much to stoke the flames.

Thus, it isn’t particularly odd that many investors decided to offload their MSFT shares upon learning that nearly half of Microsoft’s backlog can be made or broken by OpenAI.

The rise of ‘Microslop’

Elsewhere, it is notable that, on the more grassroots side of the internet, Microsoft has – like many of its big tech peers – been burning much of the goodwill it had left.

The company has been pushing its Copilot AI aggressively and integrating it with much of its software in ways that make disabling or removing the service difficult, if not impossible.

The drive has gone so far that many newer laptops built with the assumption of running on Windows 11 have a dedicated Copilot button on their keyboards. While Microsoft reported impressive AI usage and adoption figures, their veracity can be doubted since the technology giant has something of a captive audience.

While hardly scientific, some of the mood on the main street regarding Microsoft can be gleaned from the fact that the firm has a new nickname – ‘Microslop’ – which has become so widespread, along with ‘slop’ becoming Webster’s word of 2025, that CEO Satya Nadella felt the need to push back against the notion.

Featured image via Shutterstock

Source: https://finbold.com/microsoft-stock-just-crashed-360-billion-in-a-day-heres-why/