Bitcoin has officially confirmed a key breakout above $123,400, marking a significant technical milestone that could set the stage for its next major move.

The leading cryptocurrency climbed to nearly $125,000 on Monday, gaining 1.37% in the past 24 hours, according to Binance data.

The breakout follows weeks of consolidation, with the daily RSI now sitting above 72, suggesting strong bullish momentum but also signaling that the market may be approaching overbought territory.

Analyst Rekt Capital Confirms Range Breakout

Crypto strategist Rekt Capital noted that Bitcoin achieved the exact daily close required to confirm a range breakout, closing above the critical $123,400 level and retesting it as support. “The breakout looks confirmed,” the analyst said, “as long as BTC continues to hold above $123.4K.”

This level had previously acted as strong resistance throughout August and September, and holding it could establish a new base for further upside – potentially targeting the $128K to $130K range in the short term.

Profit-Taking Risk Emerges After TD Sell Signal

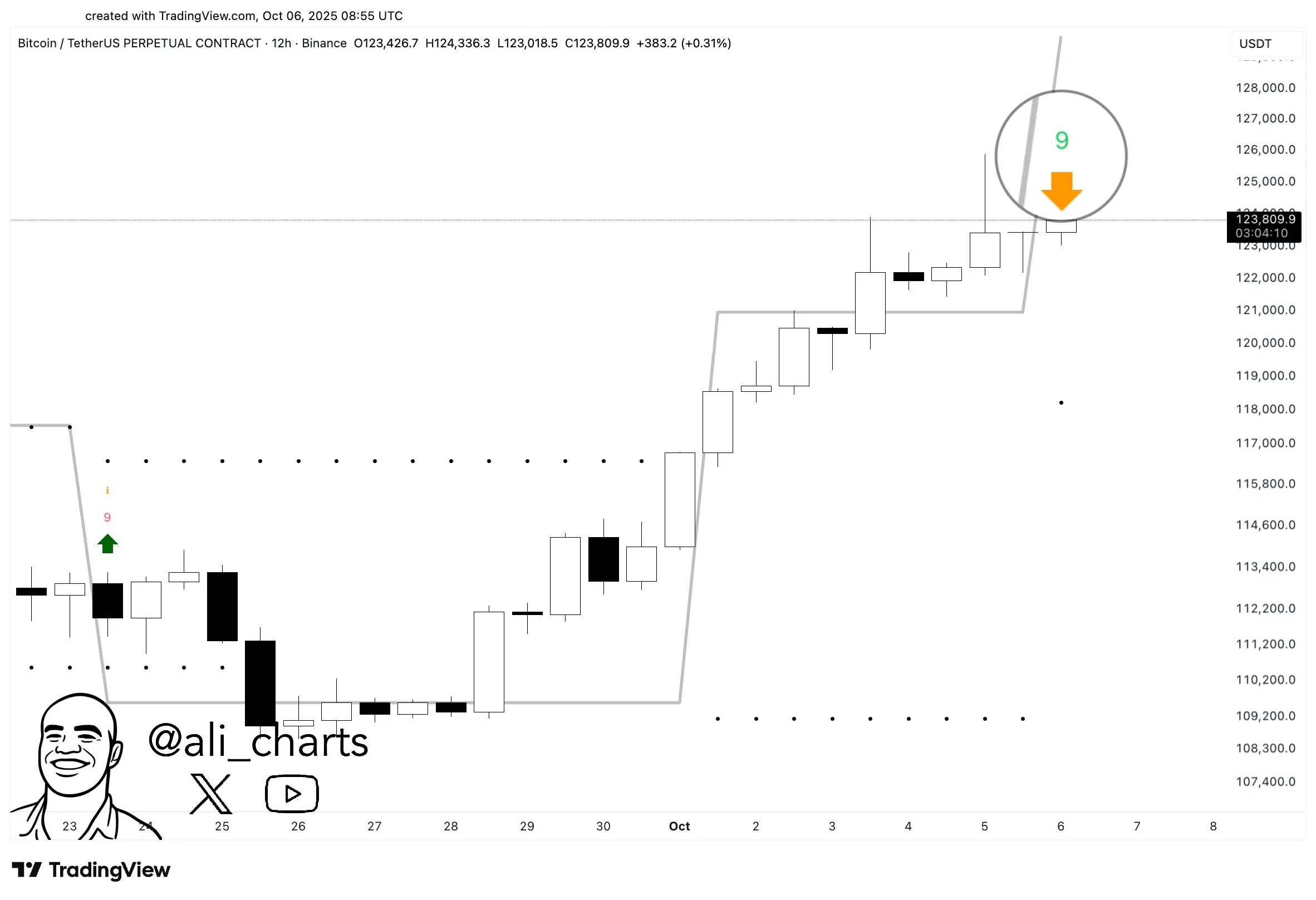

However, not all analysts are convinced the rally will continue uninterrupted. Market analyst Ali pointed out that the TD Sequential indicator has just flashed a sell signal on Bitcoin’s 12-hour chart, suggesting that some traders may soon start taking profits.

Historically, this indicator has preceded short-term pullbacks following sharp rallies, making the next few days critical for determining whether Bitcoin’s momentum will persist or cool off.

Altcoin Market Gears Up for Rotation

While Bitcoin’s price action remains strong, other analysts see early signs of an upcoming altcoin resurgence. Michaël van de Poppe highlighted that Bitcoin’s dominance is beginning to trend lower, which has already fueled Ethereum’s jump from $1,500 to $4,800.

According to van de Poppe, this shift could mark the start of a broader move into altcoins: “The downtrend in Bitcoin dominance has just started, and we might be seeing the next leg down – meaning more upside potential for altcoins.”

RSI and Market Structure Point to Caution

On the technical front, Bitcoin’s RSI above 70 indicates that the market is entering an overbought zone, often preceding periods of cooling or sideways action. Nonetheless, as long as the price holds above the $123,400 support, analysts expect traders to treat any short-term dips as buying opportunities.

What’s Next for Bitcoin

Bitcoin now finds itself at a crossroads: a confirmed breakout supported by strong momentum, yet flashing early signs of potential exhaustion. Traders will be closely watching whether BTC can sustain its strength above $123,400 or if a correction toward the $118K–$120K zone will follow before another leg higher.

For now, the market’s focus remains on whether this breakout will lead to new all-time highs – or serve as a brief pause before altcoins take the spotlight.

Source: https://coindoo.com/market/bitcoin-price-key-breakout-holds-yet-profit-taking-looms/