DeFi stablecoin market, Sturdy Finance, is back in operation after falling victim to an $800k fraud. On June 12, fraudsters hit Sturdy Finance, estimatingly scamming around $800,000 from the market.

The platform restored procedures on June 16, and permitted users to continue trading and investing in stablecoins. DeFi has also offered a $100,000 reward to the sammers along with dropping the lawsuit, if the fraudsters undo the theft for remaining cash to the platform’s crypto wallet.

The Market’s shut down after the attack led the team to examine the issue closely to determine how the scammers executed it and implement necessary protection standards to prevent such case repetitions.

Snap-Back of Sturdy Finance in DeFi Market

Sturdy Finance returned to the game, indicating a come-back in the stablecoin market. The platform restarted its work and execution processes, enabling users to resume investing and trading in stablecoins.

The Sturdy Finance Incident is a reminder of the risks linked with decentralized Finance. Cybersecurity continues to be a direct apprehension for DeFi platforms, and the need for robust security systems must be addressed.

Sturdy Finance states, “The stablecoin market has regained operations and now operates within the market, allowing users to access their funds. No accounts in this market were ever under threat; the market was only halted as an alarmed warning. As for additional safety measures, the bb-a-USD pool has been turned off.”

The stablecoin market is now unpaused, enabling users in this market to access their funds!

No funds in this market were ever at risk; the market was only paused out of an abundance of caution. As an additional safety measure, the bb-a-USD pool has been disabled 🛡 pic.twitter.com/uRL0gKQSEJ

— Sturdy 🧱 (@SturdyFinance) June 16, 2023

The bb-a-USD Boosted Pool is a group of one Composable Stable Pool (CSP) that has pool tokens of three different Linear Pools. Each Linear Pool has a linked stable token. It can be a USDT, USDC, or DAI. Balancer launched its first iteration of Boosted Pools with lending protocol Aave.

18/ With this bb-a-USD as an example, a protocol that pairs their token with this pool unlocks:

✅ Easy access to swap paths for multiple USD tokens

✅ Interconnected unfragmented stablecoin liquidity

✅ An additional boost from Aave for LPs.— Balancer (@Balancer) April 6, 2023

Launch of Boosted Protocols on Decentralized Finance

On Dec 15, 2021, Balancer Labs announced the launch of Boosted Pools on Aave. Being industry’s most popular borrowing and lending protocol, its total assets boasted over $13.4 Billion that time.

Its lenders earned interest by sealing their crypto in its liquidity pools, and borrowers could rightfully take out loans by providing crypto as collateral.

AAVE in the Crypto Market Scenario

Aave specializes in overcollateralized loans, where users must deposit crypto worth more than they wish to borrow. It is done to save lenders from losing money due to loan insolvencies and allows the Aave protocol in collateral liquefaction if it drops too much in value.

The project is also responsible for developing flash loans. For its part, Balancer doubles as a decentralized exchange and a sort-of DIY crypto-index fund provider, with users earning fees for creating attractive liquidity pools for speculators.

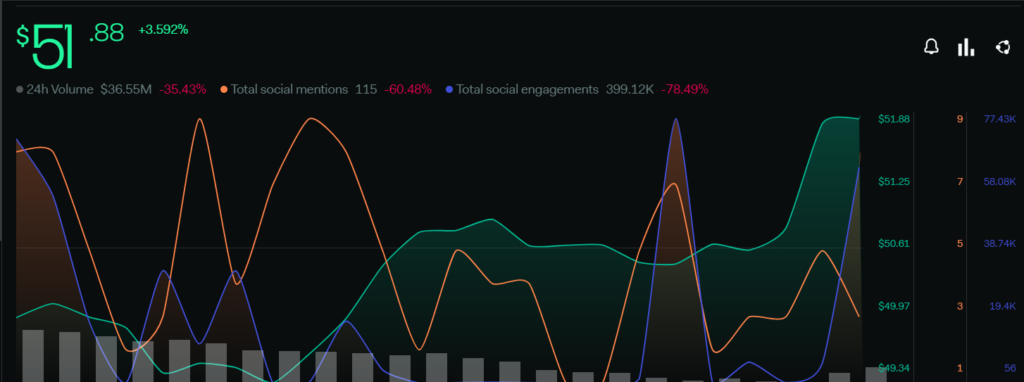

As per the Data from LunarCrush, the current price of AAVE is $51.88, with around a 3.6% increase within 24 hours of the period. The recorded volume of the previous day’s trade was $36.55 Million, 35.43% less than the last recorded volume.

The total social mentions of AAVE were counted as 115 due to a decrease of 60.48% mentions from the previous day. Total social engagements amounted to 399.12K as a result of 78.49% from the last recorded statistics.

At press time, the total social mentions are 77.43K, with 9 social mentions and a price of $51.878 for AAVE.

Source: https://www.thecoinrepublic.com/2023/06/17/defi-has-sturdy-finance-back-resuming-work-after-800000-hack/